Volvo 2014 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Following the most comprehensive product renewal program in the Volvo Group’s history,

which began in the autumn of 2012 and culminated in 2013, the focus in 2014 was on

implementing measures to strengthen our internal efficiency and reduce the Group’s costs.

In the past decade, the Group’s acquisition-driven expansion,

including such acquisitions as Renault Trucks, Mack, UD Trucks

and SDLG, has provided us with access to new brands and new

markets. The final big piece of the puzzle in this strategy was the

acquisition of 45% of the Chinese company Dongfeng Commer-

cial Vehicles, which was concluded in January 2015. The expan-

sion and streamlining to commercial vehicles can be described as

the first phase in the Group’s transformation. We are currently in

the second phase. It is now about capitalizing on the benefits

derived from years of growth in the form of brands, products, geo-

graphic coverage and volumes. It is about merging all the different

parts into an efficient Volvo Group, in which they all work seam-

lessly together. It is about generating synergy gains to increase

our profitability.

Improved underlying profitability

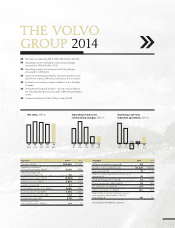

The trends in our markets displayed large variations. The North

American economy was strong, while Europe was largely charac-

terized by uncertainty about the strength of the economic recov-

ery and concern surrounding Russia. In Asia, the trend in Japan

was generally positive and growth in India turned in the right

direction, while China had a weaker development. In South Amer-

ica, Brazil was impacted by a weak economic development. The

mixed trend is reflected by the Group’s deliveries of trucks, which

in total were on the same level as in 2013 while deliveries of con-

struction equipment declined substantially, with a weak trend

mainly in China. It is also reflected in our net sales which, adjusted

for currency and acquired and divested units, only rose by 2% to

SEK 283 billion.

Our operating income excluding restructuring costs improved

slightly to SEK 8.4 billion corresponding to an operating margin of

3.0%. Income was in total negatively affected by a number of

large items of a non-recurring nature such as provisions for the EU

investigation, expected credit losses in China and a litigation in

the U.S. However, the underlying profitability improved because

we succeeded in our work to increase gross margins on both new

trucks and the products and services we offer in the aftermarket.

All the measures we implement to enhance our efficiency and

reduce our costs also contributed to improve the profitability.

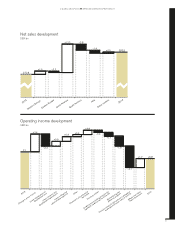

The activities in our 2013–2015 strategic program are being

implemented according to plan. These include a structural reduc-

tion in the number of white-collar employees and consultants, a

restructuring of the industrial structure in Europe and Japan,

streamlining the sales and service organization for trucks in

Europe and a restructuring of global spare-parts distribution. As

planned, the program generated savings at a clearly increasing

rate during the year and the combined savings in cash spend in

research and development and costs for sales and administration

amounted to SEK 2.2 billion compared with 2013. In the autumn,

we identified further opportunities to reduce our costs and conse-

quently increased the scope of the strategic program with addi-

tional measures in Volvo CE, a reorganization of Group Trucks

Sales and an overview of what is core and non-core in our IT

operations. All of the new and ongoing measures will be imple-

mented before the end of this year and have full effect next year.

In total, these measures are expected to result in savings of

SEK10 billion for the full-year 2016 compared with the full-year

2012. Costs for the program amount to SEK 6–7 billion.

Another of our priorities for 2014 was to strengthen our finan-

cial position and this was achieved by a combination of activities

to improve the cash flow as well as the divestment of Volvo Rents.

In total, we reduced the financial net debt by nearly SEK 10 billion

and at the end of the year, the financial net debt in the industrial

operations was 14% of shareholders’ equity.

Our truck operations advances its positions

In our truck operations, North America was the biggest source of

rejoice with a strong market, significantly improved profitability

and higher market shares for both Volvo and Mack. In general, the

market-share trend was positive in several of our markets, which

confirms that our efforts and focus on supporting our customers

are successful. In Europe, the new series of Volvo trucks contin-

ued to advance its position with a combination of good price real-

ization and increasing market shares. We are also very pleased

about the nomination of the new Renault Trucks T series as “Inter-

national Truck of the Year 2015.” After a weak 2014, we can now

see that Renault Trucks is gradually increasing sales of the new

truck series. We also continued to gain market shares in the

important Brazilian market, which however weakened significantly

during the year with increasing price pressure.

In January, 2015, we completed the acquisition of 45% of the

Chinese company Dongfeng Commercial Vehicles, which includes

most of Dongfeng’s operation in heavy-duty and medium-duty

commercial vehicles. In 2013 DFCV had 26,000 employees and

sales amounted to SEK 37 billion. With deliveries of 172,000

trucks, DFCV is among the leading manufacturers in both the

heavy-duty and medium-duty segments. The strategic alliance is

a true milestone and means a fundamental change in the Volvo

Group’s potential in the Chinese trucks market, which is the larg-

est in the world.

A year of extensive efficiency measures

and improved underlying profitability

A GLOBAL GROUP 2014

CEO COMMENT

2