Volvo 2014 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

152

Provisions are recognized when a legal or constructive obligation exists as a

result of a past event and it is probable that an outfl ow of resources will be

required to settle the obligation and the amount can be reliably estimated.

Provisions for residual value risks

Residual value risks are attributable to operating lease contracts or sales

transactions combined with buy-back agreements or residual value guar-

antees. Residual value risks are the risks that the Volvo Group in the

future would have to dispose used products at a loss if the price develop-

ment of these products is worse than what was expected when the

contracts were entered. Provisions for residual value risks are made on a

continuing basis based upon estimations of the used products’ future net

realizable values. The estimations of future net realizable values are made

with consideration to current prices, expected future price development,

expected inventory turnover period and expected direct and indirect

selling expenses. If the residual value risks pertain to products that are

recognized as tangible assets in the Volvo Group’s balance sheet, these

risks are refl ected by depreciation or write-down of the carrying value of

these assets. If the residual value risks pertain to products, which are not

recognized as assets in the Volvo Group’s balance sheet, these risks are

refl ected under provisions.

Read more in Note 7 Revenue.

Provision for product warranty

Estimated provision for product warranties are recognized when the products

are sold. The provision includes both expected contractual warranties and

so called technical goodwill warranties and is determined based on histori-

cal statistics considering known quality improvements, costs for remedy

of defaults etc. Provision for campaigns in connection with specifi c quality

problems are recognized when the campaign is decided.

Provision for restructuring costs

A provision for decided restructuring measures is recognized when a

detailed plan for the implementation of the measures is complete and

when this plan is communicated to those who are affected. A provision

and costs for termination benefi ts as a result of a voluntary termination

program is recognized when the employee accepts the offer. Restructur-

ing costs can be reported as a separate line item in the income statement

if they relate to a major change of the Group structure. Normally restruc-

turing costs are included in other operating income and expenses.

ACCOUNTING POLICY

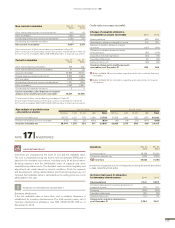

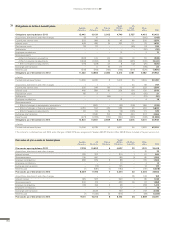

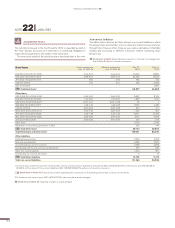

NOTE 21 OTHER PROVISIONS

SOURCES OF ESTIMATION UNCERTAINTY

!

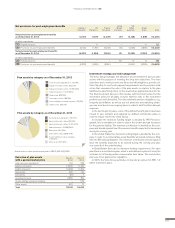

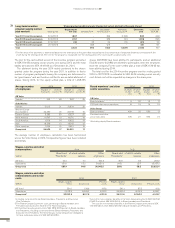

Residual value risks

In the course of its operations, the Volvo Group is exposed to residual

value risks through operating lease agreements and sales combined with

repurchase agreements. Residual value commitments amounted to SEK

21,146 M (17,781) as of December 31, 2014. Residual value risks are

refl ected in different ways in the Volvo Group’s consolidated fi nancial

statements depending on the extent to which the risk remains with the

Volvo Group.

In cases where signifi cant risks pertaining to the product remain with the

Volvo Group, the products, primarily trucks, are generally recognized in the

balance sheet as assets under operating leases. Depreciation of these prod-

ucts are recognized on a straight-line basis over the term of the commit-

ment and the depreciable amount is adjusted to agree with estimated net

realizable value at the end of the commitment. The estimated net realiza-

ble value of the products at the end of the commitment is monitored indi-

vidually on a continuing basis. A decline in prices for used trucks and con-

struction equipment may negatively affect the Volvo Group’s operating

in come. High inventories in the truck industry and the construction equip-

ment industry and low demand may have a negative impact on the prices

of new and used trucks and construction equipment. In monitoring esti-

mated net realizable value of each product under a residual value commit-

ment, management makes considerations of current price-level of the used

product model, value of options, mileage, condition, future price deteriora-

tion due to expected change of market conditions, alternative distribution

channels, inventory lead-time, repair and reconditioning costs, handling

costs and indirect costs associated with the sale of used products. Addi-

tional depreciations and estimated impairment losses are immediately

recognized in the income statement.

The total risk exposure for assets under operating lease is recognized

as current and non-current residual value liabilities.

Read more in Note 22 Liabilities about residual value liabilities.

If the residual value risk commitment is not signifi cant, independent from the

sale transaction or in combination with a commitment from the customer to

buy a new product in connection to a buy-back option, the asset is not rec-

ognized on the balance-sheet. Instead, the risk the Volvo Group would

have to dispose the used products at a loss is reported as a residual value

provision.

To the extent the residual value exposure does not meet the defi nition

of a provision, the gross exposure is reported as a contingent liability.

Read more in Note 24 Contingent liabilities.

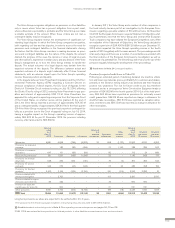

Provision for product warranty

Warranty provisions are estimated with consideration of historical claims

statistics, the warranty period, the average time-lag between faults occur-

ring and claims to the company and anticipated changes in quality indexes.

Estimated costs for product warranties are recognized as cost of sales

when the products are sold. Estimated warranty costs include contractual

warranty and goodwill warranty (warranty cover in excess of contractual

warranty or campaigns which is accepted as a matter of policy or normal

practice in order to maintain a good business relation with the customer).

Differences between actual warranty claims and the estimated fi nal claims

cost generally affect the recognized expense and provisions in future peri-

ods. Re funds from suppliers, that decrease the Volvo Group’s warranty

costs, are recognized to the extent these are considered to be certain.

Provisions for extended coverage

An extended coverage is a product insurance sold to a customer to cover

a product according to specifi c conditions for an agreed period and/or

content in addition to the factory contractual warranty. Provisions for

extended coverage is from 2014 presented separately in the table on the

next page. In 2013, the provision was included in the line Warranties. The

provision is intended to cover the risk that the expected cost of providing

services under the contract exceed the expected revenue.

Legal proceedings

Provisions for legal disputes are included within Other provisions in the

table on the next page, except the provision related to the EU antitrust

investigation and the provision related to the engine emission case in the

U.S, that are separately specifi ed.

FINANCIAL INFORMATION 2014