Volvo 2014 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

154

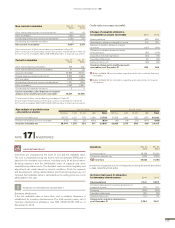

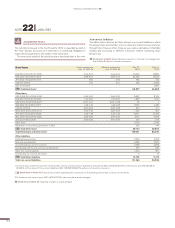

Bond loans Actual interest rate

Dec 31, 2014, % Effective interest rate

Dec 31, 2014, % Dec31,

2014 Dec 31,

2013

EUR 2007–2014/2016–2078 0.44–5.04 0.44–5.04 44,062 19,883

SEK 2007–2014/2016–2019 0.68–5.04 0.68–5.04 23,562 19,437

JPY 2013–2014/2016–2017 0.60 0.60 784 124

USD 2013/2016 0.41 0.41 469 5,246

CNY 2012/2015 – – – 1,895

B/S Total Bond loans168,877 46,585

Other loans

USD 2008–2014/2016–2024 0.46–3.00 0.46–3.00 9,852 8,105

EUR 2007–2014/2016-2027 1.44–6.50 1.45–6.50 1,869 1,734

GBP 2002–2007/2016-2027 6.00–11.11 6.00–11.68 59 1

SEK 2007–2014/2016-2017 0.42–1.61 0.42–1.62 2,055 4,180

CAD 2014/2016 2.63–2.65 2.66–2.68 874 911

MXN 2012–2014/2016–2017 4.20–4.37 4.20–4.37 1,233 847

JPY 2007–2014/2016–2023 0.45–1.38 0.45–1.39 12,701 10,772

BRL 2009–2013/2019–2024 2.86–5.90 2.93–6.00 7,517 5,932

AUD 2013–2014/2016 3.89–4.82 3.94–4.90 319 516

Other loans 2,1393,726

Revaluation of outstanding derivatives to SEK2536140

B/S Total Other loans1 39,154 36,864

Total Bond loans and Other loans3108,031 83,449

Other liabilities

Deferred leasing income 2,364 2,462

Residual value liabilities 4,586 4,840

Accrued expenses service contracts 5,498 2,928

Outstanding interest and currency risk derivatives2275256

Other non-current liabilities 1,004 981

Outstanding raw material derivatives 510

B/S Total Other liabilities 13,732 11,477

Total non-current liabilities 121,763 94,926

The hybrid bond issued in the fourth quarter 2014 is classifi ed as debt in

the Volvo Group’s accounts as it constitutes a contractual obligation to

make interest payments to the holder of the instrument.

The terms and details of the hybrid bond are described later in this note.

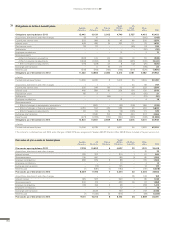

Non-current liabilities

The tables below disclose the Volvo Group’s non-current liabilities in which

the largest loans are listed by currency. Loans are mainly in local currencies

through Volvo Treasury. Volvo Treasury uses various derivatives to facilitate

lending and borrowing in different currencies without increasing Volvo

Group’s risk.

Read more in Note 4 about Goals and policies in fi nancial risk management

and in Note 30 about Financial Instruments.

NOTE 22 LIABILITIES

1 Of which loans raised to fi nance the credit portfolio of the Customer Finance Operations amounted to SEK 44,620 M (25,619) in Bond loans and SEK 28,348 M

(20,590) in Other loans. Of non-current liabilities, SEK 108,295 M (83,715) pertains to fi nancial instruments.

2 Read more in Note 30 Financial Instruments regarding Non-current part of Outstanding interest and currency risk derivatives.

3 Of the above non-current loans, SEK 4,478 M (3,181) were secured by assets pledged.

Read more in Note 23 regarding changes in assets pledged.

ACCOUNTING POLICY

FINANCIAL INFORMATION 2014