Volvo 2014 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

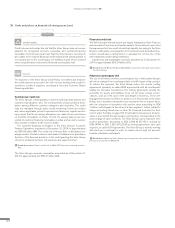

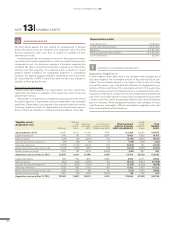

Specifi cation of deferred tax assets

and tax liabilities Dec 31,

2014 Dec 31,

2013

Deferred tax assets:

Unused tax-loss carryforwards 5,911 6,581

Other unused tax credits 152 114

Intercompany profi tin inventories 1,299 1,263

Allowance for inventory obsolescence 615 486

Valuation allowance for doubtful receivables 802 656

Provisions for warranties 3,726 2,825

Provisions for residual value risks 249 244

Provisions for post-employmentbenefi ts 4,974 3,747

Provisions for restructuring measures 223 140

Adjustment to fair valueat corporate

acquisitions/divestitures – 441

Market value of derivative instruments 27 28

Land 1,226 1,574

Other deductible temporary differences 4,936 4,352

Deferred tax assets before deduction

for valuation allowance 24,140 22,451

Valuation allowance (336) (125)

Deferred tax assets after deduction

for valuation allowance 23,804 22,326

Netting of deferred tax assets/liabilities (7,973) (9,160)

B/S Deferred tax assets, net 15,831 13,166

Deferred tax liabilities:

Accelerated depreciation on property,

plant and equipment 2,156 3,023

Accelerated depreciation on leasing assets 2,836 2,227

LIFO valuation of inventories 558 362

Capitalized product and software development 2,472 2,435

Adjustment to fair valueat corporate

acquisitions/divestitures 34 –

Untaxed reserves 84 85

Provisions for post-employment benefi ts 39 37

Other taxable temporary differences 2,590 3,396

Deferred tax liabilities 10,769 11,565

Netting of deferred tax assets/liabilities (7,973) (9,160)

B/S Deferred tax liabilities, net 2,796 2,406

Deferred tax assets/liabilities, net113,035 10,760

1 The deferred tax assets and liabilities above are partially recognized in the balance

sheet on a net basis after taking into account offsetting possibilities. Deferred

tax assets and liabilities have been measured at the tax rates that are expected

to apply during the period when the asset is realized or the liability is settled,

according to the tax rates and tax regulations that have been resolved or enacted at

the balance-sheet date.

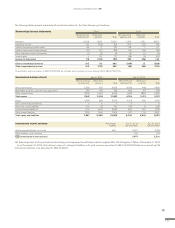

As of December 31, 2014 the total deferred tax assets, after deduction for

valuation allowance, attributable to unused tax-loss carryforwards amounted

to SEK 5,638 M (6,456) of which SEK 2,081 M (2,409) pertains to Sweden,

SEK 1,568 M (1,533) to France and SEK 1,115 M (1,272) to Japan.

The valuation allowance amounted to SEK 336 M (125) of the value of

deferred tax assets. Most of the reserve, SEK 273 M (125), consists of

unused tax-loss carryforwards. Net of the total valuation allowance,

deferred tax assets of SEK 23,804 M (22,326) were recognized in the

Volvo Group’s balance sheet.

The cumulative amount of undistributed earnings in foreign subsidiar-

ies, which the Volvo Group currently intends to indefi nitely reinvest out-

side of Sweden and upon which deferred income taxes have not been

provided is SEK 52 billion (59) at year end. The main part of the undistrib-

uted earnings is pertaining to countries where the dividends are not tax-

able.

Read more in Note 4 for information on how the Volvo Group handles equity

currency risk.

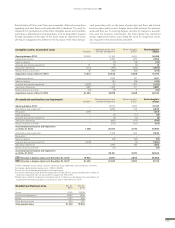

Minority interests are interest attributable to non-controlling shareholders.

Minority interests are presented in the equity, separately from the equity

of the owners of the Parent Company. At business combinations minority

interests are valued either at fair value or at the minority’s proportionate

share of the acquiree’s net assets. Minority interests are assigned the

minority shareholder’s portion of the equity of the subsidiary. Changes in a

parent’s ownership interest in a subsidiary that do not result in a loss of

control are accounted for as equity transactions.

The Volvo Group has a few non-wholly owned subsidiaries of which one of

the subsidiaries are considered to have a signifi cant minority interest.

Shandong Lingong Construction Machinery Co., (Lingong), in China has a

minority interest holding amounting to 30% share and voting rights in the

company. During the year, the profi t allocated to the minority interest of

Lingong amounted to 139 (218) and the accumulated minority interest at

the end of December 31, 2014, amounted to 1,683 (1,296).

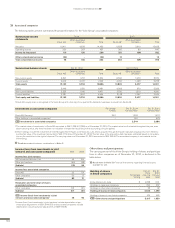

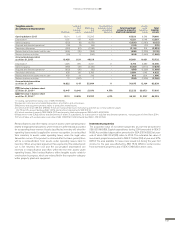

The following table presents summarized fi nancial information for

Shandong Lingong Construction Machinery Co., Lingong:

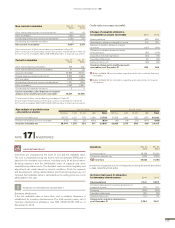

Summarized income statement 2014 2013

Net sales 7,324 8,990

Operating income 559 927

Income for the period 464 728

Other comprehensive income 829 120

Total comprehensive income 1,293 848

Dividends paid to minority interest – 162

Summarized balance sheet Dec31,

2014 Dec 31,

2013

Non-current assets 1,633 1,415

Marketable securites, cash and cash equivalents 2,584 2,435

Current assets 7,117 5,757

Total assets 11,334 9,607

Non-currentliabilities 187 1,253

Current liabilities 5,536 4,035

Total liabilities 5,723 5,288

Equity attributable to the Volvo Group’s shareholders 3,928 3,023

Minority interests 1,683 1,296

ACCOUNTING POLICY

NOTE 11 MINORITY INTERESTS

FINANCIAL INFORMATION 2014

137