Volvo 2014 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

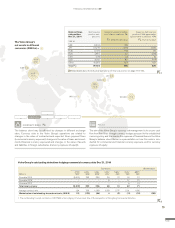

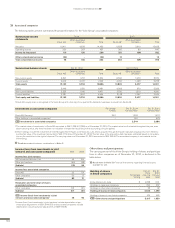

USD

7.9

BRL

7.9

The Volvo Group’s global operations expose the Group to fi nancial risks in

the form of interest rate risks, currency risks, credit risks, liquidity risks

and other price risks. Work on fi nancial risks comprises an integrated

element of the Volvo Group’s business. The Volvo Group strive to minimize

these risks by optimizing the Group’s capital costs by utilizing economies

of scale, minimize negative effects on income as a result of changes in

currency or interest rates and to optimize risk exposure. All risks are man-

aged pursuant to the Volvo Group’s established policies in these areas.

Read more about accounting principles for fi nancial instruments in Note 30,

Financial Instruments.

Read more about management of capital on page 25 and page 86.

INTEREST-RATE RISKS A

Interest-rate risk refers to the risk that changed interest-rate levels will

affect the Volvo Group’s consolidated earnings and cash fl ow (cash-fl ow

risks) or the fair value of fi nancial assets and liabilities (price risks).

POLICY

Matching the interest-fi xing terms of fi nancial assets and liabilities

reduces the exposure. Interest-rate swaps are used to change/infl uence

the interest-fi xing term for the Volvo Group’s fi nancial assets and liabili-

ties. Currency interest-rate swaps enable borrowing in foreign currencies

from different markets without introducing currency risk. The Volvo Group

has also standardized interest-rate forward contracts (futures) and FRAs

(forward-rate agreements). Most of these contracts are used to hedge

interest-rate levels for short-term borrowing or investments.

Cash-fl ow risks

The effect of changed interest rate levels on future currency and inter-

est-rate fl ows primarily pertains to the Volvo Group’s Customer Finance

Operations and net fi nancial items. Customer Finance Operations meas-

ure the degree of matching interest rate fi xing on borrowing and lending.

The calculation of the matching degree excludes equity, which amounted

to between 8 and 9% in the Customer Finance Operations. At year-end

2014, the degree of such matching was 101% (99) for the segment

Customer Finance, which was in line with the Volvo Group’s policy. The

centralized Treasury function has, for practical as well as business rea-

sons, the mandate to mismatch the Customer Finance portfolio down to a

matching ratio of 80%. At year-end 2014, the matching ratio was 110%

(95). Any gains or losses from the mismatch impact the segment Group

functions and other within Industrial Operations. At year-end 2014, in

addition to the assets in its Customer Finance Operations, the Volvo

Group’s interest-bearing assets consisted primarily of cash, cash equiva-

lents and liquid assets invested in short-term interest-bearing securities.

The objective for the Volvo Group’s short-term interest-bearing securities

is to achieve a return on these assets equivalent to a three-month fi xed

term security. On December 31, 2014, the average interest on Industrial

Operations fi nancial assets was 0.9% (1.1). After taking derivatives into

account, outstanding loans had interest terms corresponding to a short

term interest-rate fi xing term, between one to three months. The average

interest on Industrial Operations fi nancial liabilities at year-end amounted

to 3.8% (3.3), including the Volvo Group’s credit costs.

Price risks C

Exposure to price risks as result of changed interest-rate levels refers to

fi nancial assets and liabilities with a longer interest-rate fi xing term (fi xed

interest).

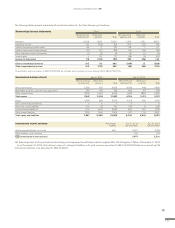

The following table 4:1 shows the effect on earnings before taxes in

Industrial Operations net fi nancial position, excluding pensions and similar

obligations, if interest rates were to increase by 1 percentage point, (100

basis points) assuming an average interest-rate fi xed term of three months.*

The impact on equity is earnings after tax.

* The sensitivity analysis on interest rate risks is based on simplifi ed assumptions. It is

not improbable for market interest rates to change by one percentage point (100

basis points) on an annual basis. However, in reality, these rates often rise or decline

at different points in time. The sensitivity analysis also assumes a parallel deferment of

the return curve, and that the interest rates on assets and liabilities will be equally

impacted by changes in market interest rates. Accordingly, the impact of real interest -

rate changes may differ from the analysis presented in table 4:1.

Read more about the Industrial Operations net fi nancial position on pages

114 –115 .

Read more in Note 20 Provisions for post-employment benefi ts regarding

sensitivity analysis on the defi ned benefi t obligations when changes in the applied

assumptions for discount rate and infl ations are made.

INTEREST-RATE RISKS CURRENCY RISKS CREDIT RISKS

FINANCIAL RISKS

OTHER PRICE RISKSLIQUIDITY RISKS

NOTE 4 GOALS AND POLICIES IN FINANCIAL RISK MANAGEMENT

CASH-FLOW RISKS

PRICE RISKS FINANCIAL CURRENCY

EXPOSURE

CURRENCY EXPOSURE

OF EQUITY

COMMERCIAL CURRENCY

EXPOSURE COMMERCIAL CREDIT RISK COMMODITY RISK

FINANCIAL CREDIT RISK

FINANCIAL

COUNTERPARTY RISK

INTEREST-RATE RISKS CURRENCY RISKS CREDIT RISKS

FINANCIAL RISKS

OTHER PRICE RISKSLIQUIDITY RISKS

FINANCIAL INFORMATION 2014

124