Vodafone 2007 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2007 141

Financials

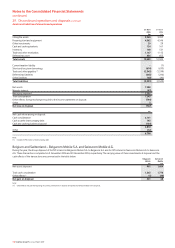

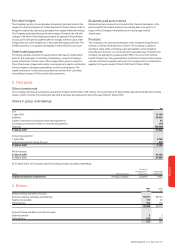

Pensions

Under both IFRS and US GAAP, the Group recognises actuarial gains and

losses as they are incurred. Under IFRS, these gains and losses are recognised

directly in equity. These gains and losses are included in the determination of

net loss under US GAAP.

The Group’s adoption of SFAS No. 158, “Employers’ Accounting for Defined

Benefit Pension and Other Postretirement Plans – an amendment of FASB

Statements No. 87, 88, 106 and 132(R)” on 31 March 2007 did not have a

significant impact on the Group’s results or financial position.

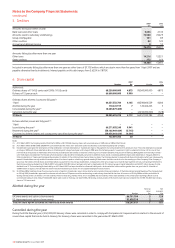

Disposals

Under both IFRS and US GAAP, the cumulative foreign currency gains and

losses arising on the translation of the assets and liabilities of entities with a

functional currency other than sterling are reclassified from accumulated

other recognised income and expense and included in the determination of

profit for the period or net loss on sale or liquidation of a foreign entity.

Differences in the amount reclassified arise due to differences in the carrying

values of the underlying net assets and because the Group deemed the

cumulative translation differences at the date of transition to IFRS to be zero.

During the year ended 31 March 2007, £1,539 million (2006: losses of

£9 million, 2005: losses of £63 million) of foreign currency losses were

reclassified from other recognised income and expense and included in the

determination of US GAAP net loss as a result of the disposal of Vodafone

Japan and the Group’s interests in Belgacom Mobile SA and Swisscom Mobile

AG (2006: Vodafone Sweden, 2005: partial disposal of Vodafone Egypt). Under

IFRS, these losses amounted to £838 million for the year ended 31 March

2007 (2006: gains of £36 million, 2005: gains of £2 million).

In addition to the impact of transferring cumulative exchange losses to the

income statement, in the year ended 31 March 2007 this line item also

includes the £512 million incremental gain resulting from lower US GAAP

carrying values immediately prior to the disposal of Belgacom Mobile SA and

Swisscom Mobile AG.

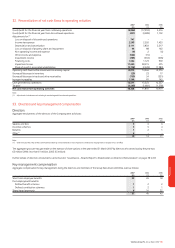

h. Income taxes

The most significant component of the income tax adjustment is due to

temporary differences between the book basis and tax basis of intangible

assets other than goodwill acquired in business combinations prior to

29 September 2004, resulting in the recognition of deferred tax liabilities

under US GAAP. This line item also includes the tax effects of the other

pre-tax IFRS to US GAAP adjustments described above.

Under IFRS, the Group does not recognise a deferred tax liability on the

outside basis differences in its investment in associates to the extent that the

Group controls the timing of the reversal of the difference and it is probable

the difference will not reverse in the foreseeable future. Under US GAAP, the

Group recognises deferred tax liabilities on these differences.

i. Minority interests

Minority interests are reported as a component of total equity under IFRS

and, accordingly, profit for the period does not include an adjustment for

profit for the period attributable to minority interests. Under US GAAP,

minority interests are reported outside of shareholders’ equity and the

minority interest in the income of consolidated subsidiaries is an adjustment

to US GAAP net income.

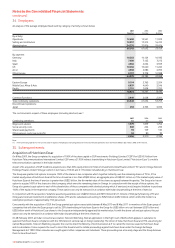

j. Changes in accounting principles

Post employment benefits

During the second half of the year ended 31 March 2005, the Group

amended its policy for accounting for actuarial gains and losses arising from

its pension obligations effective 1 April 2004. Until 31 March 2004, the Group

used a corridor approach under SFAS No. 87, “Employers’ Accounting for

Pensions” in which actuarial gains and losses were deferred and amortised

over the expected remaining service period of the employees. The Group now

recognises these gains and losses through the income statement in the

period in which they arise.

The cumulative effect on periods prior to adoption of £288 million has been

shown, net of tax of £93 million, as a cumulative effect of a change in

accounting principle in the reconciliation of net loss. The effect of the change

in the year ended 31 March 2005 was to increase loss from continuing

operations by £55 million (or 0.08 pence per share).

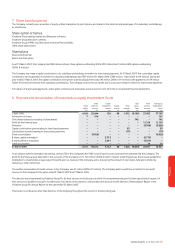

Intangible assets

On 29 September 2004, the SEC Staff issued new guidance on the

interpretation of SFAS No. 142 in relation to the valuation of intangible assets

in business combinations and impairment testing. This guidance has been

codified as EITF Topic D-108. Historically, the Group assigned to mobile

licences the residual purchase price in business combinations in excess of the

fair values of all assets and liabilities acquired other than mobile licences and

goodwill. This approach was on the basis that mobile licences were

indistinguishable from goodwill. The new SEC guidance required the Group to

distinguish between mobile licences and goodwill. However, the new

guidance did not permit the amount historically reported as mobile licences

to be subsequently reallocated between mobile licences and goodwill.

The new guidance affects the allocation of the purchase price in future

business combinations involving entities with mobile licences. The Group has

applied the guidance relating to the allocation of purchase price to all

business combinations consummated subsequent to 29 September 2004.

This has resulted in values being assigned to licences using a direct valuation

method, with any remaining residual purchase price allocated to goodwill.

In impairment testing of mobile licences associated with the Verizon Wireless

equity method investment accounted for under SFAS No. 142, the Group has

used a similar residual approach to determine the fair value of the licences

when testing the asset for recoverability. In their announcement, the SEC

Staff stated that the residual method of accounting for intangible assets

should no longer be used and that companies should perform an impairment

test using a direct method on all assets which were previously tested using a

residual method. The Group’s licences in other businesses are not tested for

recoverability using a residual method and were, therefore, not affected by

the new guidance.

The Group completed its transitional impairment test of Verizon Wireless’

mobile licences as of 1 January 2005. This resulted in a pre-tax charge of

£11,416 million. This impairment loss was included, net of the related tax of

£5,239 million, in the cumulative effect of change in accounting principle in

the reconciliation of net loss. The tax effect comprises the release of

£1,220 million representing the Group’s share of Verizon Wireless’ deferred

tax liabilities and £4,019 million deferred tax liabilities representing taxes

recognised by the Group on its investment in Verizon Wireless. Fair value was

determined as the present value of estimated future net cash flows allocable

to the mobile licences. Verizon Wireless is included in the segment “Mobile

telecommunications – US”.

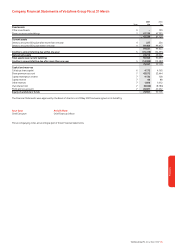

Share-based payments

The Group adopted SFAS No. 123 (Revised 2004), “Share-based Payment”,

and related FASB staff positions on 1 October 2005. SFAS No. 123 (Revised

2004) eliminates the option to account for share-based payments to

employees using the intrinsic value method and requires share-based

payments to be recorded using the fair value method. Under the fair value

method, the compensation cost for employees and directors is determined at

the date awards are granted and recognised over the service period.

Concurrent with the adoption of SFAS No. 123 (Revised 2004), the Group

adopted Staff Accounting Bulletin (SAB) 107. SAB 107 summarises the views

of the SEC Staff regarding the interaction between SFAS No. 123 (Revised

2004) and certain SEC rules and regulations and provides the staff’s views

regarding the valuation of share-based payment arrangements for public

companies.