Volvo 2014 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Customer Finance operations recorded

strong levels of new business volume during the

year, driven primarily from the markets in Europe

and America. Adjusted for changes in exchange

rates, the new business volume increased by

13.5% compared to 2013. Financing pene-

tration of new Volvo Group products improved

during the year.

The gross-credit portfolio increased, on a

currency-adjusted basis by 2.4% when com-

pared to 2013. Growth was achieved net of sale

of Volvo Rents, which reduced the credit port-

folio by SEK 6.3 billion during the year. Overall

portfolio performance and credit reserves

improved with continued strong performance

noted in North America. The funding of the

credit portfolio is matched in terms of maturity,

interest rates and currencies in accordance

with Volvo Group policy.

Read more in Note 4 Goal and policies in

fi nancial risk Management in section cash fl ow

risks.

The operating income for 2014 improved to

SEK 1,717 M (1,522) excluding restructuring

charges of SEK 5 M (0). The positive impacts

are mainly due to profi table growth, improved

portfolio performance and operating expense

control.

During the year, Volvo Financial Services

syndicated approximately SEK 8.3 billion of the

credit portfolio across a number of markets,

including SEK 3.7 billion in Brazil, to support

funding and risk diversifi cation strategies,

effectively reducing concentration risk and

freeing up credit capacity to support sales.

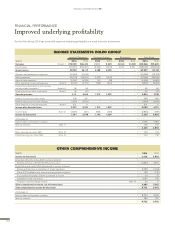

Income Statement Customer Finance, SEK M 2014 2013

Finance and lease income 10,111 9,539

Finance and lease expenses (5,923) (5,534)

Gross income 4,188 4,005

Selling and administrative expenses (1,711) (1,640)

Credit provision expenses (858) (923)

Other operating income and expenses 98 79

Operating income 1,717 1,522

Income taxes (568) (468)

Income for the period 1,149 1,054

Return on Equity, % 12.5 12.1

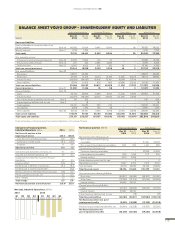

Key ratios,

Customer Finance1 2014 2013

Number of fi nanced units 54,819 51,466

New fi nancing volume, SEK billion 54,7 47.0

Credit portfolio net, SEK billion 117 104

Credit provisions expenses SEK M 858 923

Operating income, excl. restructuring charges SEK M 1,717 1,522

Credit reserves, % of credit portfolio 1.33 1.31

Return on shareholders’ equity, % 12.5 12.1

Total penetration rate, % 28 27

Penetration by business area1, %

Volvo CE 39 36

Volvo Trucks 30 30

Renault Trucks 23 21

MackTrucks 23 21

Buses 27 16

UD Trucks 11 12

1 Share of unit sales fi nanced by Volvo Financial Services in relation to the total num-

ber units sold by the Volvo Group in markets where fi nancial services are offered.

Customer Finance Operations

FINANCIAL INFORMATION 2014

113