Volvo 2014 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

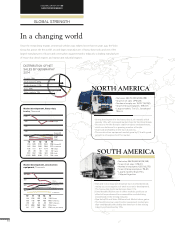

Demand was good in North America and Japan as

a result of the economies developing well. On the

other hand the European market showed little or

no growth and the South American market was

weak with the main market in Brazil declining

sharply as a consequence of lower GDP growth. After a weak

2013, the heavy-duty truck market in India rebounded while the

Chinese market declined.

Varying market conditions

In 2014, the heavy-duty truck market in Europe 30 (EU plus Nor-

way and Switzerland) declined by 5% to 227,600 trucks com-

pared with 240,400 in 2013 when demand was strong as an

effect of prebuys of Euro 5 trucks ahead of the new emissions

regulations Euro 6. For 2015 the total market is expected to be at

a level of about 240,000 heavy-duty trucks.

In 2014, the total North American retail market for heavy-duty

trucks increased by 14% to 270,300 vehicles (236,800). For

2015, the total market is expected to reach a level of about

310,000 heavy-duty trucks.

In 2014, the Brazilian market decreased by 11% to 92,700

heavy-duty trucks (103,800). For 2015 the total market in Brazil

is expected to continue to decline to about 75,000 heavy-duty

trucks.

In Japan the total market for heavy-duty trucks rose by 25% to

42,200 vehicles (33,800). The Japanese market for medium-duty

trucks grew by 27% to 46,200 trucks (36,400). For 2015 the

total market in Japan is expected to be at a level of about 40,000

heavy-duty trucks and 45,000 medium-duty trucks.

In India, the total market for heavy-duty trucks grew by 18% to

154,800 trucks (131,700). On the other hand, the total Indian

market for medium-duty trucks declined by 18% to 62,300 trucks

(76,300). For 2015 the total market in India is expected to reach

a level of about 160,000 heavy-duty trucks and about 73,000

medium-duty trucks.

In China, the total market for heavy-duty trucks declined by 4%

to 743,700 vehicles (773,900). The total market for medium-duty

trucks declined by 15% to 243,500 vehicles (286,400). For 2015

the total market in China is expected to reach a level of about

730,000 heavy-duty trucks and 220,000 medium-duty trucks.

During 2014 market conditions varied signifi cantly

between different parts of the world.

CONTINUED

PRODUCT RENEWAL AND

RESTRUCTURING

TRUCKS

Facts The truck operation’s product offer stretches from heavy-

duty trucks for long-haulage and construction work to light-duty

trucks for distribution. The offering also includes maintenance and

repair services, fi nancing and leasing.

Position on world market Volvo Group is the world’s second

largest manufacturer of heavy-duty trucks.

Brands Volvo, UD Trucks, Renault Trucks, Mack and Eicher.

As of January 2015, Dongfeng is also included.

Number of regular employees 58,067 (58,542)

Share of Group net sales, % 67

(65)

BOARD OF DIRECTORS’ REPORT 2014

GROUP PERFORMANCE

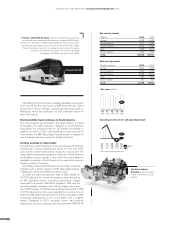

During the year Volvo Trucks launched

I-Shift Dual Clutch, the fi rst transmis-

sion on the market with a dual clutch

system for heavy vehicles. Thanks to

power-shift gear changes without any

interruption in power delivery, torque

is maintained and the truck does not

lose any speed during gear changes.

For the driver, the result is more comfort-

able and effi cient progress on the road.

I-Shift Dual Clutch is a transmission con-

sisting of two input shafts and a dual clutch. This

means that two gears can be selected at the same time. It is the clutch

that determines which of the gears is currently active. I-Shift Dual Clutch is

based on I-Shift, but the front half of the gearbox has been redesigned

with entirely new components. Trans-

missions with dual clutches are

already used in cars, but Volvo

Trucks is the fi rst manufacturer

in the world to offer a similar

solution for series-produced

heavy vehicles.

Volvo Trucks

launches unique

gearbox

70