Volvo 2014 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

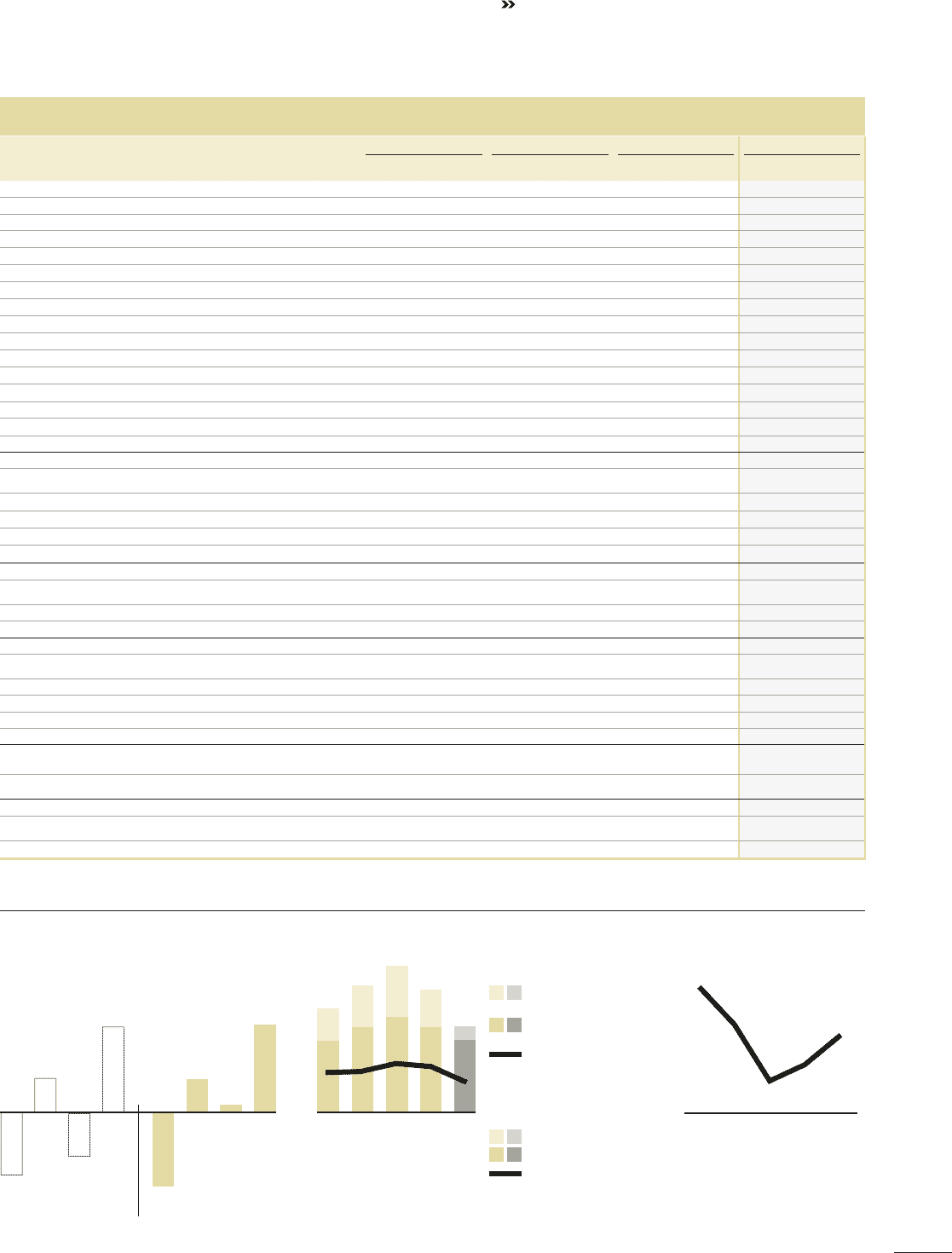

Capital expenditures, Industrial Operations

13

12

11

10

Capital expenditures,

% of net sales

14

4.0

7.1

4.1

8.5

4.9

9.5

4.6 3.1

8.5

Property, plant and

equipment, SEK bn

Capitalized development

costs, SEK bn

3.2 4.1 5.1 3.7

7.2

1.4

Self-fi nancing ratio,

Industrial Operations %

Cash-flow from operating activities

divided by net investments in fixed

assets and leasing assets.

