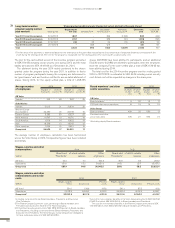

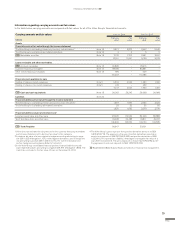

Volvo 2014 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

153

The Volvo Group recognizes obligations as provisions or other liabilities

only in cases where Volvo has a present obligation from a past event,

where a fi nancial responsibility is probable and the Volvo Group can make

a reliable estimate of the amount. When these criteria are not met, a

contingent liability may be recognized.

The Volvo Group regularly reviews the development of signifi cant out-

standing legal disputes in which the Volvo Group companies are parties,

both regarding civil law and tax disputes, in order to assess the need for

provisions and contingent liabilities in the fi nancial statements. Among

the factors that the Volvo Group considers in making decisions on provi-

sions and contingent liabilities are the nature of the dispute, the amount

claimed, the progress of the case, the opinions or views of legal counsels

and other ad visers, experience in similar cases, and any decision of the Volvo

Group’s management as to how the Volvo Group intends to handle the

dispute. The actual outcome of a legal dispute may deviate from the

expected outcome of the dispute. The difference between actual and

expected outcome of a dispute might materially affect future fi nancial

statements, with an adverse impact upon the Volvo Group’s operating

income, fi nancial position and liquidity.

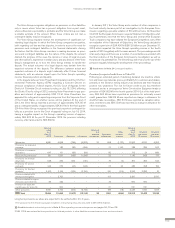

In the dispute between Volvo Powertrain Corporation and the U.S. Envi-

ronmental Protection Agency (EPA) regarding a Consent Decree on

emission compliance of diesel engines, the U.S. Court of Appeals for the

District of Colombia Circuit rendered a ruling on July 18, 2014, affi rming

the District Court’s ruling of 2012, ordering Volvo Powertrain to pay pen-

alties and interest of approximately USD 72 M. Volvo Powertrain has

appealed the ruling and is expecting a response from the Supreme Court

of the United States on whether review will be granted. At the end of

2013, the Volvo Group reported a provision of approximately SEK 65 M

and a contingent liability of approximately SEK 401 M. In the third quarter

2014 the Volvo Group recognized the previously reported contingent lia-

bility as a provision due to the Court of appeals’ ruling on July 18, 2014,

having a negative impact on the Group’s operating income of approxi-

mately SEK 422 M. As per 31 December 2014 the provision including

currency effect amounted to SEK 560 M.

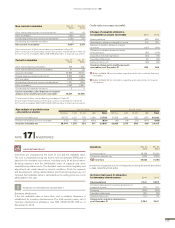

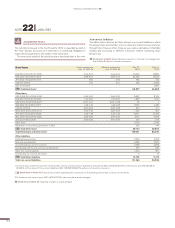

Carrying

value

as of

Dec 31,

2013 Provisions Reversals Utilizations

Acquired

and

divested

companies Translation

differences

Other

reclassi-

fi c a t i o n s

Carrying

value

as of

Dec 31,

2014

Of which

due within

12 months

Of which

due after

12 months

Warranties 9,881 6,848 (795) (5,202) 30 958 (1,137) 10,583 5,330 5,253

Provisions for extended

coverage – 183 (83) (499) – 37 1,150 788 286 502

Provisions in insurance

operations 647 151 (66) (99) – 80 – 713 24 689

Restructuring measures17811,597(166)(1,099)–32 –1,145968177

Provisions for residual

value risks 646 292 (48) (151) – 75 (4) 810 265 545

Provisions for service

contracts 343 275 (47) (146) – 27 30 482 298 184

Provisions for fi nished

products22,470 3,745 (309) (3,190) – 351 (715) 2,352 2,282 70

Provision related to EU

antitrust investigation – 3,703 – – – 107 – 3,810 – 3,810

Provision related to engine

emission case in the U.S 65 422 – – – 73 – 560 560 –

Provision for expected

credit losses for Volvo CE – 500 – – – 21 – 521 521 –

Other provisions 2,661 3,743 (403) (2,724) – 189 (18) 3,449 1,940 1,509

B/S Total 17,494 21,459 (1,917) (13,110) 30 1,951 (694) 25,213 12,473 12,740

Long-term provisions as above are expected to be settled within 2 to 3 years.

1 The provision for the effi ciency program included in restructuring measures amounted to SEK 0.9 (0.5) billion.

Read more about restructuring costs in Note 8 Other operating income and expenses and pages 24, 72 and 76.

2 SEK 713 M was reclassifi ed from provisions for fi nished products to other liabilities, accrued revenue from service contracts.

In January 2011, the Volvo Group and a number of other companies in

the truck industry became part of an investigation by the European Com-

mission regarding a possible violation of EU antitrust rules. On November

20, 2014 the European Commission issued a Statement of Objections stat-

ing its preliminary view that the Volvo Group and several other European

Truck companies may have violated the European Competition rules. After

an evaluation of the Statement of Objections, the Volvo Group decided to

recognize a provision of EUR 400 M (SEK 3.8 billion as per December 31,

2014) which impacted the Volvo Group’s operating income in the fourth

quarter of 2014 negatively with the same amount. The proceedings are still

at an early stage and there are a number of uncertainties associated with

the fi nal outcome of the European Commission’s investigation as well as

the amount of a potential fi ne. The Volvo Group will re-assess the size of the

provision regularly following the development of the proceedings.

Read more in Note 24 Contingent liabilities.

Provision for expected credit losses in Volvo CE

Following an extended period of declining demand, low machine utiliza-

tion and lower raw materials prices, profi tability for customers and dealers

primarily in the Chinese mining industry has declined and their fi nancial

position has weakened. The risk for future credit losses has therefore

increased and as a consequence Volvo Construction Equipment made a

provision of SEK 660 M in the fourth quarter 2014. Out of the total provi-

sion, SEK 500 M has been reported as provisions for externally issued

credit guarantees. SEK 83 M was reported as change in allowance for

doubtful trade receivables, SEK 54 M was reported as valuation allow-

ance, inventories and SEK 23 M was reported as change in allowance for

other receivables.

FINANCIAL INFORMATION 2014