Vodafone 2007 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2007 7

Over 11 million customers now benefit from lower roaming pricing through

Vodafone Passport and our European customers are now benefiting from our

commitment to reduce roaming prices by 40% compared to summer 2005.

We expect roaming revenues to be lower year on year in 2008 due to the

combined effect of Vodafone’s own initiatives and direct regulatory

intervention.

During the year, we began implementing the core cost reduction programmes

we developed last year. We have successfully outsourced IT application

development and maintenance and we are well on track to deliver expected

unit cost savings of approximately 25% to 30% within two to four years. We

have also made faster than expected progress on data centre consolidation,

with anticipated savings of 25% to 30% in one to two years. Centralisation of

our network supply chain management was also completed in April 2007 and

is expected to reduce costs by around £250 million within one year.

In addition, we are seeking to reduce the longer term cost of ownership of our

networks through network sharing arrangements and have announced

initiatives in Spain and the UK.

While many of these cost initiatives are multi-year programmes that are

expected to deliver significant benefits over time, we are focused on realising

some early savings in the year ahead and, for Europe and common functions,

continue to target a 10% mobile capital expenditure to revenue ratio next

year, with broadly stable mobile operating expenses compared to the 2006

financial year.

Innovate and deliver on our customers’ total communications needs

There are several key initiatives underway in this area and we expect these to

begin to become more significant to the Group towards the end of next year.

As part of our drive to substitute fixed line usage with mobile, we have

launched several fixed location pricing plans offering customers fixed line

prices when they call from within or around their home or office. These

offerings target fixed to mobile substitution from home and office

environments and are proving popular with customers. Vodafone At Home

and Vodafone Office are currently available in seven markets for consumers

and twelve markets for businesses, with over three million and over two

million customers respectively.

Complementary to our high speed mobile broadband (HSDPA) offerings,

Vodafone is now offering fixed broadband services (DSL) in five markets. With the

exception of Arcor, our fixed line business in Germany, the provision of these

services to date has been on a resale basis. We will continue to develop our

approach for the provision and roll out of DSL services on a market by market

basis and in some cases may complement our resale approach by building or

acquiring our own infrastructure where the returns justify the investment.

We are also developing products and services to integrate the mobile and PC

environments by enhancing our Vodafone live! service and forming

partnerships with leading internet players. In the coming months, our

customers will be able to experience PC to mobile instant messaging with

Yahoo! and Microsoft, search with Google, auctions via eBay, videos through

YouTube and social networking with MySpace, all via their mobile.

Mobile advertising is also a potentially significant future revenue stream for

our business. We have signed agreements with Yahoo! in the UK and leading

providers in Germany and Italy to enter into this new business through

banner and content based advertising.

Deliver strong growth in emerging markets

Our focus is to build on our strong track record of creating value in emerging

markets. We have delivered further strong growth in our existing operations in

Egypt, Romania and South Africa. Our recent acquisition in Turkey has

performed ahead of our business plan at the time of the acquisition, with

strong revenue growth and better than expected profitability.

The acquisition of interests in Hutchison Essar accelerates Vodafone’s move

to a controlling position in a leading operator in India and significantly

increases our presence in emerging markets. With market penetration of

around 14% and with a population of over 1.1 billion, India provides a very

significant opportunity for future growth. We look forward to bringing

Vodafone’s products, services and brand to the Indian market.

Arun Sarin

Chief Executive

Actively manage our portfolio to maximise returns

Our strategy is to invest only where we can generate superior returns for our

shareholders. We look to invest in markets that offer a strong local position,

with a focus on specific regions, with any transactions subject to strict

financial investment criteria.

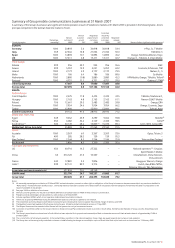

In line with this strategy, we executed a number of transactions during the

year. We sold our non-controlling interests in Belgium and Switzerland at

attractive valuations, with cash

proceeds of £1.3 billion and

£1.8 billion respectively. More

recently, we increased our

emerging markets presence with

an additional 4.8% interest in

Vodafone Egypt and gained control in India for £5.5 billion in May 2007.

We remain committed to our investment in Verizon Wireless in the US which

continues to deliver strong performances on all key metrics, with record

customer growth, due in part to a market leading low churn rate, and

continued success in driving the uptake of non-voice services.

Align capital structure and shareholder returns policy to strategy

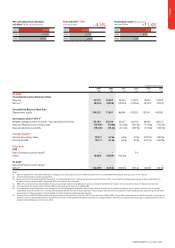

In May 2006, we outlined a new capital structure and returns policy

consistent with the operational strategy of the business, resulting in a

targeted annual 60% payout of adjusted earnings per share in the form of

dividends.

We also moved to a higher level of gearing and, having returned over £19

billion to shareholders excluding dividends in the two previous financial years,

including a £9 billion one-off return in August 2006, we have no current plans

for further share purchases or one-time returns. The Board remains

committed to its existing policy of distributing 60% of adjusted earnings per

share by way of dividend. However, in recognition of the earnings dilution

arising from the Hutchison Essar acquisition, it has decided that it will target

modest increases in dividend per share in the near term until the payout ratio

returns to 60%.

Prospects for the year ahead

Our focus in the year ahead will be on improving price elasticity in Europe,

achieving more savings from our cost reduction programmes, delivering on

our total communications strategy and beginning to realise the very

significant growth opportunity in India.

We expect market conditions to remain challenging for the year ahead in

Europe, notwithstanding continued positive trends in data revenue and voice

usage. Overall growth prospects for the EMAPA region remain strong due to

increasing market penetration and they are further enhanced by the recent

acquisition in India.

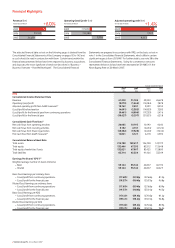

Against this background, Group revenue is expected to be in the range of

£33.3 billion to £34.1 billion, with adjusted operating profit in the range of

£9.3 billion to £9.8 billion. Capital expenditure on fixed assets is anticipated to

be in the range of £4.7 billion to £5.1 billion, including in excess of £1.0

billion in India. Free cash flow is expected to be £4.0 billion to £4.5 billion,

after taking into account £0.6 billion of payments related to long standing tax

issues, a net cash outflow of £0.8 billion in respect of India and a £0.5 billion

outflow from items rolling over from 2007.

We have completed the first year under our new strategy and I am excited by

the start we have made. We have made good progress towards fulfilling our

total communications vision and this is a journey that we are all looking

forward to taking at Vodafone.

We are well placed to continue executing our strategy in the year ahead, to

deliver the core benefits of mobility to our customers and to generate

superior returns for our shareholders.

“India exposes us to one of

the fastest growing

communications markets

in the world”

Strategy