Volvo 2014 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE VOLVO GROUP’S LARGER ACQUISITIONS AND DIVESTMENTS

1998 Acquisition of the excavator operations of Samsung

Heavy Industries.

1999 Sale of Volvo Cars to Ford.

2001 Acquisition of the truck manufacturers Mack and

Renault VI.

2003 Acquisition of Bilia’s European truck and construction

equipment dealers.

2004 Acquisition of remaining 50% of the Canadian bus

manufacturer Prévost.

2006 Acquisition of Japanese Nissan Diesel

(Now UD Trucks) started. Completed in 2007.

2007 Acquisition of 70% of Chinese wheel loader

manufacturerLingong (SDLG).

2007 Acquisition of Ingersoll Rand’s road development division.

2008 Formation of joint venture with Eicher Motors of India

within trucks and buses.

2012 Acquisition of the French vehicle manufacturer Panhard.

2012 Divestment of Volvo Aero to the British company GKN.

2012 Increase to just over 25% ownership in engine

manufacturer Deutz.

2013 Agreement to acquire 45% of Chinese truck company

Dongfeng Commercial Vehicles.

2013 Agreement on acquisition of hauler business from Terex.

2014 Divestment of Volvo Rents in North America.

2015 Acquisition of 45% of Chinese company Dongfeng

Commercial Vehicles.

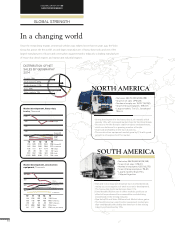

A GLOBAL GROUP 2014 GROUP PERFORMANCE GLOBAL STRENGTH

THE GROUP’S FIVE

LARGEST MARKETS

UNITED STATES • FRANCE

BRAZIL • JAPAN

UNITED KINGDOM

EUROPE

• Net sales: SEK 106,176 M (105,320)

• Share of net sales: 38% (39)

• Number of employees: 50,833 (52,334)

• Share of Group employees: 55% (55)

• Largest markets: France, the UK,

Germany and Sweden.

• The market for heavy-duty trucks in Europe declined by 5%.

• Somewhat increased market share for Volvo and somewhat

lowered market share for Renault Trucks.

• Renault Trucks T range voted International Truck of the Year

2015.

• The construction equipment market increased by 7%.

OTHER MARKETS

• Net sales: SEK 21,481 M (20,942)

• Share of net sales: 7% (7)

• Number of employees: 2,626 (2,574)

• Share of Group employees: 3% (3)

• Largest markets: Australia, South Africa,

Algeria, Morocco and New Zealand.

• Demand in Australia was negatively impacted by the down-

turn in the mining industry.

• The South African market was relatively stable with a recovery

in GDP growth during the second half of the year.

ASIA

• Net sales: SEK 52,076 M (53,512)

• Share of net sales: 18% (20)

• Number of employees: 17,793 (17,953)

• Share of Group employees: 19% (19)

• Largest markets: Japan, China, South

Korea, Turkey and India.

• Sharp and accelerating decline in the important Chinese mar-

ket for construction equipment, which declined by 18%.

• Mixed development in the truck markets.

• Demand in Japan supported by infrastructure investments.

• Recovery in demand in the Indian truck market.

• Acquisition of 45% of the Chinese company Dongfeng

Commercial Vehicles completed in January 2015.

T

TS

T

S

S

S

T

S

T

S

h

e down-

•

•

•

•

•

•

•

•

d accelerating

• Sharp and

d

c

c

cc

65