Vodafone 2007 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2007 57

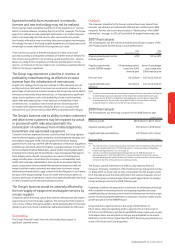

In respect of Arcor, the Group’s non-mobile operation in Germany, the

capital structure provides all partners, including the Group, the right to

withdraw capital from 31 December 2026 onwards and this right in relation

to the minority partners has been recognised as a financial liability.

During the year, the Group entered into an agreement with the Essar Group,

conditional on the completion of the Group’s acquisition of a controlling

stake in Hutchison Essar. Under this agreement, the Essar Group was

granted two put options over its interest in Hutchison Essar that may result

in significant cash outflows for the Group (see page 136).

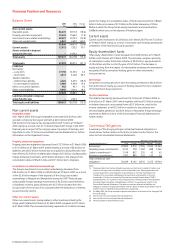

Off-balance sheet arrangements

The Group does not have any material off-balance sheet arrangements, as

defined by the SEC. Please refer to notes 30 and 31 to the Consolidated

Financial Statements for a discussion of the Group’s commitments and

contingent liabilities.

Quantitative and qualitative disclosures about

market risk

A discussion of the Group’s financial risk management objectives and

policies and the exposure of the Group to liquidity, market and credit risk is

included within note 24 to the Consolidated Financial Statements.

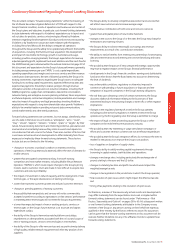

valuation date, by appraisal. If an initial public offering takes place and the

common stock trades in a regular and active market, the market value of

the Company’s interest will be determined by reference to the trading price

of common stock.

In conjunction with the acquisition of Hutchison Essar, the Group entered

into a share sale and purchase agreement with a Bharti group company

regarding the Group’s 5.60% direct shareholding in Bharti Airtel. On 9 May

2007, a Bharti group company irrevocably agreed to purchase this

shareholding and the Group expects to receive $1.6 billion in cash

consideration for such shareholding by November 2008. The shareholding

will be transferred in two tranches, the first before 31 March 2008 and the

second by November 2008. Following the completion of this sale, the Group

will continue to hold an indirect stake of 4.39% in Bharti Airtel.

Potential cash outflows

In respect of the Group’s interest in the Verizon Wireless partnership, an

option granted to Price Communications, Inc. by Verizon Communications

Inc. was exercised on 15 August 2006. Under the option agreement, Price

Communications, Inc. exchanged its preferred limited partnership interest in

Verizon Wireless of the East LP for 29.5 million shares of common stock in

Verizon Communications Inc. Verizon Communications Inc. has the right,

but not the obligation, to contribute the preferred interest to the Verizon

Wireless partnership, diluting the Group’s interest. However, the Group also

has the right to contribute further capital to the Verizon Wireless

partnership in order to maintain its percentage partnership interest. Such

amount, if contributed, would be $0.9 billion.

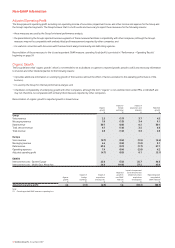

Performance