Volvo 2014 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194

|

|

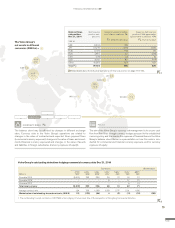

The Volvo Group’s most signifi cant accounting policies are primarily

described together with the applicable note. Read more in Note 1,

Accounting Policies for a specifi cation. The preparation of AB Volvo’s

Consolidated Financial Statements requires the use of estimates and

assumptions that may affect the recognized amounts of assets and liabil-

ities at the date of the fi nancial statements. In addition, the recognized

amounts of net sales and expenses during the periods presented are

affected. In preparing these fi nancial statements, management has made

its best judgments of certain amounts included in the fi nancial state-

ments, materiality taken into account. Actual results may differ from pre-

viously made estimates. In accordance with IAS 1, the company is required

to disclose the assumptions and other major sources of estimation uncer-

tainties that, if actual results differ, may have a material impact on the

fi nancial statements.

!The sources of uncertainty which has been identifi ed by the Volvo

Group and which are considered to fulfi ll these criteria are pre-

sented in connection to the items considered to be affected. The table

below discloses where to fi nd these descriptions.

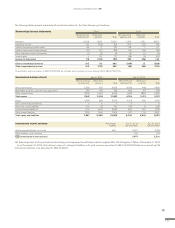

Source of estimation uncertainty Note

Buy-back agreements and residual value

guarantees 7, Revenue

Deferred taxes 10, Income taxes

Impairment of goodwill and other intangible

assets 12, Intangible assets

Impairment of tangible assets 13, Tangible assets

Credit loss reserves 15,

16,

Customer-fi nancing

receivables

Receivables

Inventory obsolescence 17, Inventories

Assumptions when calculating pensions and

other post-employment benefi ts

20, Provisions for post-

employment benefi ts

Product warranty costs 21, Other provisions

Legal proceedings 21, Other provisions

Residual value risks 21, Other provisions

NOTE 2 KEY SOURCES OF ESTIMATION UNCERTAINTY

121

FINANCIAL INFORMATION 2014