Volvo 2014 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

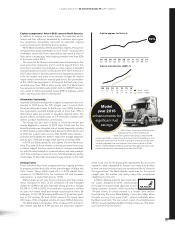

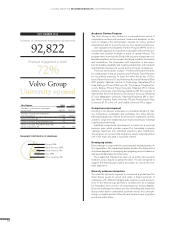

Captive engines for Volvo, %

07

63

08

61

04

42

05

49

06

60

10

75

11

80

12

79

13

86

14

92

09

54

92%

Captive transmissions (AMT), %

08

15

−

10

26

7

11

40

18

12

46

27

13

57

40

14

75

47

09

20

−

I-Shift − Volvo

mDrive − Mack

which is not core for the brand, grew signifi cantly. But in its core

segments, Mack maintained its number one heavy-duty position

in both construction and refuse, and moved from fi fth to second in

the regional haul. The Mack Granite model was, for the second

straight year, the number one selling heavy-duty conventional

straight truck in the U.S.

In March, Mack launched a new brand iden-

tity system designed to better communicate

the brand’s forward-thinking approach to pro-

viding customer solutions, while honoring its

114-year history. A central element is a sleeker, more modern

logo featuring the iconic Mack Bulldog – which has ridden above

the grille on every truck since 1932 – poised confi dently above

the Mack word mark. The new system is part of a comprehensive

effort to ensure that Mack fulfi lls its brand promise as “The Amer-

ican Truck You Can Count On.”

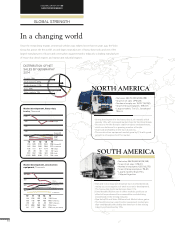

A GLOBAL GROUP 2014 BUSINESS MODEL NORTH AMERICA

Volvo Trucks’ model year 2016 VN series

highway tractors in North America will

deliver even greater fuel savings compared with

previous generation models through an assortment of aerodynamic and

powertrain enhancements. Further sculpting of airfl ow around the exte-

rior and underneath the hood improves fuel effi ciency by up to 3.5%.

Volvo’s new XE-Adaptive Gearing and Torque Management options can

provide fuel effi ciency improvements of more than 2.5%.

Model

year 2016

enhancements for

signifi cant fuel

savings

Captive components: Volvo I-Shift converts North America

In addition to helping our brands deliver the optimized perfor-

mance and fuel effi ciency demanded by customers and regula-

tors, proprietary powertrains represent an important ongoing

source of revenue for the Group and our dealers.

While Mack has always offered proprietary engines, the push for

increased Volvo power penetration is more recent – and has been

remarkably successful. From representing only about a third of

Volvo sales a decade ago, Volvo engines powered more than 92%

of the trucks sold in 2014.

The impact of the Group’s automated manual transmission has

been even more impressive, and it could be argued that in this

area, Volvo innovation has changed an entire market. Automated

manual transmissions were mostly absent from North America in

2007 when Volvo’s I-Shift became the fi rst integrated solution to

enter the market, and many in the industry thought the market

would remain committed to manual gear boxes. But penetration

of the I-Shift has skyrocketed – to the point that last year, it rep-

resented more than 75% of Volvo trucks sold. The Mack brand

has experienced similarly rapid growth with its mDRIVE transmis-

sion, which in 2014 represented nearly 50% of highway vehicle

sales, only four years after its introduction.

Aftermarket leadership

Improved distribution and growth in captive components also con-

tributed to 2014 being the fi fth straight year of record North

American aftermarket sales for the Group; since 2009, the Group

has consistently recorded annual growth of more than 18% in

aftermarket sales per vehicle in operation. Beyond parts, this

growth refl ects increased sales of soft offers like extended war-

ranties, contract maintenance, and leasing.

The Group has also been a leader in connected vehicle and

remote diagnostics solutions. In 2012, Volvo Trucks was the fi rst

brand to introduce an integrated, robust remote diagnostics solution

to North America, and the Mack brand followed in 2013. By the end

of 2014, the systems were on more than 60,000 active vehicles –

and have demonstrated the ability to reduce the average diagnostic

time by up to 70%, and average repair times by more than 20%.

In 2014, the Group opened its new Uptime Center in North Car-

olina. This state-of-the-art facility co-locates personnel from every

customer support function, connects them to customers and deal-

ers with the latest telematics, communications, and case manage-

ment tools, and makes it easy for cross-functional teams to quickly

interact face-to-face when necessary to keep vehicles on the road.

Strong brands

These initiatives have been complemented by ongoing activities

to properly position and build on the brand images of Mack and

Volvo Trucks. These efforts paid off in a 2014 market share

increase to 21.2% (20.1) for the combined U.S. and Canadian

retail market – a market that grew by 17.5%.

Market share growth was driven primarily by the Volvo brand,

which increased its share of the combined U.S. and Canadian

market to 12.4% (11.4), with especially strong growth in Canada

(15.3% vs. 13.1% in 2013). The brand also succeeded in shifting

its sales mix toward small and medium-sized regional fl eets. By

adding an 11-liter XE (“Exceptional Effi ciency”) powertrain pack-

age to the existing 13- and 16-liter versions, the brand drove

2014 sales of this integrated solution to nearly 30% of deliveries.

The Mack brand’s overall share of the combined U.S. and Cana-

dian market was fl at at 8.7% because the long haul segment,

26

7

40

18

46

27

57

40

75

47

I Shift

Vo

lvo

mDr

ive

−

Ma

ck

lvo Trucks’ model year 2016 VN series

tractors in North America will

fl i di

th

l

16

nts for

fuel

55