Volvo 2014 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

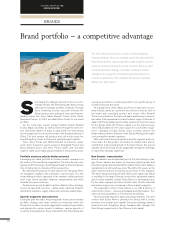

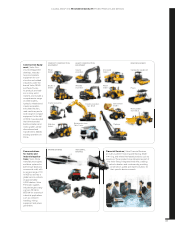

Brand portfolio – a competitive advantage

The Volvo Group does business under several leading and

respected brands. These are strategic assets through which the

Volvo Group delivers value propositions addressing the specifi c

needs of customers around the world. The Volvo Group, as part

of a brand portfolio strategy, is therefore working to further

strengthen the image for its brands by improving delivery on

customer expectations. This will allow the Group to optimally

address the total market.

A GLOBAL GROUP 2014

BUSINESS MODEL

BRANDS

Since taking the strategic decision to focus on com-

mercial vehicles, the Volvo Group has built a strong

and industry-leading portfolio of brands. Through

direct ownership, licenses and joint ventures, the

Group has access to a range of iconic and industry-

leading names like Volvo, Mack, Renault Trucks, Volvo Penta,

Nova and Prevost. In 2014, we added Terex Trucks to our brand

portfolio.

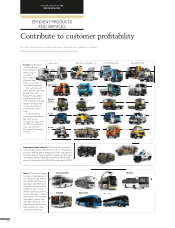

On the truck side, current product brands include Renault

Trucks, Mack, UD, Volvo, as well as Eicher through the joint ven-

ture with Eicher Motors in India. In early 2015, the Volvo Group

received approval for a new joint venture with Dongfeng Group in

China. The joint venture will produce and sell trucks under the

brand Dongfeng Trucks in China and selected export markets.

Volvo, Terex Trucks and SDLG branded construction equip-

ment, Volvo, Sunwin (in a joint venture in Shanghai), Prevost and

Nova branded buses and Volvo Penta marine and industrial

engines make up the major product brands in the business areas.

Portfolio structure unlocks hidden potential

Leveraging our brand portfolio to increase market coverage is at

the center of the new Group organization. The Volvo Group is rea-

ligning itself from being a decentralized brand-by-brand organiza-

tion, to delivering on a brand portfolio perspective.

By clarifying the purpose of each brand in the Group portfolio,

we strengthen relations with a broader customer base. This has

meant taking a holistic approach to the markets, while previously

each truck brand operated relatively independently and often

towards the same customers.

Furthermore, we will be able to better utilize the other strategic

assets we have built over time – global scale, industrial footprint,

distribution networks, supply chains and customer relationships.

Specifi c segments and customers

During the past two years, the prerequisites to execute on a brand

portfolio strategy have been worked on extensively within the

Group. This includes a common approach to market segmentation

and aligning the various brands to address various aspects of

customer buying behavior. Every brand within the Volvo Group has

a purpose and delivers a value proposition to a specifi c group of

customers around the world.

At a global level, Volvo, Mack and Prevost represent our pre-

mium brands, aimed at customers who choose a holistic view of

the brand and associated product and service offer. Renault

Trucks is positioned in the high-end space addressing customers

who value total operational cost and network support. Outside of

Japan, UD Trucks addresses the value segment, a new focus area

for the Group, while UD Trucks in Japan is in the high-end seg-

ment. SDLG addresses the value space for construction equip-

ment – primarily in China. Eicher, which currently services the

Indian market, will form the basis of the Group offering in the highly

cost-competitive market segments.

With each brand being assigned a specifi c segment and cus-

tomer base, the Group aims to increase its market share and its

contribution to the overall growth of the Volvo Group. This proved

valuable when the Group Trucks organization designed road maps

to reach their strategic objectives.

New Brands – new potential

Growth markets are an important part of the Volvo Group’s strat-

egy. These markets are drivers of long-term global growth and

they offer a great deal of potential for quality trucks which balance

operational cost with purchase price. We defi ne this space as the

value segment and are increasing our presence in this segment.

The Volvo Group has launched the UD Quester range and SDLG

is excelling in the large Chinese construction equipment market

and in select markets outside China. Buses is developing a bus

for the value segment and Volvo Penta’s sales of both industrial

and marine engines are increasing in these market segments.

The acquisition of Terex Trucks allows us to offer a full line of

construction trucks – covering articulated and rigid haulers. This

opens up new possibilities in construction and mining.

China and India represent large and unique markets. The joint

venture with Eicher Motors provided the Group with a strong

presence in the Indian truck market. The recent strategic alliance

announced with Dongfeng Group fundamentally changes the

Volvo Group’s opportunity in the Chinese truck market.

30