Volvo 2014 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

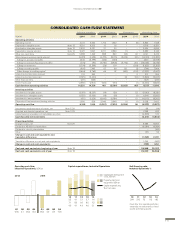

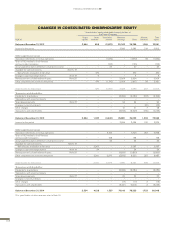

4:3

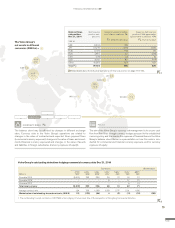

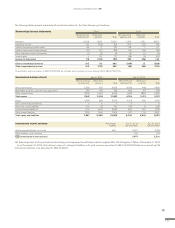

Commercial currency exposure

Transaction exposure from commercial fl ows

The Volvo Group conducts manufacturing in 19 countries around the

globe and more than 90% of net sales are generated in countries other

than Sweden. Transaction exposure from commercial fl ows in foreign

currency is generated from internal purchases and sales between manu-

facturing units and market companies and external sales and purchases

in foreign currency around the globe. As the predominant parts of the

operations in the Volvo Group are situated outside Sweden, the fl uctua-

tions in currency rates affecting the transaction fl ows in foreign currency

are in many cases not against SEK. Industrial Operations transaction

exposure in key currencies is presented in table 4:5. The graph repre-

sents the transaction exposure from commercial operating net cash fl ows

in foreign currency, expressed as net surpluses or defi cits in key curren-

cies. The defi cit in SEK and KRW is mainly an effect of expenses for

manufacturing plants in Sweden and Korea, but limited external revenues

in those currencies. The EUR defi cit on the other hand, is the net of sig-

nifi cant gross volumes of sales and purchases made by many entities

around the globe in EUR. The surplus in USD is mainly generated from

external sales to entities within the US and emerging markets.

The hedging of the Volvo Group’s commercial currency exposure is

decided centrally. The Volvo Group’s consolidated currency portfolio

exposure is the value of forecasted future payment fl ows in foreign

currency. The Volvo Group only hedge the part of the forecasted portfolio

that is considered highly probable to occur, i.e. fi rm fl ows, where the main

parts will be realized within six months. The Volvo Group uses forward

contracts and currency options to hedge the portion of the value of fore-

casted future payment fl ows in foreign currency. The hedged amount of

fi rm fl ows for all periods fall within the framework of the Volvo Group’s

currency policy. The table 4:2 shows outstanding forward and option

contracts for the hedging of commercial currency risks.

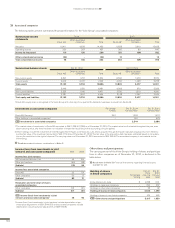

Translation exposure from the consolidation of operating income in

foreign subsidiaries

In conjunction with the translation of operating income in foreign subsidiaries,

the Volvo Group’s earnings are impacted if currency rates change. The Volvo

Group does not hedge this risk. For more information on currency hedging of

equity see below. The table 4:7 shows the translation effect when consol-

idating operating income for 2014 in foreign subsidiaries in key currencies.

Read more in section currency exposure of equity below regarding currency

hedging of equity.

Sensitivity analysis- transactional exposure*

The table 4:3 illustrates the impact on operating income if key currencies for

Industrial Operations appreciate by 10% against all other currencies. The

impact on equity is impact on operating income after tax.

The defi cit in transaction exposure in SEK is mainly generated from

fl ows in USD, GBP, CAD and EUR against SEK.

Industrial Operations currency review

The tables 4:4 4:5 4:6 4:7 and 4:8 on the next page illustrate the

currency impact on sales and operating income in key currencies. The

effect arises from translation during the consolidation of foreign curren-

cies and from commercial net fl ows in foreign currency.

Read more about Industrial Operations transactional exposure in section

Commercial currency exposure above.

Financial currency exposure

Loans and investments in the Volvo Group’s subsidiaries are performed

mainly in local currencies through Volvo Treasury, which minimizes individ-

ual companies’ fi nancial currency exposure. Volvo Treasury uses various

derivatives to facilitate lending and borrowing in different currencies with-

out increasing the risk for the Volvo Group. The net fi nancial position of

the Volvo Group is affected by currency fl uctuations since fi nancial assets

and liabilities are distributed among the Volvo Group companies that con-

duct their operations using different currencies.

Table 4:1 discloses the impact on earnings before tax on Industrial

Operations net fi nancial position, excluding pensions and similar net obliga-

tions, if SEK were to strengthen by 10%.

Currency exposure of equity

The carrying amount of assets and liabilities in foreign subsidiaries are

affected by current exchange rates in conjunction with the translation of

assets and liabilities to SEK. To minimize currency exposure of equity, the

size of equity in foreign subsidiaries is continuously optimized with respect

to commercial and legal conditions. Currency hedging of equity may occur

in cases where a foreign subsidiary is considered overcapitalized. Net

assets in foreign subsidiaries, associated companies and joint ventures

amounted at year-end 2014 to SEK 70 billion (66). The need to undertake

currency hedging relating to investments in associated companies, joint

ventures and other companies is assessed on a case-by-case basis.

On the map on page 124–125 the Volvo Group’s net assets in different

currencies (SEK bn) are displayed.

Goals and policies in fi nancial risk management (cont.)

* The sensitivity analysis on currency rate risks is based on simplifi ed assumptions.

It is not improbable for the value in a currency rate to appreciate by 10% in rela-

tion to other currencies. In reality however, currencies usually do not change in

the same direction at any given time, so the actual effect of exchange-rate

changes may differ from the sensitivity analysis. Please refer to tables 4:1 4:3

Risk currency

exposure 2014

Transaction exposure

from operating

net fl ows

Impact on operating

income if currency

rate appreciates

against all other

currencies by 10%

B (Currency risks) SEK bn

SEK (33.1) (3.3)

EUR (4.0) (0.4)

KRW (8.7) (0.9)

USD 16.1 1.6

Sensitivity analysis*

FINANCIAL INFORMATION 2014

126