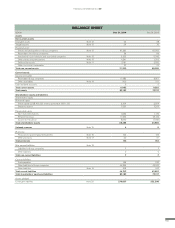

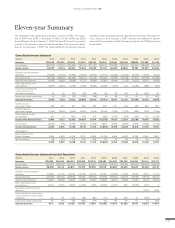

Volvo 2014 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

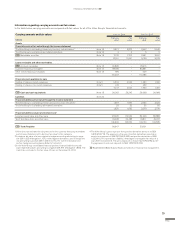

INCOME (LOSS) FROM INVESTMENTS

IN GROUP COMPANIES

NOTE 5

Income from investments in

Group Companies 2014 2013

Dividends received

Volvo China Investment Co. Ltd. 367 312

VFS AB 450 1,080

Volvo Danmark AS 61 –

Volvo East Asia (Pte) Ltd., Singapore 108 105

Volvo Holding Sverige AB 4,500 –

Volvo Korea Holding AB 1,300 –

Volvo Event Management UK Ltd. 1 –

Volvo Norge AS 39 –

Volvo Malaysia Sdn Bhd. – 59

VCE N.V. – 37

Volvo UK Holding Ltd. – 11

Volvo Group UK Ltd. – 85

Subtotal 6,826 1,689

Write-down of shares

Volvo Group UK Ltd. (134) –

Volvo Italia Spa – (63)

Volvo Business Services AB – (40)

Volvo Parts AB – (50)

Volvo Group Japan Corporation – (843)

Subtotal (134) (996)

Income from divestment of shares

Non-compete clause Volvo Rents 0 –

Adjustment divestment Volvo Aero AB 2012 – (106)

Subtotal 0 (106)

Income from investments in Group Companies 6,692 587

Transfer price adjustments and royalties amount to an expense of 1,120

(1,128).

Dividend of 28 (31) was received from VE Commercial Vehicles Ltd. and

of 19 (–) from Deutz AG. Income include write-down of participation in

Blue Chip Jet HB with – (5) and in Blue Chip Jet II HB with 21 (26).

INCOME FROM INVESTMENTS IN JOINT

VENTURES AND ASSOCIATED COMPANIES

NOTE 6

Income from other investments includes a dividend of 7 (5) from Eicher

Motors Ltd. 2013 the shares in Johanneberg Science Park AB and Lind-

holmen Science Park AB were written down by 4.

INCOME FROM OTHER INVESTMENTS

NOTE 7

Interest expenses and similar charges totalling 947 (1,139) included inter-

est of 944 (1,136) to subsidiaries.

INTEREST EXPENSES

NOTE 8

Other fi nancial income and expenses include exchange rate gains and

losses, costs for credit rating and costs for stock exchange listing.

OTHER FINANCIAL INCOME

AND EXPENSES

NOTE 9

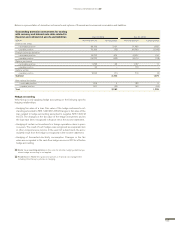

Group contributions amounted to a net of 3,504 (832).

ALLOCATIONS

NOTE 10

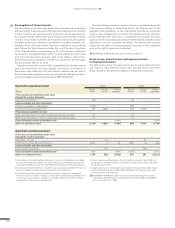

Income taxes were distributed as follow:

2014 2013

Current taxes relating to the period (20) (1)

Current taxes relating to prior periods – (253)

Deferred taxes (359) 587

I/S Total income taxes (379) 333

Deferred taxes relate to estimated tax on the change in tax-loss carryfor-

wards and temporary differences. Deferred tax assets are recognized to

the extent that it is probable that the amount can be utilized against future

taxable income. The tax-loss carry forwards have indefi nite period of

utilization.

Deferred taxes related to change in tax-loss carryforwards amount to

an expense of 357 (income of 590) and to changes in other temporary

differences to an expense of 2 (3).

The table below discloses the principal reasons for the difference

between the corporate income tax of 22% and the tax for the period.

2014 2013

Income before taxes 7,069 (1,954)

Income tax according to applicable tax rate (1,555) 430

Capital gains/losses – (23)

Non-taxable dividends 1,513 380

Non-taxable revaluations of shareholdings (34) (227)

Other non-deductible expenses (23) (15)

Other non-taxable income 10 42

Adjustment of current taxes for prior periods – (253)

Withholding tax (20) (1)

Remeasurement of deferred tax assets (269) –

Recognition and derecognition of deferred tax

assetsdue to change in tax rate (1) –

Income taxes for the period (379) 333

Specifi cation of deferred tax assets Dec 31,

2014 Dec 31,

2013

Unused tax-loss carryforwards 2,037 2,394

Provisions for post-employmentbenefi ts 150 149

Provisions for restructuring measures 4 7

B/S Deferred tax assets 2,191 2,550

NOTE 11 INCOME TAXES

FINANCIAL INFORMATION 2014

171