Volvo 2014 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

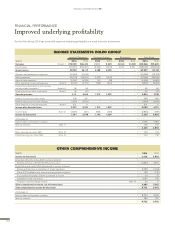

Net sales

Net sales increased by 4% explained mainly by

the 7% sales increase for Trucks business area.

While Buses, Volvo Penta and Customer

Finance also contributed positively, Construc-

tion Equipment experienced a slight decline.

The divestment of Volvo Rents, which was part

of Corporate Functions, Group Functions &

Other segment, on 31 January 2014 contrib-

uted to lower the sales in 2014. Changes in

currency exchange rates mainly related to USD,

EUR and GBP impacted sales positively.

Operating income

Operating income decreased by SEK 1.3 billion

compared to previous year. The positive gross

income impact was offset by costs of non-

recurring nature. The increased gross income

was mainly related to Trucks business areas but

also Bus and Volvo Penta made positive contri-

bution while Construction Equipment had a neg-

ative development compared to previous year.

The operating income was negatively impacted

by the EU antitrust litigation provision of SEK

3.8 billion and provision for expected credit

losses related to credit guarantees in China of

SEK 0.7 billion. Furthermore the provision of

SEK 0.4 billion related to the engine emission

case in US (EPA) and increased cost for restruc-

turing measure of SEK 1.9 billion had a negative

impact on operating income. The capital gain of

SEK 0.8 billion from the divestment of non-stra-

tegic property and SEK 0.2 billion from release

of a provision related to the divesture of Volvo

Rents impacted operating income positively.

The comparable figures for 2013 included a

write down of Volvo Rents of SEK 1.5 billion.

Net financial items

Net interest expense for the Volvo Group

amounted to SEK 1.7 billion compared to SEK

2.4 billion in the preceding year. Interest expenses

decreased due to lower financial liabilities and

lower interest rates on outstanding debt.

Volvo Group

Net sales by business area, SEK M 2014 2013 %

Trucks 190,904 178,474 7

Construction Equipment 52,855 53,437 (1)

Buses 18,645 16,707 12

Volvo Penta 7,790 7,550 3

Corporate Functions,

Group Functions & Other 8,162 12,410 (34)

Eliminations (2,356) (3,158) (25)

Industrial Operations1275,999 265,420 4

Customer Finance 10 ,111 9,539 6

Reclassifications and eliminations (3,162) (2,336) 35

Volvo Group 282,948 272,622 4

1 Adjusted for acquired and divested units and changes in currency rates, net sales

increased by 2%.

Change in operating income,

SEK bn

Change

(excluding

currency) Currency

impact Total

Operating income 2013 7.1

Change in gross income Industrial Operations 3.2 0.3 3.5

Change in gross income Customer Finance 0.2 0.0 0.2

Lower credit losses

10.1 0.0 0.1

Change in group structure20.1 0.0 0.1

Lower capitalization of development cost (2.3) 0.0 (2.3)

Lower research and development expenditures 0.9 (0.2) 0.7

Lowerselling and administrative expenses 0.9 (0.3) 0.6

Volvo Rents revaluation of assets held for sale

2013and divestment31.7 0.0 1.7

Provision related to EU antitrust investigation (3.7) (0.1) (3.8)

Provision related to engine emission case in the U.S (0.4) 0.0 (0.4)

Provision for expected credit losses for Volvo CE (0.7) 0.0 (0.7)

Divestment of commercial real estate 0.8 0.0 0.8

Restructuringand efficiency program (1.9) 0.0 (1.9)

Other 0.2 (0.1) 0.1

Operating income 2014 5.8

1 Of the lower credit losses SEK 0.1 billion are related to Customer Finance.

2 The net effect on operating income from changes in group structure is SEK

0.1 billion. The gross effect is negative SEK 0.9 billion on gross income, SEK

0.9 billion on selling expenses and SEK 0.1 billion on credit losses.

3 Read more in Note 3 Acquisitions and divestments of shares in sub-

sidiaries.

Operating income (loss) by business area, SEK M 2014 2013

Trucks 4,157 6,145

Construction Equipment 652 2,592

Buses 92 (190)

Volvo Penta 724 626

Corporate Functions, Group Functions & Other (1,689) (3,606)

Eliminations 176 49

Industrial Operations 4,111 5,616

Customer Finance 1,712 1,522

Volvo Group 5,824 7,13 8

Operating margin, % 2014 2013

Trucks 2.2 3.4

Construction Equipment 1.2 4.9

Buses 0.5 (1.1)

Volvo Penta 9.3 8.3

Industrial Operations 1.5 2.1

Volvo Group 2.1 2.6

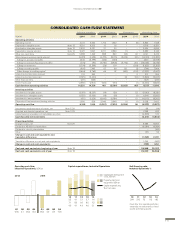

Net sales, SEK bn

13121110

310265 300

14

273 283

Operating income, SEK M

20142013

Q4

996

Q3

2,398

Q2

3,262

Q1

482

Q4

(2.258)

Q3

2,250

Q2

3,563

Q1

2,269

Other financial income and expense was

positively impacted by SEK 1.1 billion (0.2) from

revaluation of derivatives related to hedging.

Read more in Note 9 Other financial income

and expenses.

Income taxes

The tax expense for the year amounted to SEK

2.9 billion (0.9) corresponding to a tax rate of

56% (20). The high tax rate is mainly explained

by the provision for the EU antitrust litigation

not being tax deductible.

Income for the period and earnings

per share

The income for the period amounted to SEK

2,235 M (3,802), corresponding to diluted earn-

ings per share of SEK 1.03 (1.76). The return on

shareholders’ equity was 2.8% (5).

111

FINANCIAL INFORMATION 2014