13121110

72

14

112 180210294

Operating cash fl ow,

Industrial Operations, SEK bn

20142013

Q4

10.6

Q3

0.9

Q2

4.0

Q1

(9.0)

Q4

10.3

Q3

(5.3)

Q2

4.1

Q1

(7.6)

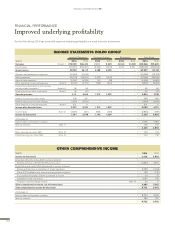

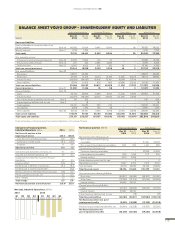

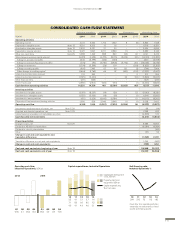

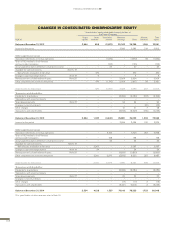

CONSOLIDATED CASH FLOW STATEMENT

Industrial operations Customer Finance Eliminations Volvo Group Total

SEK M 2014 2013 2014 2013 2014 2013 2014 2013

Operating activities

Operating income 4,103 5,624 1,712 1,522 8 (8) 5,823 7,138

Depreciation tangible assets Note 13 6,701 6,205 15 16 – – 6,716 6,221

Amortization intangible assets Note 12 3,503 5,021 31 34 – – 3,534 5,055

Depreciation leasing vehicles Note 13 2,470 3,247 3,211 2,899 (1) – 5,680 6,146

Other non-cash items Note 29 5,288 1,496 888 890 (35) 30 6,141 2,416

Total change in working capital whereof (3,272) (1,956) (4,772) (8,774) (6,059) (35) (14,103) (10,765)

Change in accounts receivable 1,346 (4,799) (133) (120) ––1,213 (4,919)

Change in customer-fi nancing receivables (144) (91) (4,740) (8,923) (5,756) 284 (10,640) (8,730)

Change in inventories (1,594) (3,209) (28) 114 – (168) (1,622) (3,263)

Change in trade payables (995) 7,905 65 60 131 (1) (799) 7,964

Other changes in working capital (1,884) (1,762) 64 95 (435) (150) (2,255) (1,817)

Interest and similar items received 317 362 – – – 2 317 364

Interest and similar items paid (1,879) (2,404) – – 33 (33) (1,846) (2,437)

Other fi nancial items (221) (225) – – – – (221) (225)

Income ta xes paid (2,680) (2,641) (624) (181) – (1) (3,304) (2,823)

Cash fl ow from operating activities 14,331 14,729 461 (3,594) (6,055) (45) 8,737 11,090

Investing activities

Investments in tangible assets (7,079) (8,307) (14) (26) – 52 (7,093) (8,281)

Investments in intangible assets (1,523) (3,903) (18) (18) – (1) (1,541) (3,922)

Investment in leasing vehicles (470) (1,529) (9,645) (6,784) – 51 (10,115) (8,262)

Disposals of fi xed assets and leasing vehicles 1,090 556 3,949 2,848 (1) (1) 5,038 3,403

Operating cash fl ow 6,349 1,546 (5,267) (7,574) (6,056) 56 (4.973) (5,972)

Investments and divestments of shares, net Note 5, 29 69 (14)

Acquired and divested operations, net Note 3, 29 7,398 932

Interest-bearing receivables incl marketable securities (4,808) 510

Cash fl ow after net investments (2,314) (4,544)

Financing activities

Change in loans, net Note 29 6,686 12,955

Dividend to AB Volvo’s shareholders (6,084) (6,084)

Dividend to minority shareholders –(162)

Other (57) 56

Change in cash and cash equivalents excl.

translation differences (1,769) 2,221

Translation difference on cash and cash equivalents 1,044 (460)

Change in cash and cash equivalents (725) 1,761

Cash and cash equivalents, beginning of year Note 18 26,96825,207

Cash and cash equivalents, end of year Note 18 26,242 26,968

FINANCIAL INFORMATION 2014

117