Volvo 2014 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Board is responsible for the internal controls according to the Swedish

Companies Act and the Code. The purpose of this report is to provide

shareholders and other interested parties with an understanding of how

internal control is organized at Volvo with regard to fi nancial reporting. The

description has been designed in accordance with the Swedish Annual

Accounts Act and is thus limited to internal control over fi nancial reporting.

Introduction

Volvo has a function for internal control with the objective to provide sup-

port for management, allow ing them to continuously provide solid and

improved internal controls relating to fi nancial reporting. Work that is con-

ducted through this function is primarily based to ensure compliance with

directives and policies, and to create effective conditions for specifi c con-

trol activities in key processes related to fi nancial reporting. The Audit

Committee is informed of the results of the work performed by the Inter-

nal Control function within Volvo with regard to risks, control activities and

follow-up on the fi nancial reporting.

Volvo also has a Corporate Audit function with the primary task of inde-

pendently monitoring that companies in the Group follow the principles

and rules that are stated in the Group’s directives, policies and instruc-

tions for fi nancial reporting. The head of the Corporate Audit function

reports directly to the CEO, and to the Group’s General Counsel and the

Board’s Audit Committee.

Control environment

Fundamental to Volvo’s control environment is the business culture that is

established within the Group and in which managers and employees oper-

ate. Volvo works actively on communications and training regarding the com-

pany’s basic values as described in The Volvo Way, an internal document

concerning Volvo’s business culture, and the Group’s Code of Conduct, to

ensure that good morals, ethics and integrity permeate the organization.

The foundation of the internal control process relating to the fi nancial

reporting is based on the Group’s directives, policies and instructions,

as well as the organization’s responsibility and authority structure. The

principles for internal controls and directives and policies for the fi nancial

reporting are contained in Volvo Financial Policies & Procedures (FPP),

an internal document comprising all important instructions, rules and

principles.

number of performance shares per invested share could be allotted. As

for the matching shares, no allotment will be made for a yearly plan if the

Annual General Meeting held the following year resolves that no dividend

should be distributed to the shareholders. Allotment of performance

shares is conditional on the Volvo Group’s ROE reaching at least 10 per-

cent for the annual plan 2014, 11 percent for the annual plan 2015 and 12

percent for the annual plan 2016. Maximum allotment of performance

shares is effected if ROE reaches 25 percent for the annual plan 2014,

26 percent for the annual plan 2015 and 27 percent for the annual plan

2016. Maximum allotment of performance shares under a yearly plan

amounts to seven shares per invested share for the CEO, six shares per

invested share for Group Executive Team members and fi ve shares per

invested share for other participants.

The Remuneration Committee conducts an annual evaluation of the

remuneration policy, Volvo’s system for variable remuneration to execu-

tives and the long-term, share-based incentive program to senior execu-

tives, and the Board prepares a special report of this evaluation and the

conclusions. The report on the evaluation for 2014 will be available on

Volvo’s website no later than two weeks prior to the Annual General

Meeting 2015, www.volvogroup.com. For more information about remu-

neration to the Group Executive Team and an account of outstanding

share and share-price related incentive programs to the management,

refer to Note 27 in the Group’s notes in the Annual Report.

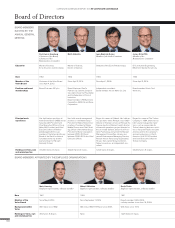

Changes to the Group Executive Team

As a result of the merger of the previous three sales regions in the truck

operation into a single global sales organization, and with the purpose of

creating a smaller and more effi cient management team, the number of

members of the Group Executive Team was reduced from 16 to 10 includ-

ing the CEO as from January 1, 2015. This was achieved by the following

changes:

• The merger of the three sales and marketing organizations in Group

Trucks resulting in one Group Executive Team member instead of three.

• The head of Volvo Construction Equipment and the head of Volvo Finan-

cial Services are no longer members of the Group Executive Team. The

head of Volvo Construction Equipment will continue to report to the

Executive Vice President Business Areas and the head of Volvo Financial

Services will continue to report to the Group’s Chief Financial Offi cer.

• Corporate Process & IT has been relocated organizationally under the

Group’s Chief Financial Offi cer.

• The Corporate Sustainability & Public Affairs and Corporate Communi-

cation staff functions were merged into a single unit resulting in one

Group Executive Team member instead of two.

After the organizational change, the Group Executive Team comprises of

the CEO, the Executive Vice Presidents of the three Group Trucks divi-

sions, the Executive Vice President Business Areas, and the Executive

Vice Presidents of the fi ve Corporate Functions.

On January 1, 2015, Henry Sténson joined the Volvo Group and the

Group Executive Team, and assumed the position as Executive Vice Pres-

ident Corporate Communication & Sustainability Affairs.

Group Management

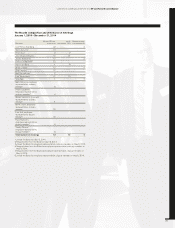

Volvo Group Internal Control Programme

Yearly evaluation of the effectiveness of internal control over

fi nancial reporting (ICFR) within the Volvo Group.

R

e

m

e

d

i

a

t

i

o

n

o

f

d

e

fi

c

i

e

n

c

i

e

s

a

n

d

r

e

p

o

r

t

i

n

g

P

l

a

n

a

n

d

s

e

l

e

c

t

y

e

a

r

l

y

f

o

c

u

s

a

r

e

a

s

T

e

s

t

o

f

d

e

t

a

i

l

s

(

v

a

l

i

d

a

t

i

o

n

)

FPP VICS

Volvo Group Internal

Control Programme

P

r

o

c

e

s

s

a

n

d

c

o

n

t

r

o

l

d

e

s

i

g

n

a

s

s

e

s

s

m

e

n

t

Internal control over fi nancial reporting

10

106

CORPORATE GOVERNANCE REPORT 2014 CORPORATE GOVERNANCE