Volvo 2014 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194

|

|

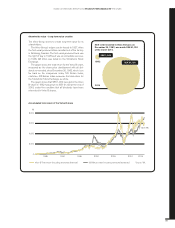

BOARD OF DIRECTORS’ REPORT GROUP PERFORMANCE VOLVO FINANCIAL SERVICES

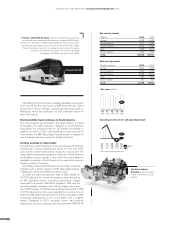

Operating income*, SEK M

13

1,522

14

1,717

12

1,496

11

969

10

167

1,717

Return on shareholders’ equity, %

14

12.5

13

12.1

12.5

Distribution of credit portfolio

Volvo Trucks, 48%

Volvo CE, 23%

Renault Trucks, 10%

Mack Trucks, 12%

Buses, 5%

UD Trucks, 2%

Penetration rate*, %

3030

Volvo

Trucks

Renault

Trucks

Mack

Trucks

Buses Volvo

CE

UD

Trucks

2321 2321 2716 3936 1112

13 14

* Share of unit sales fi nanced by Volvo Financial Services in relation to

total number units sold by the Volvo Group in markets where fi nancial

services are offered.

Customer fi nance operations

Total new fi nancing volume in 2014 amounted to SEK 54.7 billion

(47.0). Adjusted for changes in exchange rates, new business vol-

ume increased by 13.5% compared to 2013. In total, 54,819 new

Volvo Group vehicles and machines (51,466) were fi nanced dur-

ing the year. In the markets where fi nancing is offered, the aver-

age penetration rate was 28% (27).

As of December 31, 2014, the net credit portfolio amounted to

SEK 117,101 M (103,873). The funding of the credit portfolio is

matched in terms of maturity, interest rates and currencies in

accordance with Volvo Group policy. For further information, see

note 4 to the Consolidated fi nancial statements.

The operating income excluding restructuring charges amounted

to SEK 1,717 M compared to SEK 1,522 M in the previous year.

Restructuring charges amounted to SEK 5 M (0). Return on

shareholders’ equity was 12.5% (12.1). The equity ratio at the end

of the year was 8.0% (8.1). Improvements in gross income and

provisions along with good cost control are the drivers of the over-

all increase in profi tability.

During the year, credit provision expenses amounted to SEK

858 M (923) while write-offs of SEK 715 M (719) were recorded.

The write-off ratio for 2014 was 0.66% (0.71). At the end of

December 31, 2014, credit reserves were 1.33% (1.31) of the

credit portfolio.

VFS closed the year 2014 with a credit portfolio of SEK 117 billion.

*Excl. restructuring charges

82