Volvo 2014 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Net sales increased by 4% driven predominan-

tely by the 22% increased sales in North Amer-

ica refl ecting the growing economic momentum

in the region with improved sales for all of Volvo

Group’s business areas. In South America sales

decreased by 10% as a result of decreased

demand for Trucks due to decreased GDP

growth and business activity across the conti-

nent. Brazil, being the main market in South

America, has also been affected by the more

stringent terms for fi nancing from state owned

development bank with signifi cant increased

interest rates and down payment requirement

which affects demand negatively.

Western Europe has had a stable sales

development where the decreased volumes

have been offset by price realization for the new

truck models for Volvo and Renault Trucks.

Eastern Europe has declined mainly as a result

of the geopolitical uncertainties surrounding

Russia.

Sales development in Asia has been positive for

Trucks while Construction Equipment has experi-

enced a 25% decline in sales due to deteriorating

demand in predominately China as a result of

reduced construction and infrastructure projects.

Furthermore the weakening of SEK towards

the currencies in major markets has had a pos-

itive impact of sales in 2014.

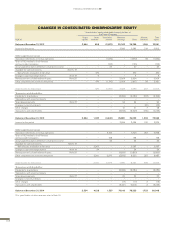

Improved underlying profi tability

Gross income increased by SEK 2.6 billion in the

year which is mainly explained by positive volume

development for vehicle sale and price realiza-

tion on the new Volvo and Renault Trucks mod-

els. Positive impact from price realization was

also visible for both vehicle and service and

aftermarket in North America while margin pres-

sure on vehicle sale for Trucks in Brazil impacted

gross income negatively in the period. Addition-

ally the negative demand development in Asia in

general, and China in particular, for Construction

Equipment had a negative volume and margin

impact in the period. Gross income was also

negatively impacted in the period due to low

capacity utilization in the production system for

both Construction Equipment and Trucks.

Except for the changes in gross income, oper-

ating income was negatively impacted by

increased research and development cost of

SEK 1.5 billion where the lower expenditure in

the period was offset by lower capitalization con-

tributing to an overall increase in cost. The

decreased expenditure level for research and

development is due to reduced activity level after

the launch of the new ranges for Volvo and

Renault Trucks brand and implemented cost sav-

ing measures. Furthermore the selling and

administrative cost decreased by SEK 1.6 billion

due to reduced launch cost, cost saving meas-

ures and the divestment of Volvo Rents.

Other operating income and expenses

increased by SEK 4.2 billion compared to previ-

ous year and as described on page 111 main

drivers are costs of non-recurring items related

to litigations, credit losses as well as divestment

of assets and subsidiaries.

Impact of exchange rates on operating

income

Operating income for 2014 was negatively

impacted by approximately SEK 0.4 billion as a

consequence of changes in currency exchange

rates when compared with 2013, primarily

related to net fl ows in foreign currency.

Read more in Note 4 Goal and policies in

fi nancial risk management in section Currency risks.

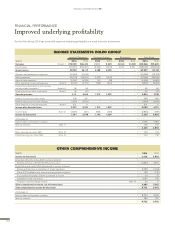

Income Statement Industrial Operations, SEK M 2014 2013

Net sales 275,999 265,420

Cost of sales (217,251) (209,307)

Gross income 58,748 56,113

Gross margin, % 21.3 21.1

Research and development expenses (16,656) (15,124)

Selling expenses (25,778) (26,904)

Administrative expenses (5,367) (5,824)

Other operating income and expenses (6,931) (2,710)

Income from investments in joint ventures

and associated companies 46 96

Income from other investments 49 (31)

Operating income (loss) Industrial Operations 4,111 5,616

Operating margin, % 1.5 2.1

Net sales by market area, SEK M 2014 2013 %

Western Europe 86,011 84,293 2

Eastern Europe 17,826 18,626 (4)

North America 73,358 60,237 22

South America 25,837 28,751 (10)

Asia 51,717 52,805 (2)

Other markets 21,249 20,708 3

Total Industrial Operations 275,999 265,420 4

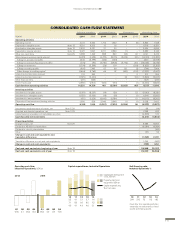

Research and development expenses

131211

10

14.613.3

13.0

5.0

15.1

5.74.4

5.0

Research and development

expenses, SEK bn

Research and development

expenses, % of Industrial

Operations’ net sales

14

16.7

6.0

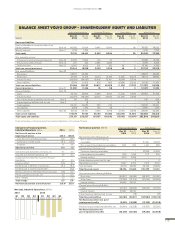

Industrial Operations

SEK bn

–40

–30

–20

–10

0

10

20

11

12

Other

–33

–36

SEK

–9

–9

KRW

–4

1

EUR

3

2

BRL

3

3

ZAR

3

3

CAD

4

4

NOK

6

7

GBP

16

13

USD

Currency flow 2014 Currency flow 2013

Transaction exposure from operating net fl ows1

1 The graph above represents the transaction exposure from commercial operating

net cash fl ows in foreign currency in Industrial Operations, expressed as net

surpluses or defi cits in key currencies. The defi cit in SEK and KRW is mainly an

effect of expenses for manufacturing plants in Sweden and Korea, but limited

external revenues in those currencies. The EUR defi cit on the other hand, is the

net of signifi cant gross volumes of sales and purchases made by many entities

around the globe in EUR. The surplus in USD is mainly generated from external

sales within the US and emerging markets.

Read more in Note 4 Goals and policies in fi nancial risk management

regarding Industrial Operations transaction exposure from operating net fl ows

as well as currency effects on sales and operating income.

Impact of exchange rates on operating income

Compared with preceding year, SEK M

Net sales16,498

Cost of sales (6,222)

Research and development expenses (254)

Selling and administrative expenses (444)

Total effect of changes in exchange rates

on operating income (422)

1 The Volvo Group sales are reported at monthly average rates.

112

FINANCIAL INFORMATION 2014