Volvo 2014 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BOARD OF DIRECTORS’ REPORT 2014 GROUP PERFORMANCE RISKS AND UNCERTAINTIES

Credit-related risk

There are three main areas of credit risks for the Volvo Group.

Firstly, within its Industrial Operations the Group sells products

with open credits to customers and issues credit guarantees for

customers’ commercial vehicles and equipment. The majority of

the outstanding credit guarantees at year-end relates to Chinese

retail customers within Construction Equipment. Secondly, the

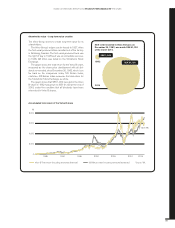

customer fi nance activity in Volvo Financial Services manages a

signifi cant credit portfolio, equivalent to SEK 117 billion at year-

end 2014. The portfolio is largely secured by the title to the

fi nanced commercial vehicles and equipment. However, in the

case of customer default, the value of the repossessed commer-

cial vehicles and equipment may not necessarily cover the out-

standing fi nanced amount. Lastly, a part of the Group’s credit risk

is related to the investment of the fi nancial assets of the Group.

The majority has been invested in interest-bearing securities

issued by Swedish real estate fi nancing institutions or deposited

with the Group’s core banks.

Liquidity risk

The Volvo Group strives to have a sound preparedness by always

having liquid funds and committed facilities to cover the Group’s

expected liquidity needs for a period of 12–18 months in a sce-

nario with no access to capital markets.

Market risk from investments in shares

or similar instruments

The Volvo Group has invested in listed shares with a direct exposure

to the capital markets. The majority of this exposure is relating to the

investments in Eicher Motors Ltd and Deutz AG. Please see note 5 for

further information. Furthermore, the Volvo Group is indirectly exposed

to market risks from shares and other similar instruments as a result

of capital in independent pension plans with asset management with

exposure to these types of instruments. Please see note 20 for fur-

ther information.

OPERATIONAL RISK

The profi tability depends on successful new products

The Volvo Group’s long-term profi tability depends on the Company’s

ability to successfully launch and market its new products. Product

life cycles continue to shorten, putting increased focus on the suc-

cess of the Group’s product development.

Resale value commitments

When selling products the Volvo Group at times enters into resale

value commitments. At the time of the sale the evolution of the used

commercial vehicle and equipment market may be uncertain, poten-

tially leading to too high commitments, impacting the future profi ta-

bility.

Local protectionism leading to changes to local content

requirements can put the Volvo Group at a disadvantage com-

pared to local competitors, cause increased sourcing costs or

require Volvo to make signifi cant investment not necessary from

an operational point of view.

Geopolitical uncertainty

Volvo is active in more than 190 countries and political instability,

armed confl icts and civil unrest may impact Volvo’s ability to trade

in affected areas. Rapid change in infl ation, devaluations or regu-

lations can sustain Volvo signifi cant losses, impairment of assets

or costs due to underutilized assets.

FINANCIAL RISK

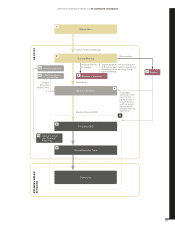

In its operations, the Volvo Group is exposed to various types of

fi nancial risks. Group-wide policies, which are updated and

decided upon annually, form the basis of each Group company’s

management of these risks. The objectives of the Group’s policies

for management of fi nancial risks are to optimize the Group’s cap-

ital costs by utilizing economies of scale, to minimize negative

effects on income as a result of changes in currency or interest

rates, to optimize risk exposure and to clarify areas of responsibil-

ity. Monitoring and control that established policies are adhered

to is continuously conducted. Information about key aspects of

the Group’s system for internal controls and risk management in

conjunction with the fi nancial reporting is provided in the Corpo-

rate Governance Report on page 106–107. Most of the Volvo

Group’s fi nancial transactions are carried out through the

in-house bank, Volvo Treasury, that conducts its operations within

established risk mandates and limits. Customer credit risks are

mainly managed by the different business areas.

The nature of the various fi nancial risks and objectives and the

policies for the management of these risks are described in detail in

notes 4 and 30. Various aspects of fi nancial risk are described

briefl y in the following paragraphs. Volvo Group’s accounting poli-

cies for fi nancial in struments are described in note 30. The overall

impact on a company’s competitiveness is also affected however by

how various macro -economic factors interact.

Interest-related risk

Interest-related risk includes risks that changes in interest rates will

impact the Group’s income and cash fl ow (cash-fl ow risks) or the

fair value of fi nancial assets and liabilities (price risks).

Currency-related risk

More than 90% of the net sales of the Volvo Group are generated

in countries other than Sweden. A majority of the Group’s costs

also stems from other countries than Sweden. To reduce currency

exposure, the Volvo Group strives to have manufacturing located

in the major markets. However, changes in exchange rates have a

direct impact on the Volvo Group’s operating income, balance

sheet and cash fl ow, as well as an indirect impact on Volvo’s com-

petitiveness, which over time affects the Group’s earnings.

84