Volvo 2014 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

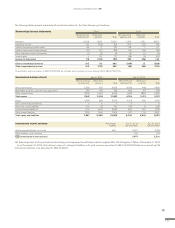

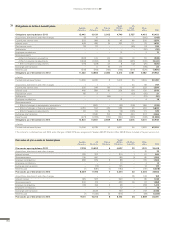

Reclassifi cations and other mainly consist of assets under operating lease

related to legal sales transactions, where revenue is deferred and accounted

for as operating lease revenue. Assets classifi ed as inventory will, when the

operating lease model is applied for revenue recognition, be reclassifi ed

from inventory to assets under operating lease, when the legal sales

transaction occurs. If the product is returned after the lease period, there

will be a reclassifi cation from assets under operating leases back to

inventory. When a buy-back agreement has expired, but the related prod-

uct is not returned, the cost and the accumulated depreciation are

reversed in reclassifi cation and other, within the line item assets under

operating leases. Most reclassifi cations within tangible assets relate to

construction in progress, which are reclassifi ed to the respective category

within property, plant and equipment.

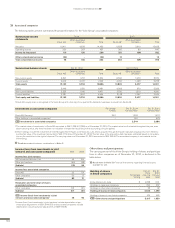

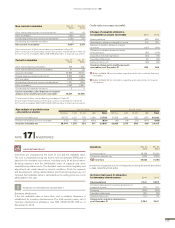

Investment properties

The acquisition value of investment properties at year-end amounted to

SEK 600 M (689). Capital expenditures during 2014 amounted to SEK 3

M (9). Accumulated depreciation amounted to SEK 335 M (362) at year-

end, of which SEK 23 M (26) refers to 2014. The estimated fair value of

investment properties amounted to SEK 0.7 billion (0.6) at year-end. 97%

(98) of the area available for lease were leased out during the year. Net

income for the year was affected by SEK 78 M (259) in rental income

from investment properties and of SEK 13 M (63) in direct costs.

Tangible assets,

Accumulated depreciation

Buildings

Land and

land

improve-

ments

Machinery

and

equipment3

Construction in

progress, includ-

ing advance

payments

Total investment

property, property,

plant and equipment

Assets

under

operating

leases

Total

tangible

assets

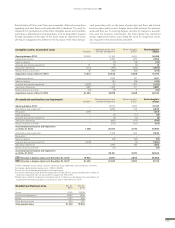

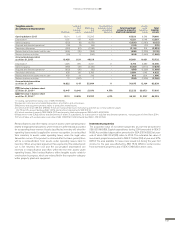

Opening balance 2013 16,114 1,113 50,093 – 67,320 9,346 76,666

Depreciation41,157 113 4,951 – 6,221 6,146 12,367

Sales/scrapping (252) (8) (3,075) – (3,335) (2,790) (6,125)

Acquired and divested operations

6(36) (3) (64) – (103) (73) (176)

Translation differences (891) (61) (2,166) – (3,118) 219 (2,899)

Reclassifi ed to/from assets held for sale (595) (35) (268) – (898) (1,238) (2,136)

Reclassifi cations and other (69) 5 (342) – (406) (1,559) (1,965)

Accumulated depreciation

as of Dec 31, 2013 15,428 1,124 49,129 – 65,681 10,051 75,732

Depreciation41,308 395 5,001 11 6,716 5,680 12,396

Sales/scrapping (689) (49) (4,430) – (5,168) (2,710) (7,878)

Acquired and divested operations

6(622) (36) (20) – (678) (1,306) (1,984)

Translation differences 928 66 2,795 – 3,789 1,143 4,932

Reclassifi ed to/from assets held for sale 459 14 219 – 693 1,214 1,906

Reclassifi cations and other 10 (367) 0 – (358) (1,908) (2,266)

Accumulated depreciation

as of Dec 31, 2014 16,822 1,147 52,694 11 70,675 12,164 82,839

B/S Net value in balance sheet

as of Dec 31, 20132, 5 15,447 10,040 21,970 4,776 52,233 25,672

777,905

B/S Net value in balance sheet

as of Dec 31, 2014

2, 5 17,131 10,535 23,337 4,179 55,181 31, 218

786,399

1 Including capitalized borrowing costs of SEK 160 M (73).

2 Acquisition costs less accumulated depreciation, amortization and write-downs.

3 Machinery and equipment pertains mainly to production related assets.

4 Of which write-down SEK 541 M (650). These are mainly pertaining to restructuring activities as communicated on pages

24, 72 and 76, whereof buildings SEK 140 M, land and land improvements SEK 319 M.

5 Of which investment property SEK 266 M (327) and property, plant and equipment SEK 54,915 M (51,906).

6 Read more in note 3, Acquisitions and divestments of shares in subsidiaries, for a description of acquired and divested operations. Including sale of Volvo Rents 2014.

7 Of which Sales with residual value commitment SEK 10,837 M (10,041), Rental fl eet SEK 1,153 M (734).

FINANCIAL INFORMATION 2014

141