Volvo 2014 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

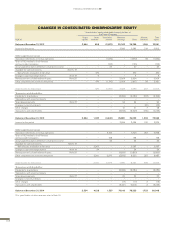

Net fi nancial debt, excluding provisions for post-

employment benefi ts, in the Industrial Operations

amounted to SEK 9.9 billion, equal to 14.2% of share-

holders equity, which is a decrease of SEK 9.9 billion

compared to the end of December 31, 2013. The

change is mainly explained by positive operating cash

fl ow of SEK 6.4 billion, the positive effect on fi nancial

debt from the divestment of assets of SEK 6.9 billion

related to Volvo Rents and the divestment of commer-

cial real estate offset by the dividend paid to AB Volvo

shareholders, negative currency effects and the

acquisition of Terex hauler business. Including post-

employment benefi ts the Industrial Operations net

debt amounted to SEK 26.4 billion, equal to 37.6% of

shareholders’ equity.

Read more in note 3 regarding Volvo Group’s

acquisitions and divestments of shares in subsidi-

aries.

Net debt in the Volvo Group’s Industrial Operations amounted to SEK 26.4 billion at December 31, 2014,

equal to 37.6% of shareholders’ equity. Excluding provisions for post-employment benefi ts the Industrial

Operation’s net debt amounted to SEK 9.9 billion, which equal to 14.2% of shareholders’ equity.

FINANCIAL POSITION

Strengthened fi nancial position

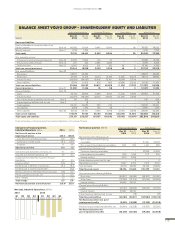

BALANCE SHEET VOLVO GROUP – ASSETS

Industrial Operations Customer Finance Eliminations Volvo Group

SEK M

Dec 31

2014 Dec 31

2013

Dec 31

2014 Dec 31

2013

Dec 31

2014 Dec 31

2013

Dec 31

2014 Dec 31

2013

Assets

Non-current assets

Intangible assets Note 12 37,010 36,479 105 109 – – 37,115 36,588

Tangible assets Note 13

Property, plant and equipment 54,821 51,819 94 87 – – 54,915 51,906

Investment property 266 327 – – – – 266 327

Assets under operating leases 19,484 17,013 17,872 13,714 (6,138) (5,055) 31,218 25,672

Financial assets

Investments in joint ventures

and associated companies Note 5 4,821 4,377 – – – – 4,821 4,377

Other shares and participations Note 5 5,004 1,944 13 6 – – 5,017 1,950

Non-current customer-fi nancing receivables Note 15 1,205 727 51,380 49,466 (1,254) (6,401) 51,331 43,792

Deferred tax assets Note 10 15,022 12,326 809 840 – – 15,831 13,166

Prepaid pensions Note 20 126 11 – 11 – – 126 22

Non-current interest-bearing receivables Note 16 1,041 550 22 34 378 (104) 1,441 480

Other non-current receivables Note 16 3,528 3,017 150 128 (165) (208) 3,513 2,937

Total non-current assets 142,328 128,590 70,445 64,395 (7,179) (11,768) 205,594 181,217

Current assets

Inventories Note 17 45,364 40,964 169 189 – – 45,533 41,153

Current receivables

Customer-fi nancing receivables Note 15 623 679 48,063 40,854 (850) (1,464) 47,836 40,069

Tax assets 2,918 1,692 496 57 – – 3,414 1,749

Interest-bearing receivables Note 16 1,736 1,645 345 473 (968) (1,209) 1,113 909

Internal funding14,3742,256––(4,374)(2,256)––

Accounts receivable Note 16 30,495 29,170 400 245 – – 30,895 29,415

Other receivables Note 16 13,950 12,207 1,984 1,383 (1,265) (936) 14,669 12,654

Non interest-bearing assets held for sale Note 3 288 8,102 – – – – 288 8,102

Interest-bearing assets held for sale Note 3 – 2 – – – – – 2

Marketable securities Note 18 6,927 2,570 385 21 – – 7,312 2,591

Cash and cash equivalents Note 18 24,178 25,660 2,470 1,679 (406) (371) 26,242 26,968

Total current assets 130,853 124,947 54,312 44,901 (7,863) (6,236) 177,302 163,612

Total assets 273 ,181 253,537 124,757 109,296 (15,042) (18,004) 382,896 344,829

1 Internal funding is internal lending from Industrial Operations to Customer Finance.

The Volvo Group’s liquid funds, i.e. cash and cash

equivalents and marketable securities, amounted to

SEK 33.6 billion on December 31, 2014 which

includes SEK 0.2 (0.2) billion that is not available for

use by the Volvo Group and SEK 6.1 billion (7.7) where

other limitations exist, mainly liquid funds in countries

where exchange controls or other legal restrictions

apply. This means that it is not possible to immediately

use the liquid funds in other parts of the Volvo Group,

however normally there is no limitation for use by the

Group’s operations in the respective country.

Read more in Note 18 Marketable securities

and liquid funds.

In addition to the liquid funds, granted but unutilized

credit facilities amounted to SEK 39.2 billion as of

December 31, 2014, an increase of SEK 7.3 billion

compared to year-end 2013. On July 1, 2014 the Volvo

Group through its subsidiary Volvo Treasury AB signed

new credit facilities of EUR 3.5 billion replacing the

company’s existing facilities in EUR.

AB Volvo issued a hybrid bond in 2014 through its

subsidiary Volvo Treasury AB, amounting to EUR 1.5

billion in order to further strengthen the Volvo Group’s

balance sheet and prolong the maturity structure of

the debt portfolio.

Read more in Note 22 Liabilities regarding the

Volvo Group’s new credit facilities in EUR and the

hybrid bond.

Total assets in the Volvo Group amounted to SEK

382.9 billion as of December 31, 2014, an increase of

SEK 38.1 billion compared to year-end 2013. This is

mainly a result of increased customer-fi nancing

receivables due to portfolio growth in the Customer

Finance Operations, the acquisition of Terex hauler

114

FINANCIAL INFORMATION 2014