Volvo 2014 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

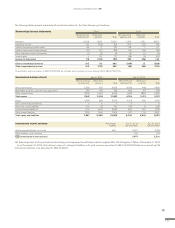

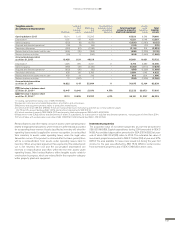

Intangible assets, acquisition costs Goodwill Capitalized product and

software development Other intangible

assets1

Total intangible

assets

Opening balance 2013 22,093 31,745 5,930 59,768

Capital expenditures2–3,7502053,955

Sales/scrapping – (5) (18) (23)

Acquired and divested operations521 (3) (3) 15

Translation differences (734) (790) (402) (1,926)

Reclassifi cations and others 32 (162) (84) (214)

Acquisition cost as of Dec 31, 2013 21,412 34,535 5,628 61,575

Capital expenditures2–1,3901511,541

Sales/scrapping – (81) (28) (109)

Acquired and divested operations5(1,382) 79 200 (1,103)

Translation differences 1,488 1,790 411 3,689

Reclassifi cations and other (24) (5) 6 (23)

Acquisition cost as of Dec 31, 2014 21,494 37,708 6,368 65,570

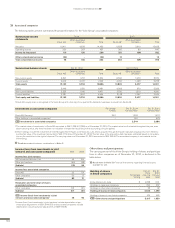

Accumulated amortization and impairment Goodwill Capitalized product and

software development Other intangible

assets1

Total intangible

assets

Opening balance 2013 –18,3752,69521,070

Amortization and impairment4–3,2823163,597

Revaluation 1,458 – – 1,458

Sales/scrapping – (5) (11) (16)

Acquired and divested operations5–(3)(3)(6)

Translation differences – (685) (114) (799)

Reclassifi cations and other – (210) (107) (317)

Accumulated amortization and impairment

as of Dec 31, 2013 1,458 20,754 2,775 24,987

Amortization and impairment4–3,1983353,533

Revaluation – – – –

Sales/scrapping – (53) (20) (73)

Acquired and divested operations5(1,458) – (2) (1,460)

Translation differences – 1,299 186 1,485

Reclassifi cations and other – (17) – (17)

Accumulated amortization and impairment

as of Dec 31, 2014 – 25,181 3,274 28,455

B/S Net value in balance sheet as of December 31, 2013319,954 13,781 2,853 36,588

B/S Net value in balance sheet as of December 31, 2014321,494 12,527 3,094 37,115

1 Other intangible assets mainly consist of entrance fees, trademarks and distribution networks.

2 Including capitalized borrowing costs of SEK 0 M (35).

3 Costs less accumulated amortization and impairments.

4 Of which impairments SEK 60 M (4). Impairment of SEK 36 M in product development relates to

restructuring activities as communicated on pages 24, 72 and 76.

5 Read more in Note 3, Acquisitions and divestments of shares in subsidiaries, for a description of

acquired and divested operations. Including the sale of Volvo Rents for 2014.

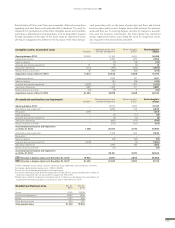

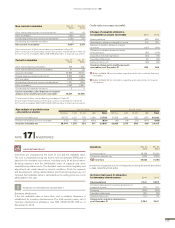

Goodwill per Business Area Dec 31,

2014 Dec 31,

2013

Trucks 11,515 10,915

Construction Equipment 8,392 7,536

Buses 1,053 996

Other business areas 534 507

Total goodwill value 21,494 19,954

that estimates of future cash fl ows are reasonable, different assumptions

regarding such cash fl ows could materially affect valuations. The need for

impairment of goodwill and certain other intangible assets with indefi nite

useful lives is determined on an annual basis, or more frequently if re quired

through calculation of the value of the asset. Such an impairment review

will require management to determine the fair value of the Volvo Group’s

cash generating units, on the basis of projected cash fl ows and internal

business plans and forecasts. Surplus values differ between the business

areas and they are, to a varying degree, sensitive to changes in assump-

tions and the business environment. The Volvo Group has performed

similar impairment reviews since 2002. No need for impairment losses

was required for the period 2002 until 2014.

FINANCIAL INFORMATION 2014

139