Volvo 2014 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

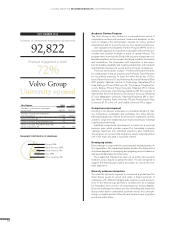

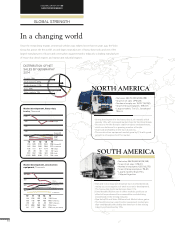

DISTRIBUTION OF NET

SALES BY GEOGRAPHY

2014

Europe, 38%

North America, 27%

South America, 10%

Asia, 18%

Other markets, 7%

200

400

600

800

1,000

Europe 30

N. America

Brazil

Japan

India

China

Europe 30

N. America

Brazil

Japan

India

China

13

240

236

104

34

132

774

14

228

270

93

42

155

744

12

222

250

87

32

195

636

11

242

216

111

25

237

882

10

179

142

102

25

212

1,015

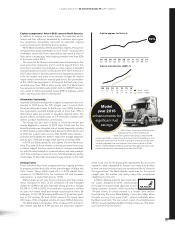

Market development, heavy-duty

trucks, Thousands

100

200

300

400

Europe

N. America

S. America

China

Asia (excl. China)

Europe

N. America

S. America

China

Asia (excl. China)

13

118

166

46

261

201

14

125

185

38

216

196

12

122

164

44

253

199

11

125

112

42

399

177

10

94

82

35

371

141

Market development, construction

equipment, Thousands

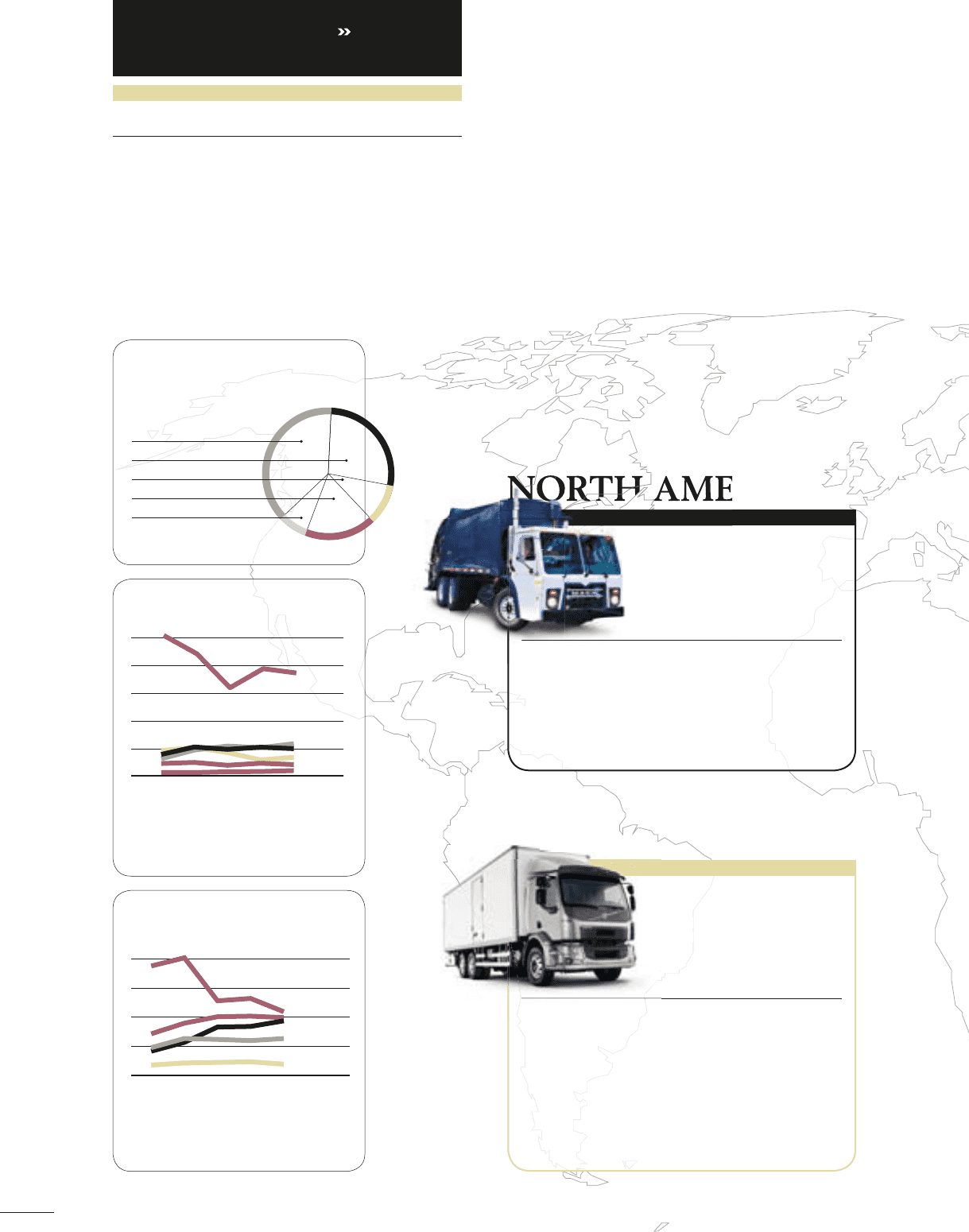

NORTH AMERICA

Since the streamlining towards commercial vehicles was initiated more than ten years ago, the Volvo

Group has grown into the world’s second largest manufacturer of heavy-duty trucks and one of the

largest manufacturers of buses and construction equipment and is today also a leading manufacturer

of heavy-duty diesel engines and marine and industrial engines.

In a changing world

A GLOBAL GROUP 2014

GROUP PERFORMANCE

GLOBAL STRENGTH

SOUTH AMERICA

• Net sales: SEK 76,258 M (63,088)

• Share of net sales: 27% (23)

• Number of employees: 15,217 (16,397)

• Share of Group employees: 16% (17)

• Largest markets: The U.S., Canada and

Mexico.

• Strong development in the heavy-duty truck market, which

grew by 14%, with increased market share for the Volvo Group.

• Successes for the Group’s captive engines and gearboxes,

which are delivered in a growing number of trucks.

• Improved profi tability in the truck business.

• The construction equipment market grew by 11% with good

growth in all segments of the market.

• Net sales: SEK 26,958 M (29,758)

• Share of net sales: 10% (11)

• Number of employees: 6,353 (6,275)

• Share of Group employees: 7% (6)

• Largest markets: Brazil, Peru,

Chile and Argentina.

• Demand in the important Brazilian truck market declined,

mainly as a consequence of weak economic development.

The heavy-duty truck market was down 11%.

• Considerable decline also in other markets, partly as an

effect of lower demand for commodities and declining

investments in the mining industry.

• New Volvo FH and Volvo FM launched. Market share gains.

• The South American construction equipment market was

also considerably affected by the downturn in the mining

industry and declined by 17%.

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

S

O

U

T

H

•

N

•

S

•

N

•

S

•

L

C

a

nt

B

•

Dem

and

in

th

ei

mpo

rta

a

T

T

H A

H

A

•

Net sales: SEK 76

•

Share of net sales

•

Number of em

p

lo

y

•

Share of Grou

p

e

m

•

L

arg

est markets:

T

M

e

xi

co

.

•

Strong development in the heavy

-

duty tr

64