Volvo 2014 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194

|

|

1

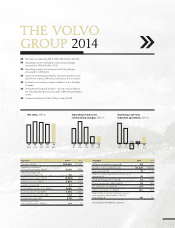

Net sales increased by 4% to SEK 282.9 billion (272.6).

Operating income excluding restructuring charges

amounted to SEK 8.4 billion (7.9).

Operating margin excluding restructuring charges

amounted to 3.0% (2.9).

Improved underlying profi tability with good traction in the

activities to improve effi ciency and reduce the cost base.

Increased cost-savings scope in addition to the Strategic

Program.

Strengthened fi nancial position – at year end net debt in

the Industrial Operations amounted to 14% of shareholders’

equity.

Proposed dividend of SEK 3.00 per share (3.00).

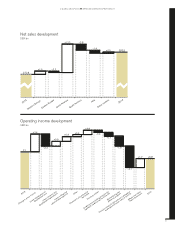

Net sales, SEK bn

13 14121110

273 283300310265

Operating income excl.

restructuring charges, SEK bn

1110

26.918.0

13

7.9

14

8.4

12

19.6

Operating cash fl ow,

Industrial operations, SEK bn

1413121110

6.41.5

(4.9)

14.119.0

THE VOLVO

GROUP 2014

Net sales, SEK M 282,948 272,622

Operating income excl.

restructuring charges, SEK M 8,393 7,854

Operating margin excl.

restructuring charges, % 3.0 2.9

Restructuring charges,SEK M (2,569) (715)

Operating income, SEK M 5,824 7,138

Operating margin, % 2.1 2.6

Income after fi nancial items, SEK M 5,089 4,721

Income for the period, SEK M 2,235 3,802

Diluted earnings per share, SEK 1.03 1.76

Dividend per share, SEK 3.0013.00

Operating cash fl ow,

Industrial Operations, SEK bn 6.4 1.5

Return on shareholders’ equity, % 2.8 5.0

Number of permanent employees 92,822 95,533

Share of women, % 18 17

Share of women,Presidents and other senior

executives, % 21 19

Employee Engagement Index, % 72 76

Energy consumption, MWh/SEK M 7.9 9.6

CO2 emissions, tons/SEK M 0.8 1.1

Water consumption, m3/SEK M 18.1 21.9

Share of direct material purchasing spend

from suppliers having made a CSR self-

assessment, % 80 72

1 According to the Board’s proposal.

Key ratios 2014 2013 Key ratios 2014 2013