Volvo 2014 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

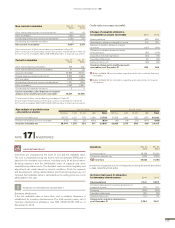

Volvo Group applies the cost method for recognition of intangible assets.

Borrowing costs are included in the cost of assets that are expected to

take more than twelve months to complete for their intended use or sale.

When participating in industrial projects in partnership with other com-

panies the Volvo Group in certain cases pays an entrance fee to partici-

pate. These entrance fees are capitalized as intangible assets.

Research and development expenses

The Volvo Group applies IAS 38 Intangible Assets, for the recognition of

research and development expenses. Pursuant to this standard, expendi-

tures for the development of new products, production systems and soft-

ware are recognized as intangible assets if such expenditures, with a high

degree of certainty, will result in future fi nancial benefi ts for the company.

The cost for such intangible assets is amortized over the estimated useful

life of the assets.

The rules require stringent criteria to be met for these development

expenditures to be recognized as assets. For example, it must be possible

to prove the technical functionality of a new product or software prior to

its development being recognized as an asset. In normal cases, this means

that expenditures are capitalized only during the industrialization phase of

a product development project. Other research and development expenses

are recognized in the income statement as incurred.

The Volvo Group has developed a process for conducting product devel-

opment projects named the Global Development Process (GDP). The GDP

has six phases focused on separate parts of the project. Every phase starts

and ends with a reconciliation point, known as a gate, the criteria for which

must be met for the project’s decision-making committee to open the gate

and allow the project to progress to the next phase. During the industrial-

ization phase, the industrial system is prepared for serial production and

the product is launched. During 2014 the GDP process has been updated

and is going forward named DVP Project Handbook and still consists of

six different phases. The updated process will not have an impact on the

accounting principles for research and development expenses and will be

applied from 1 January 2015 in the Volvo Group.

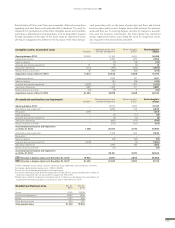

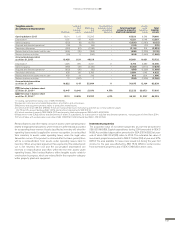

Goodwill

Goodwill is recognized as an intangible asset with indefi nite useful life.

For non-depreciable assets such as goodwill, impairment tests are per-

formed annually, as well as if there are indications of impairments during

the year, by calculating the asset’s recovery value. If the calculated recov-

ery value is less than the carrying value, the asset is written down to its

recovery value.

The Volvo Group’s valuation model is based on a discounted cash-fl ow

model, with a forecast period of four years. Valuation is performed on

cash-generating units, identifi ed as the Volvo Group’s business areas.

Each business area is fully integrated ensuring maximum synergy, hence

no independent cash-fl ows exists on a lower level.

Goodwill is allocated to these cash-generating units based on expected

future benefi t from the combination. The valuation is based on a business

plan which is an integral part of the Volvo Group’s fi nancial planning pro-

cess and represents management’s best estimate of the development of

the Group’s operations. Assumption of 2% (2) long-term market growth

beyond the forecast period and the Group’s expected performance in this

environment is a basis for the valuation. In the model, the Volvo Group is

expected to maintain stable capital effi ciency over time. Other parameters

considered in the calculation are operating income, mix of products and

services, expenses and level of capital expenditures. Measurements are

based on nominal values and applies a general rate of infl ation applicable

for the main markets where the Volvo Group operates. The Volvo Group

uses a discounting factor measured at 12% (12) before tax for 2014.

In 2014, the value of Volvo Group’s operations exceeded the carrying

amount of goodwill for all business areas, thus no impairment was recog-

nized. The Volvo Group has also tested whether a negative adjustment of

one percentage point to the aforementioned parameters would result in

impairment for any goodwill value however none of the business areas

would be impaired as a result of this test. The operating parameters applied

in the valuation are based on management’s strategy and indicates higher

value than historical performance for Buses, although as described on

page 22 the cost effi ciency programs are expected to increase the oper-

ating parameters to a level above the ones applied in the valuation.

Furthermore the Volvo Group is operating in a cyclical industry where

performance could vary over time.

The surplus values differ between the business areas and are to a

varying degree sensitive to changes in the assumptions described above.

Therefore, the Volvo Group continuously follows the performance of the

business areas whose surplus value is dependent on the fulfi llment of the

Volvo Group’s assessments. Instability in the recovery of the market and

volatility in interest and currency rates may lead to indications of a need for

impairment. The most important factors for the future operations of the

Volvo Group are described in the Volvo Group business area section, as

well as in the Risk management section.

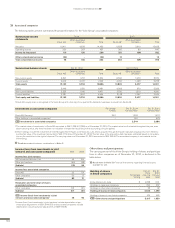

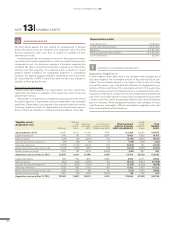

Amortization and impairment

Amortization is made on a straight-line basis based on the cost of the

assets, adjusted in appropriate cases by impairments, and estimated use-

ful lives. Amortization is recognized in the respective function to which it

belongs, meaning that amortization of product development is part of the

research and development expenses in the income statement. Impair-

ment tests for amortizable assets are performed if there are indications of

impairment at the balance sheet date.

Amortization periods

Trademarks 20 years

Distribution networks 10 years

Product and software development 3 to 8 years

ACCOUNTING POLICIES

Impairment of goodwill and other intangible assets

Intangible assets other than goodwill are amortized and depreciated over

their useful lives. Useful lives are based on estimates of the period in which

the assets will generate revenue. If, at the date of the fi nancial statements,

any indication exists that an intangible non-current asset has been impaired,

the recoverable amount of the asset is calculated. The recoverable amount

is the higher of the asset’s net selling price and its value in use, estimated

with reference to management’s projections of future cash fl ows. If the recov-

erable amount of the asset is less than the carrying amount, an impairment

loss is recognized and the carrying amount of the asset is reduced to the

recoverable amount. Determination of the recoverable amount is based

upon management’s projections of future cash fl ows, which are generally

based on internal business plans or forecasts. While management believes

SOURCES OF ESTIMATION UNCERTAINTY

!

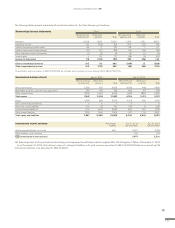

NOTE 12 INTANGIBLE ASSETS

FINANCIAL INFORMATION 2014

138