Volvo 2014 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

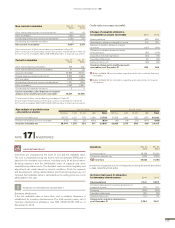

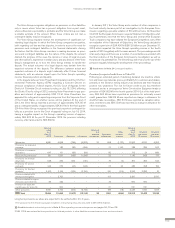

Credit loss reserves

An allowance for account receivables is recognized as soon as it is prob-

able that a credit loss has incurred, that is when there has been an event

that has triggered the customer’s inability to pay. As of December 31,

2014, the total credit loss reserves for account receivables amounted to

2.63% (2.02) of total account receivables.

Refer to Note 4 regarding credit risk.

SOURCES OF ESTIMATION UNCERTAINTY

!

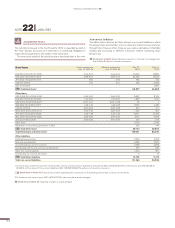

NOTE 16 RECEIVABLES

Receivables are recognized at amortized cost. Changes to the credit loss

reserves as well as any interest and gain or loss upon divestment of

receivables are recognized in Other operating income and expense.

Refer to Note 30 under heading Derecognition of fi nancial assets, for

receivables subject to cash enhancement activities.

ACCOUNTING POLICIES

Customer-fi nancing receivables

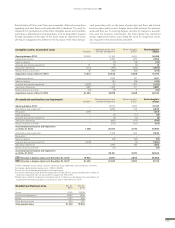

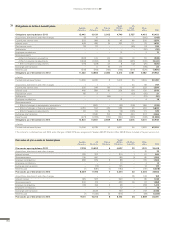

(days/SEK M) payments due

Dec 31, 2014 Dec 31, 2013

Not due 1–30 31–90 >90 Total Not due 1–30 31–90 >90 Total

Overdue amount – 468 323 232 1,023 –8632796261,768

Valuation allowance for doubtful customer-fi nancing

receivables, specifi c reserve (116) (105) (57) (86) (364) (84) (70) (37)(125)(316)

Customer-fi nancing receivables, net book value (116) 363 266 146 659 (84) 793 242 501 1,452

Customer fi nancing receivables

total exposure

Dec 31, 2014 Dec 31, 2013

Not due 1–30 31–90 >90 Total Not due 1–30 31–90 >90 Total

Customer fi nancing receivables 89,931 8,012 2,410 263 100,616 74,517 7,956 2,095 471 85,040

Concentration of credit risk

Customer concentration

The ten largest customers in Customer Finance account for 7.0% (6.8) of

the total asset portfolio. The rest of the portfolio is pertinent to a large

number of customers. Hence the credit risk is spread across many mar-

kets and customers.

