Volvo 2014 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

162

Purchases and sales of fi nancial assets and liabilities are recognized on

the transaction date. Transaction expenses are included in the asset’s fair

value, except in cases in which the change in value is recognized in the

income statement. The transaction costs that arise in conjunction with the

assumption of fi nancial liabilities are amortized over the term of the loan

as a fi nancial cost.

A fi nancial asset is derecognized in the balance sheet when all signifi -

cant risks and benefi ts linked to the asset have been transferred to a third

party.

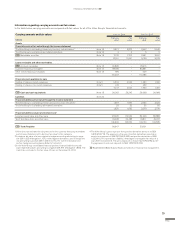

The fair value of assets is determined based on valid market prices,

when available. If market prices are unavailable, the fair value is deter-

mined for each asset using various measurement techniques.

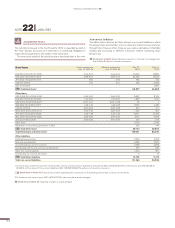

Financial instruments are classifi ed based on the degree that market

values have been utilized when measuring fair value. All fi nancial instru-

ments measured at fair value held by Volvo Group are classifi ed as level 2

with the exception of shares and participations, which are classifi ed as

level 1 for listed instruments and level 3 for not listed instruments. The

valuation of level 2 instruments is based on market conditions using

quoted market data existing at each balance sheet date. The basis for the

interest is the zero-coupon-curve in each currency which is used to calcu-

late the present value of all the estimated future cash fl ows. The fair value

of forward exchange contracts is discounted to balance sheet date based

on the forward rates for each currency as per balance sheet date.

Read more in Note 5 about valuation policy for other shares and

participations.

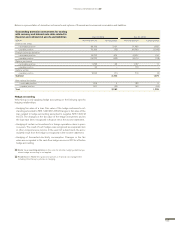

Financial assets at fair value through the income statement

All of the Volvo Group’s fi nancial assets that are recognized at fair value

through the income statement are classifi ed as held for trading. As pre-

sented in the table on next page, these instruments are derivatives, used

for hedging interest, currency and raw material prices, and marketable

securities (further presented in note 18).

Derivatives used for hedging interest rate exposure in the Customer

Finance portfolio as well as for the fi nancing of activities in Industrial

Operations are included in this category. Unrealized gains and losses

from fl uctuations in the fair values of the fi nancial instruments are recog-

nized in Other fi nancial income and expense. The Volvo Group intends to

hold these derivatives to maturity, which is why, over time, the market val-

uation will be offset as a consequence of the interest-rate fi xing on bor-

rowing and lending for the Customer Finance Operations, and thus not

affect operating income or cash fl ow.

Financial instruments used for hedging currency risks arising from

future fi rm commercial cash fl ows are also recognized under this cate-

gory. Unrealized and realized gains and losses are recognized in Other

fi nancial income and expenses to be able to net all internal fl ows before

entering into external derivatives, except for gains and losses from deriv-

atives hedging currency risks of future cash fl ows for specifi c orders

which are recognized in operating income.

Read more in Note 9 about the effect in the income statement from

revaluation of the derivatives.

The Volvo Group only applies hedge accounting on a few specifi c hedging

relationships. Refer to section on Hedge accounting in this note for the

Volvo Group’s policy choice on hedge accounting.

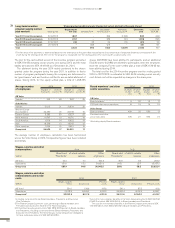

Loan receivables and other receivables

Included in this category are accounts receivable, customer-fi nance receiv-

ables and other interest bearing receivables.

Read more in Note 15 for accounting policy on customer-fi nance receivables.

Read more in Note 16 for accounting policy on accounts receivable and

other interest-bearing receivables.

Assets available for sale

This category includes assets available for sale and assets that have not

been classifi ed in any of the other category. For the Volvo Group this cat-

egory contains holding of shares in listed and non-listed companies.

Read more in Note 5 about other shares and participations.

ACCOUNTING POLICY

NOTE 30 FINANCIAL INSTRUMENTS

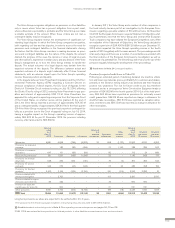

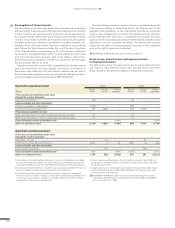

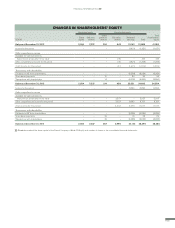

Changes in loans, net 2014 2013

New borrowings 180,066 150,320

Amortizations (169,436) (134,834)

Syndications (4,661) (3,604)

Changes in group composition (280) 138

Other 997 935

Changes in loans, net 6,686 12,955

During 2014 external loans in the Volvo Group balance sheet increased

by SEK 13.0 billion (3.5), whereof SEK 9.7 billion (positive 5.4) was related

to currency effects. Syndications was performed in the Customer Finance

Operations to an amount of SEK 8.3 billion (6.6), whereof SEK 3.7 billion

(3.0) had no impact on the cash fl ow. Both the negative currency effect

and the syndications with no impact on the cash fl ow have been adjusted

on changes in loans, net in the cash fl ow.

Realized gains and losses on derivatives used to hedge future cash

fl ows from the acquisition of Dongfeng Commercial Vehicles amounted to

SEK 1.2 billion and is reported in changes in loans, net in the cash fl ow

and included on line Other in the table Changes in loans, net above.

Important increase/decrease in bond loans and other loans

In 2014, the Volvo Group increased its borrowings as a consequence of

higher demands of funding in the Customer Finance Operations. Indus-

trial Operations reduced its borrowings mainly as a consequence of an

improved operating cash fl ow and the divesture of Volvo Rents and com-

mercial real estate.

A hybrid bond was issued in 2014, amounting to EUR 1.5 billion in order

to further strengthen the Group’s balance sheet and prolong the maturity

structure of the debt portfolio. The hybrid is accounted for as a loan with

a maturity of 61.6 years and subordinated to all other fi nancial liabilities

currently outstanding.

Read more in Note 22 Liabilities regarding the hybrid bond.

FINANCIAL INFORMATION 2014