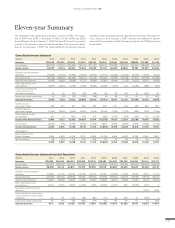

Volvo 2014 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

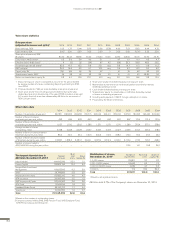

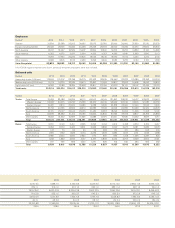

AB Volvo SEK

Retained earnings 21,705,022,946.60

Income for the period 2014 6,690,166,462.32

Total retained earnings 28,395,189,408.92

The Board of Directors and the President propose that the above sum

be disposed of as follows:

SEK

To the shareholders, a dividend of SEK 3.00 per share 6,089,823,870.00

To be carried forward 22,305,365,538.92

Total 28, 395,189,408.92

Proposed Disposition of Unappropriated Earnings

The Board of Directors is of the opinion that the Company and the

Group have capacity to assume future business risks as well as to bear

contingent losses. The proposed dividend is not expected to adversely

affect the Company’s and the Group’s ability to make further commercially

justifi ed investments in accordance with the Board of Directors’ plans.

In addition to what has been stated above, the Board of Directors has

considered other known circumstances which may be of importance for

the Company’s and the Group’s fi nancial position. In doing so, no circum-

stance has appeared that does not justify the proposed dividend.

If the Annual General Meeting resolves in accordance with the Board

of Directors’ proposal, SEK 22,305,365,538.92 will remain of the Com-

pany’s non-restricted equity, calculated as per year end 2014.

The Board of Directors has the view that the Company’s and the Group’s

shareholders’ equity will, after the proposed dividend, be suffi cient in rela-

tion to the nature, scope and risks of the business.

Had the assets and liabilities not been estimated at their market value

pursuant to Chapter 4, Section 14 a of the Swedish Annual Accounts Act, the

company’s shareholders’ equity would have been SEK 3,995,279,712.00 less.

The Board of Directors and the President certify that the annual fi nancial

report has been prepared in accordance with generally accepted account-

ing principles and that the consolidated accounts have been prepared in

accordance with the international set of accounting standards referred to

in Regulation (EC) No 1606/2002 of the European Parliament and of the

Council of 19 July 2002 on the application of international accounting

standards, and give a true and fair view of the position and profi t or loss of

the Company and the Group, and that the management report for the

Company and for the Group gives a fair review of the development and

performance of the business, position and profi t or loss of the Company

and the Group, and describes the principal risks and uncertainties that the

Company and the companies in the Group face.

Göteborg, February 26, 2015

Carl-Henric Svanberg

Board Chairman

Matti Alahuhta

Board member

Jean-Baptiste Duzan

Board member

James W. Griffi th

Board member

Kathryn V. Marinello

Board member

Hanne de Mora

Board member

Anders Nyrén

Board member

Olof Persson

President, CEO and

Board member

Lars Westerberg

Board member

Mats Henning

Board member

Mikael Sällström

Board member

Berth Thulin

Board member

Our audit report was issued on February 26, 2015

PricewaterhouseCoopers AB

Peter Clemedtson

Authorized Public Accountant

Lead Partner

Johan Rippe

Authorized Public Accountant

Partner

The record date for determining who is entitled to receive dividends is

proposed to be Tuesday April 7, 2015.

In view of the Board of Directors’ proposal to the Annual General Meet-

ing to be held April 1, 2015 to decide on the distribution of a dividend of

SEK 3.00 per share, the Board hereby makes the following statement in

accordance with Chapter 18, Section 4 of the Swedish Companies Act.

The Board of Directors concludes that the Company’s restricted equity is

fully covered after the proposed dividend. The Board further concludes that

the proposed dividend is justifi able in view of the parameters set out in Chap-

ter 17, Section 3, second and third paragraphs of the Swedish Companies

Act. In connection herewith, the Board wishes to point out the following.

The proposed dividend reduces the Company’s solvency from 46.0

percent to 41.8 percent and the Group’s solvency from 20.9 percent to

19.6 per cent, calculated as per year end 2014. The Board of Directors

considers this solvency to be satisfactory with regard to the business in

which the Group is active.

According to the Board of Directors’ opinion, the proposed dividend will

not affect the Company’s or the Group’s ability to fulfi l their payment obli-

gations and the Company and the Group are well prepared to handle both

changes in the liquidity and unexpected events.

FINANCIAL INFORMATION 2014

177