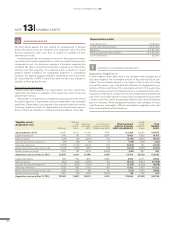

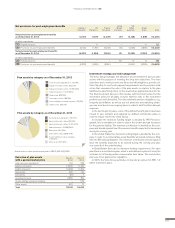

Concentration by geographical market

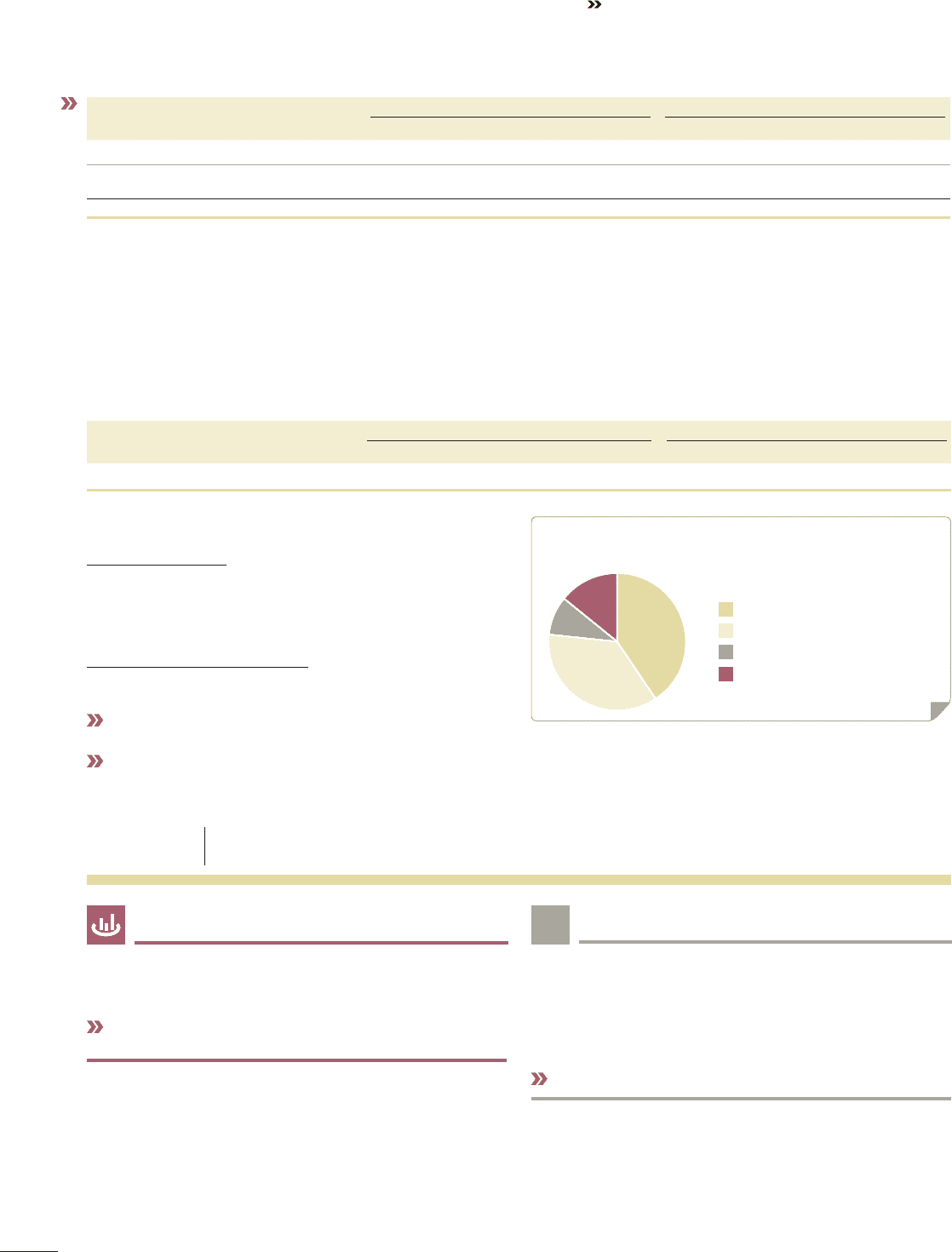

The adjacent table discloses the concentration of the customer-fi nancing

portfolio divided into geographical markets.

Read more in Note 4 about goals and policies in fi nancial risk management

and description of credit risks.

Read more about Volvo Financial Services’ development during the year on

page 81.

Geographic market, percentage

of customer-fi nancing portfolio (%).

Europe, 40.8%

North America, 36.0%

Asia, 9.3%

South America, 13.9%

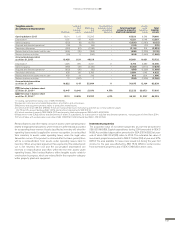

The total contractual amount to which the overdue payments pertain are

presented in the table below. In order to provide for occurred but not yet

identifi ed customer-fi nancing receivables overdue, there were additional

reserves of 1,086 (863). The remaining exposure was secured by liens on

the purchased equipment and, in certain circumstances, other credit

enhancements such as personal guarantees, credit insurance, liens on

other property owned by the borrower etc.

Collaterals taken in possession that meet the criteria for recognition in

the Balance sheet amounted to SEK 137 M (132) as of December 31,

2014.

The table above presents overdue payments within the customer-fi nanc-

ing operations in relation to specifi c reserves. It is not unusual for a receiv-

able to be settled a couple of days after its due date, which impacts the

age interval of 1–30 days. Valuation allowance presented within the inter-

val not due, is mainly an effect of recognition of impairment on portions of

contracts that have not yet been invoiced.

FINANCIAL INFORMATION 2014

144