Volvo 2014 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LIQUIDITY RISKS

Liquidity risk is defi ned as the risk that the Volvo Group would be unable

to fi nance or refi nance its assets or fulfi ll its payment obligations.

POLICY

The Volvo Group assures itself of sound fi nancial preparedness by always

having liquid funds and committed facilities to cover the Volvo Group’s

expected liquidity needs for a period of 12–18 months in a scenario with

no access to capital markets.

The Volvo Group’s liquid funds, i.e. cash and cash equivalents and market-

able securities combined, amounted to SEK 33,6 billion on December 31,

2014. In addition to this, granted but unutilized credit facilities amounted

to SEK 39,2 billion. The liquidity preparedness is therefore suffi cient to

cover the expected liquidity needs for the Volvo Group for more than 18

months in a scenario with no access to capital markets.

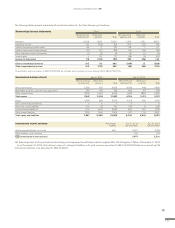

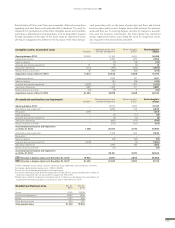

The adjacent graph 4:9 discloses expected future cash fl ows including

derivatives related to fi nancial liabilities. Capital fl ow refers to expected

payments of loans and derivatives, see note 22. Expected interest fl ow

refers to the future interest payments on loans and derivatives based on

interest rates expected by the market. The interest fl ow is recognized

within cash fl ow from operating activities.

In addition to derivatives included in capital fl ow in the adjacent graph

4:9 there are also derivatives related to fi nancial liabilities recognized as

assets, which are expected to give a future capital fl ow of SEK 1.5 billion

and a future interest fl ow of SEK 1.8 billion.

The predominant part of expected future cash-fl ows that expires within

2015 and 2016 is an effect of the Volvo Group’s normal business cycle,

with shorter duration in the Customer Finance portfolio compared to

Industrial Operations.

POLICY

Changes in commodity prices are included in the product cost calculation.

Increased commodity prices are therefore refl ected in the sales price of

the Volvo Group’s fi nal products. Purchasing agreements with commodity

suppliers may also be long-term in nature or structured in a way that short

term volatility in commodity prices have less direct effect on Volvo Group’s

cost base. Financial hedging is performed in order to reduce short-term

volatility of electricity cost in Sweden.

INTEREST-RATE RISKS CURRENCY RISKS CREDIT RISKS

FINANCIAL RISKS

OTHER PRICE RISKSLIQUIDITY RISKS

INTEREST-RATE RISKS CURRENCY RISKS CREDIT RISKS

FINANCIAL RISKS

OTHER PRICE RISKSLIQUIDITY RISKS

OTHER PRICE RISKS

Commodity risks

Commodity risks refer to the risk that changed commodity prices will

affect the consolidated earnings within the Volvo Group. Procurement of

commodities such as steel, precious metals and electricity are made on a

regular basis where prices are set in the global markets.

A hybrid bond was issued in 2014 amounting to EUR 1.5 billion in order

to further strengthen the Volvo Group’s balance sheet and prolong the

maturity structure of the debt portfolio. The hybrid bond is classifi ed as a

loan with duration of 61.6 years, subordinated to all other fi nancial liabili-

ties currently outstanding.

Volvo Group signed EUR 3.5 billion revolving credit facilities in order to

further strengthen the liquidity preparedness.

Read more in Note 22 Liabilities regarding the maturity structure

concerning bond loans and other loans, the hybrid bond as well as granted but

unutilized credit facilities.

Read more about contractual term analysis of the Volvo Group’s future

payments from non-annullable fi nancial and operational lease contracts in

Note 14.

4:9

Future cash-fl ow including derivatives related to

non-current and current fi nancial liabilities

Capital flow, SEK bn

Interest flow, SEK bn

2019

(11.3)

(1.0)

2020

(1.1)

(0.8)

2021 or later

(17.1)

(1.2)

2017

(27.5)

(2.0)

2018

(6.2)

(1.1)

2016

(44.9)

(2.8)

2015

(40.0)

(3.5)

(50)

0

(40)

(30)

(20)

(10)

129

FINANCIAL INFORMATION 2014