Volvo 2014 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

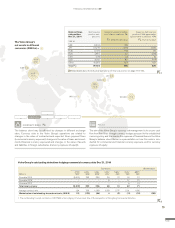

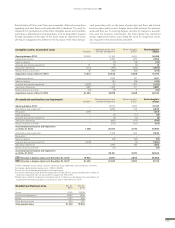

Other shares and participations

The carrying amount of the Volvo Group’s holding of shares and participa-

tions in other companies as of December 31, 2014, is disclosed in the

table below.

Read more in Note 30 Financial Instruments regarding fi nancial assets

available for sale.

Holding of shares

in listed companies Percentage

holding

Dec 31,

2014

Carrying

value

Dec 31,

2013

Carrying

value

Eicher Motors Ltd., India 8 4,228 1,191

Holdings in Japanese companies – 290 267

Holdings in other listed companies – 25 32

Holding of shares in listed companies 4,543 1,490

Holding of shares in non-listed companies 474 460

B/S Other shares and participations 5,017 1,950

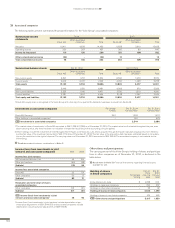

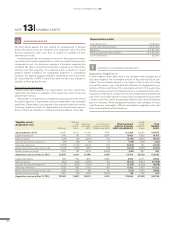

Income (loss) from investments in joint

ventures and associated companies 2014 2013

Income/loss joint ventures

VE Commercial Vehicles., Ltd. 45 104

Other joint ventures (64) (48)

Subtotal (19) 56

Income/loss associated companies

Deutz AG 32 54

Other companies 50 17

Subtotal 82 71

Revaluation and write-down of shares

associated companies

Other companies (17) (31)

Subtotal (17) (31)

I/S Income (loss) from investments in joint

ventures and associated companies

146 96

1 Income (loss) from investments in joint ventures include depreciation of pur-

chase price adjustments of SEK 29 M (35) and associated companies include

depreciation of purchase price adjustments of SEK 9 M (9).

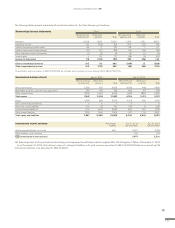

The following tables present summarized fi nancial information for the Volvo Group’s associated companies:

Summarized income

statements

2014 2013

Deutz AG1Other associated

companies Total Deutz AG1Other associated

companies Total

Net sales 10,411 4,038 14,450 11,828 3,610 15,438

Operating income 220 207 427 360 80 440

Income for the period 110 156 266 251 (69) 182

Other comprehensive income (34) – (34) 13 – 13

Total comprehensive income 76 156 232 264 (69) 195

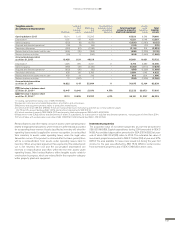

Summarized balance sheets Dec 31, 2014 Dec 31, 2013

Deutz AG1Other associated

companies Total Deutz AG1Other associated

companies Total

Non-current assets 6,847 1,707 8,554 6,594 1,979 8,573

Current assets 5,305 2,027 7,332 4,230 1,498 5,728

Total assets 12,152 3,734 15,886 10,824 3,477 14,301

Equity 5,446 1,035 6,481 4,956 970 5,926

Non-current liabilities 3,325 1,146 4,471 3,720 1,210 4,930

Current liabilities 3,381 1,553 4,934 2,148 1,297 3,445

Total equity and liabilities 12,152 3,734 15,886 10,824 3,477 14,301

1 Deutz AG’s equity share is recognized in the Volvo Group with a time lag of one quarter. No dividends have been received from Deutz AG.

Investments in associated companies Percentage

holding Dec31, 2014

Carrying value Dec 31, 2013

Carrying value

Deutz AG, Germany

125.0 1,393 1,407

Other holdings in associated companies

2–951679

B/S Investments in associated companies 2,344 2,086

1 The market value of investments in Deutz AG amounted to SEK 1,236 M (1,756) as of December 31, 2014. The market value has fl uctuated throughout the year, even

above carrying value, why there has been no indication of impairment according to the accounting principle applied.

2 Other holdings include the investment of Inner Mongolia North Hauler Joint Stock Co., Ltd., China, acquired through the hauler manufacturing business from Terex Inc

and the fair value of the investment amounted to SEK 1,114 M as of December 31, 2014. The fair value at the acquisition date has been estimated based on considera-

tion on the restriction in the right of disposal. The carrying value as of December 31, 2014 amounted to SEK 250 M. The associated company is not material for the

Volvo Group.

Read more about business combinations in Note 3.

Associated companies

FINANCIAL INFORMATION 2014

132