Volvo 2014 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2014 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Divestments

Volvo Rents divestment

The divestiture of Volvo Rents was completed on January 31, 2014. The

price amounted to USD 1.1 bn, corresponding to SEK 6.9 bn, and had a

positive impact on the Group’s cash fl ow and net fi nancial debt within the

Industrial Operation in 2014 with the same amount. In connection with the

divestment, Volvo Rents repaid all outstanding loans to Volvo Financial

Services.

During 2014 the divestment impacted operating income positively by

SEK 212 M as an effect of the ongoing completion of accounts. The

adjusted purchase price is expected to be fi nalized during the fi rst half of

2015. In 2013, assets and liabilities pertaining to Volvo Rents were clas-

sifi ed as assets held for sale and valued at fair value. A revaluation was

therefore recognized within Other operating income and expenses

amounting to negative SEK 1.5 bn and impacting the segment “Group

functions, corporate functions and other”. Net sales for Volvo Rents in

2013 amounted to SEK 4,212 M and operating income for the corre-

sponding period amounted to negative SEK 133 M.

Divestment of commercial real estate

Companies in the Volvo Group signed an agreement in March 2014, to

sell commercial real estate. The transaction was fi nalized in the second

quarter 2014 and reduced net fi nancial debt in the Volvo Group’s Indus-

trial Operation by approximately SEK 1.8 bn, out of which SEK 0.3 bn is a

claim in a subordinated loan. The impact on operating cash-fl ow from the

transaction is SEK 0.3 bn. The transaction had a positive impact on the

Group’s operating income of SEK 815 M in 2014, whereof SEK 751 M in

the segment Group functions, Corporate functions and Other and SEK 64

M in the segment Trucks. The transaction covered to a large extent real

estate in Göteborg, Sweden owned by the Volvo Group and leased to

external tenants. The transaction also included properties in Denmark,

Finland and other parts of Sweden, where the real estate to a large extent

are continuously rented by companies in the Volvo Group. Those proper-

ties were part of assets held for sale at the end of the year 2013.

The Volvo Group has not made any other divestments during 2014,

which solely or jointly have had a signifi cant impact on the Volvo Group’s

fi nancial statements.

For the comparative year 2013, the Volvo Group did not make any

signifi cant divestment.

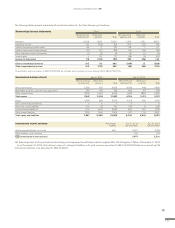

The impact on the Volvo Group’s balance sheet and cash fl ow statement

in connection with the divestment of subsidiaries and other business units

are specifi ed in the following table:

Divestments 2014 2013

Property, plant and equipment (1,584) (140)

Assets under operating lease (5,475) (162)

Inventories (221) (127)

Other receivables (340) (914)

Cash and cash equivalents – (87)

Other provisions (65) 36

Other liabilities 206 472

Divested net assets (7,479) (922)

Goodwill – (27)

Total (7,479) (949)

Additional purchase price – –

Cash and cash equivalents received 8,501 1,090

Cash and cash equivalents,

divested companies – (87)

Effect on Volvo Group cash and

cash equivalents 8,501 1,003

Effect on Volvo Group net fi nancial

position 8,868 537

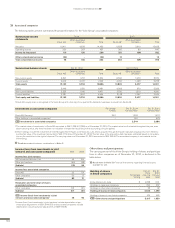

Assets and liabilities held for sale

As of December 31, 2014, the Volvo Group recognized assets amounting

to SEK 288 M and liabilities amounting to SEK 130 M as assets and

liabilities held for sale. Those mainly pertain to a planned dealer divest-

ment and divestment activities within the effi ciency program. Translation

differences on foreign operations of SEK 10 M were recognized in other

comprehensive income.

For the comparative year 2013, the Volvo Group recognized assets

amounting to SEK 8,104 M and liabilities amounting to SEK 350 M as

assets and liabilities held for sale. Translation differences on foreign oper-

ations of SEK 13 M were also included in other comprehensive income.

This referred mainly to the divestment of Volvo Rents in North America

which was completed on January 31, 2014. Commercial real estate

amounting to SEK 1,014 M was also classifi ed as assets held for sale at

year end 2013.

Assets and liabilities held for sale Dec 31,

2014 Dec 31,

2013

Tangible assets 173 7,185

Inventories 21 221

Other current receivables 94 684

Other assets – 14

B/S Total assets 288 8,104

Trade payables 87 76

Provisions 5 127

Other current liabilities 23 137

Other liabilities 15 10

B/S Total liabilities 130 350

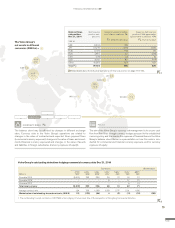

Acquisitions and divestments after the end of the period

In the beginning of January 2015 Volvo Group completed the acquisition

of 45% of the shares in Dongfeng Commercial Vehicles Co., Ltd, DFCV, in

China. The ownership in DFCV is classifi ed as an associated company and

consolidated with the equity method as of January 2015 and will be

included in the Trucks segment. The result of DFCV will, from the begin-

ning, be included in the Volvo consolidation with a time lag of one month.

When Volvo and DFCV have aligned the book closing procedures a catch

up will take place and the result will then be recognized without a time lag.

Consequently, when the catch up occurs, the result of four separate

months will be included within one quarter. During 2013 DFCV’s sales

amounted to SEK 37 billion and the pro-forma operating income amounted

to SEK 1.0 billion. During the same period DFCV sold 120,600 heavy-

duty and 51,000 medium-duty trucks.

The purchase consideration amounted to approximately SEK 7 billion

and will in the fi rst quarter be recognized as Investments in joint ventures

and associated companies within Financial assets. The Cash fl ow after

net investments will be negatively affected by the same amount and the

purchase consideration will also have the same negative impact on net

fi nancial debt. The purchase consideration was hedged and positive

effects of the hedge have been recognized within Other fi nancial income

and expenses. The total positive effect of the hedge is SEK 1.5 billion,

SEK 300 M was recognized in 2013, SEK 1.1 billion in 2014 and the

remaining part will be recognized in the fi rst quarter 2015. This is an

effect of Volvo Group not applying hedge accounting. The hedge is pre-

sented in the cash fl ow statement as Changes in loans, net. None of these

two items will hence impact the Operating cash fl ow.

Read more in Note 29 Cash fl ow regarding Changes in loans, net.

123

FINANCIAL INFORMATION 2014