Volvo 2014 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

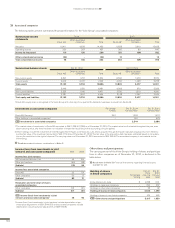

Goals and policies in fi nancial risk management (cont.)

CREDIT RISKS

Credit risks are defi ned as the risk that the Volvo Group does not receive

payment for recognized accounts receivable and customer-fi nancing

receivables (commercial credit risk), that the Volvo Group’s investments

are unable to be realized (fi nancial credit risk) and that potential profi t is

not realized due to the counterparty not fulfi lling its part of the contract

when using derivative instruments (fi nancial counterparty risk).

POLICY

The objective of the Volvo Group Credit Policy is to defi ne and measure

the credit exposure and control the risk of losses deriving from credits to

customers, credits to suppliers, counterparty risks and Customer Dealer

Financing activities.

Commercial credit risk

The Volvo Group’s credit granting is steered by Group-wide policies and

customer-classifi cation rules. The credit portfolio should contain a distri-

bution among different customer categories and industries. The credit

risks are managed through active credit monitoring, follow-up routines

and, where applicable, product repossession. Moreover, regular monitor-

ing ensures that the necessary allowances are made for incurred losses

on doubtful receivables. In Notes 15 and 16, ageing analysis are pre-

sented of customer-fi nancing receivables overdue and accounts receiva-

bles overdue in relation to the reserves made.

The customer-fi nancing receivables in the Volvo Group’s Customer

Finance Operations amounted at December 31, 2014 to approximately

net SEK 99 billion (84). The credit risk of this portfolio is distributed over

a large number of retail customers and dealers. Collaterals are provided in

the form of the fi nanced products. In the credit granting the Volvo Group

strives for a balance between risk exposure and expected return.

Read more about Volvo’s credit risk in Note 15 Customer-fi nancing receiva-

bles.

The Volvo Group’s accounts receivables amounted as of December 31,

2014 to approximately net SEK 31 billion (29).

Financial credit risk

The Volvo Group’s fi nancial assets are largely managed by Volvo Treasury

and invested in the money and capital markets. All investments must meet

the requirements of low credit risk and high liquidity. According to the Volvo

Group’s credit policy, counterparties for investments and derivative trans-

actions should have a rating better or equivalent to A from one of the

well-established credit rating institutions.

Liquid funds and marketable securities amounted as of December 31,

2014 to approximately SEK 34 billion (30).

Read more in Note 18 about Marketable securities and liquid funds within

the Volvo Group.

Financial counterparty risk

The use of derivatives involves a counterparty risk, in that a potential gain

will not be realized if the counterparty fails to fulfi ll its part of the contract.

To reduce the exposure, the Volvo Group enters into master netting

agreements (primarily so called ISDA agreements) with all counterparts

eligible for derivative transactions. The netting agreements provide the

possibility for assets and liabilities to be set off under certain circum-

stances, such as in the case of the counterpart’s insolvency. These net-

ting agreements have no effect on profi t, loss or the position of the Volvo

Group, since derivative transactions are accounted for on a gross basis,

with the exception of derivatives with positive value amounting to SEK

1billion, netted against a fair value of a loan negative 1 billion, related to

hedge accounting. Read more in Note 30, Financial Instrument in foot-

note 2, under the table on page 163. Counterparty risk exposure for deriv-

atives is also limited through weekly cash transfers corresponding to the

value change of open contracts. The Volvo Group’s gross exposure from

positive derivatives, amounting to SEK 3,909 M (3,713) is reduced by

60% (41%) to SEK 1,582 M (2,203) by netting agreements and cash

deposits, so called CSA agreements. The Volvo Group is actively working

with limits per counterpart in order to reduce risk for high net amounts

towards individual counterparts.

Read more about the Volvo Group’s gross exposure from positive derivatives

per type of instrument in Note 30.

INTEREST-RATE RISKS CURRENCY RISKS CREDIT RISKS

FINANCIAL RISKS

OTHER PRICE RISKSLIQUIDITY RISKS

FINANCIAL INFORMATION 2014

128