Volvo 2014 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

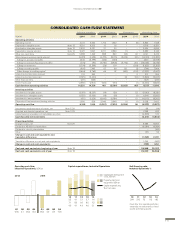

The cash fl ow within Industrial Operations was posi-

tively affected by an operating income of SEK 8.6 bil-

lion excluding the non-cash items related to the EU

antitrust investigation and expected credit losses in

China in a total amount of SEK 4.5 billion. In addition,

the cash fl ow has been positively impacted by higher

depreciations than investments in an amount of SEK

3.6 billion. This was offset by an increase of working

capital of SEK 3.3 billion. Accounts receivables

decreased by SEK 1.3 billion, inventories increased by

SEK 1.6 billion and the trade payables decreased by

SEK 1.0 billion.

Refer to section Investments below for more infor-

mation on the main reasons for the decrease in invest-

ments compared to previous year.

Financial items and paid income taxes had a SEK

4.5 billion negative effect on cash fl ow within Indus-

trial Operations, mainly through payments of interests

and income tax.

Operating cash fl ow within Customer Finance was

negative SEK 5.3 billion (7.6), mainly due to increased

customer-fi nancing receivables and investment in

leasing vehicles.

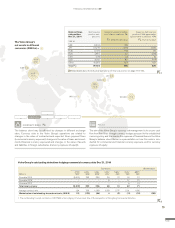

Investments

The Industrial Operations’ investments in fi xed assets

and capitalized research and development during 2014

amounted to SEK 8.6 billion (12.2). The decrease is

mainly related to lower capitalization of research and

development but also lower investments in fi xed assets.

Capital expenditures in Trucks amounted to SEK

5.7 billion (8.4). The major investments refer to fi nali-

zation of the extensive product renewals that have

taken place, including emission regulation Euro 6, the

new UD Quon for Japan and the new Volvo-range

introduced in South America, with both product devel-

opment activities and required adaptations in the

plants. There are also larger investments in the plants

in order to reduce manufacturing costs, with the Euro-

pean optimization program and rationalizations in the

US plants as main areas. The investments in dealer

networks and workshops are mainly done in Europe

and Asia (mainly Japan and Thailand), primarily for

upgrade and replacements. South America is invest-

ing in a new customer training center.

Capital expenditures for Construction Equipment

amounted to SEK 1.3 billion (2.3). The major invest-

ments during 2014 related to the new customer

center in Shippensburg, investments within our SDLG

brand and various in vestments related to our CAST

(Common Architecture Shared Technology) program.

The product related investments during the year refer

mainly to Tier 4 fi nal, the last emission regulations in

Europe and North America.

The investments in Buses were SEK 0.3 billion

(0.4), and in Penta SEK 0.3 billion (0.3).

Total investments in leasing assets during 2014

amounted to SEK 0.5 billion (1.5).

The investment level for property, plant and equip-

ment during 2014 was lower than previous years.

During 2015, investments in property, plant and

equipment are expected to be on the same level as in

2014. The optimization of the industrial and logistic

footprint, dealer investments and product related tool-

ing will continue to be the main areas.

Acquisitions and divestments

The divestiture of Volvo Rents was completed on Jan-

uary 31, 2014.

The divestiture of commercial real estate was fi nal-

ized in the second quarter of 2014.

The acquisitions of the hauler manufacturing busi-

ness from Terex Inc. was fi nalized on May 30, 2014.

In total acquired and divested operations in 2014 had

a positive impact on cash fl ow of SEK 7.4 billion (0.9).

Read more in Note 3 regarding Acquisitions

and divestments of shares in subsidiaries and

Note 29 Cash fl ow.

Financing and dividend

Net borrowings increased cash and cash equivalents

by SEK 6.7 billion during 2014 (13.0).

Read more in Note 29 Cash fl ow regarding

movements during the year on the net borrowings.

During the year dividend of SEK 6.1 billion, corre-

sponding to SEK 3.00 per share, was paid to the

shareholders of AB Volvo.

Change in cash and cash equivalents

The Volvo Group’s cash and cash equivalents

decreased by SEK 0.7 billion during the year and

amounted to SEK 26.2 billion at December 31, 2014.

Read more in Note 29 Cash fl ow regarding

principles for preparing the cash fl ow statement

and for more information on cash and cash

equivalents.

During 2014, operating cash fl ow in the Industrial Operations

amounted to a positive SEK 6.4 billion (1.5).

CASH FLOW STATEMENT

Improved operating

cash fl ow

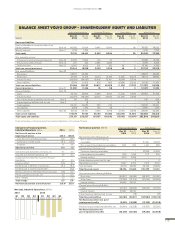

business and positive currency movements of SEK

27.2 billion related to revaluation of assets in foreign

subsidiaries, offset by the divestment of assets related

to Volvo Rents and of commercial real estate.

The value of other shares and participations

increased by SEK 3.0 billion compared to previous

year. The increase is driven by the fair value adjust-

ment of Eicher Motors Ltd. recognized through other

comprehensive income.

Read more in Note 5 Investments in joint

ventures, associated companies and other shares

and participations regarding other shares and

participations.

Read more in Note 19 Equity and number of

shares regarding the change in other reserves.

The Group’s intangible assets amounted to SEK 37.1

billion as of December 31, 2014. Investments in

research and development amounted to SEK 1.4 billion

(3.8), resulting in a net value of capitalized develop-

ment costs of SEK 12.5 billion at the end of the year.

Compared to prior year there has been a shift in the

research and development net, from net capitalization

to net amortization, as many projects was fi nalized in

2013. The Volvo Group’s total goodwill amounted to

SEK 21.5 billion as of December 31, 2014, an increase

by SEK 1.5 billion compared to year-end 2013 mainly

as a result of translation differences. The goodwill is

tested for impairment on an annual basis.

Read more in Note 12 Intangible assets

regarding the impairment test on goodwill.

The tangible assets increased by SEK 8.5 billion dur-

ing 2014, mainly related to increase in assets under

operating leases and translation differences.

The value of inventories increased by SEK 4.4

billion. The increase is related to both fi nished products

within Trucks and Construction Equipment and pro-

duction material.

The value of assets held for sale amounted SEK

0.3 billion as of December 31, 2014 compared to SEK

8.1 billion at year-end 2013. The amount last year was

related to the divestment of Volvo Rents and to the

divestment of commercial real estate which were

completed during 2014.

Read more in Note 3 regarding assets and

liabilities held for sale.

The net value of assets and liabilities related to pen-

sions and similar obligations amounted to SEK 16.6

billion as of December 31, 2014, an increase of SEK

4.3 billion compared to year-end 2013. In 2014 the

Volvo Group recognized a negative remeasurement

effect impacting the pension obligation SEK 5.5 billion,

mainly driven by lower discount rates in the US, Bel-

gium, France, the UK and Sweden. On the asset side

a positive remeasurement effect amounting to SEK

1.9 billion was recognized. In total the remeasurement

recognized through other comprehensive income had

a negative impact of SEK 3.6 billion on the provision

for post-employment benefi ts.

Read more in Note 20 Provisions for post-

employment benefi ts.

As of December 31, 2014 the shareholders’ equity for

the Volvo Group amounted to SEK 80.0 billion com-

pared to SEK 77.4 billion at year-end 2013. The equity

ratio was 20.9% compared to 22.4% on December

31, 2013. At the same date the equity ratio in the

Industrial operations amounted to 25.7% (27.0).

Cont.

116

FINANCIAL INFORMATION 2014