Volvo 2014 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In 2014, the Volvo Group improved the underlying profi tability as

a result of better volumes, reduced operating expenses from the

effi ciency measures being implemented across the Group and

higher margins for both new products and in the spare parts and

service business.

Improved gross income and lowered

operating expenses

A GLOBAL GROUP 2014

IMPROVED UNDERLYING

PROFITABILITY

Net sales increased

The Group’s net sales increased by 4% to SEK 282,948 M

(272,622). Adjusted for changes in currency exchange rates and

acquired and divested units net sales were up by 2% compared to

2013. Sales increased signifi cantly in North America, was up

slightly in Western Europe whereas it decreased in Asia, South

America and Eastern Europe. From a segment perspective sales

increased in Trucks, Buses and Volvo Penta while they decreased

for Volvo Construction Equipment (Volvo CE).

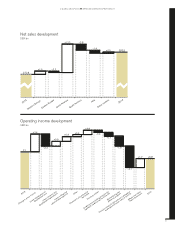

Earnings impacted by restructuring costs and provisions

The Volvo Group’s operating income amounted to SEK 5,824 M

(7,138) and the operating margin was 2.1% (2.6). The operating

income was negatively impacted by restructuring charges in an

amount of SEK 2,569 M, provisions for the EU antitrust investiga-

tion of SEK 3,790 M, expected credit losses in China of SEK 660

M as well as a litigation in the U.S. of SEK 422 M. Operating

income includes a positive impact of SEK 815 M from a capital

gain on the sale of real estate and SEK 226 M from a release of

a provision for Volvo Rents. In 2013 operating income was nega-

tively impacted by a write-down of Volvo Rents of SEK 1,500 M,

an increased warranty provision of SEK 900 M and restructuring

charges of SEK 715 M.

Excluding these items, the underlying operating income

amounted to SEK 12,224 M compared with SEK 10,253 M, cor-

responding to an operating margin of 4.3% (3.8). Compared with

2013, the increased underlying operating income was primarily

driven by increased sales volumes, a reduction in operating expenses

and improved gross income based on higher margins for new

products as well as services and aftermarket products in both

Europe and North America. This was partly off-set by a negative

market mix, with lower volumes in Brazil and China. Research and

development expenses were higher compared to 2013 as a con-

sequence of net capitalization of research and development ex pen-

ses being SEK 2,340 M lower. Cash spend in research and devel-

opment, however was reduced by SEK 916 M compared with 2013.

Unfavorable currency development had a negative impact on

operating income in an amount of SEK 422 M compared with 2013.

The truck business improved its underlying profi tability with a

positive contribution from increased margins for the new Volvo FH

range in Europe. The Volvo brand improved its market share and

had a good volume development across the continent. Volumes

and profi tability in the North American truck business increased

signifi cantly and contributed to the improved operating income.

The performance in Europe and North America was partially off-

set by a downturn in Brazil with lower volumes and pressure on

margins. From a market mix perspective the relatively higher

share of sales stemming from North America and lower share

from Brazil had a dilutive effect on margins. Low volumes of the

new UD Quester and the new Renault Trucks range as well as the

turbulent Russian market led to low capacity utilization in parts of

the industrial system.

Volvo CE was negatively impacted by lower sales volumes and

a low capacity utilization in the industrial system. Low machine

utilization in the important Chinese market, primarily in the mining

industry, led to a weakening of Volvo CE’s sales as well as the

profi tability and fi nancial positions of dealers and customers in

the country.

Buses’ operating income was positively impacted by a favorable

mix, an improved aftermarket and internal cost-effi ciency pro-

grams, while operational disturbances in one of the plants had a

negative impact. Volvo Penta’s profi tability was positively impacted

primarily by a favorable product and customer mix.

4