Vodafone 2007 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2007 23

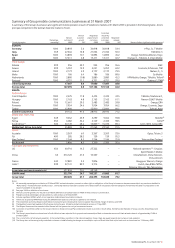

Summary of transactions since 31 March 2004

•25 May 2004 – Japan: Increased effective stake in Vodafone K.K. to 98.2%

and stake in Vodafone Holdings K.K. to 96.1% for £2.4 billion.

•1 October 2004 – Japan: Merger of Vodafone K.K. and Vodafone Holdings

K.K. completed. The Group’s stake in the merged company was 97.7%.

•12 January 2005 – Hungary: Vodafone Hungary became a wholly owned

subsidiary of the Group following various transactions throughout the

2005 financial year.

•26 January 2005 – Egypt: Disposed of 16.9% of Vodafone Egypt reducing

the Group’s effective interest to 50.1%.

•11 May 2005 – France: The Group’s effective shareholding in Neuf Cegetel

became 12.4% after a transaction completed by the Group’s associated

undertaking SFR.

•31 May 2005 – Czech Republic and Romania: 79.0% of the share capital

of MobiFon S.A. (“MobiFon”) in Romania, and 99.9% of the share capital of

Oskar Mobil a.s. (“Oskar”) in the Czech Republic were acquired for

$3.5 billion (£1.9 billion). In addition, the Group assumed approximately

$1.0 billion (£0.6 billion) of net debt.

•18 November 2005 – India: Acquired a 5.61% interest in Bharti and on

22 December 2005 acquired a further 4.39% interest in Bharti. Total

consideration for the combined 10.0% stake was Rs. 67 billion

(£858 million).

•5 January 2006 – Sweden: Sold Vodafone Sweden for €970 million

(£660 million).

•20 April 2006 – South Africa: Increased stake in Vodacom Group (Pty)

Limited (“Vodacom”) by 15.0% to 50.0% for a consideration of

ZAR15.8 billion (£1.5 billion).

•27 April 2006 – Japan: Disposed of 97.7% stake in Vodafone Japan for

¥1.42 trillion (£6.9 billion) including the repayment of intercompany debt

of ¥0.16 (£0.8 billion) to SoftBank. The Group also received non-cash

consideration with a fair value of approximately ¥0.23 trillion (£1.1 billion),

comprised of preferred equity and a subordinated loan. SoftBank also

assumed debt of approximately ¥0.13 trillion (£0.6 billion).

•24 May 2006 – Turkey: Telsim Mobil Telekomunikasyon (“Telsim”) was

acquired for $4.67 billion (£2.6 billion).

•29 June 2006 – Greece: Since Vodafone Greece announced a public offer

for all remaining shares not held by the Group on 1 December 2003, the

Group increased its effective interest in Vodafone Greece to 99.8% at

31 March 2006. Between 1 and 29 June 2006, the Group acquired a

further 0.1% interest in Vodafone Greece through private transactions at a

price equal to the price paid in the public offer, leading to an interest

of 99.9%.

•3 November 2006 – Belgium: Disposed of 25% interest in Belgacom

Mobile SA for €2.0 billion (£1.3 billion).

•25 November 2006 – Netherlands: Group’s shareholdings increased to

100.0% following a compulsory acquisition of outstanding shares.

•3 December 2006 – Egypt: Acquired an additional 4.8% stake in Vodafone

Egypt bringing the Group’s interest to 54.9%.

•20 December 2006 – Switzerland: Disposed of 25% interest in Swisscom

Mobile AG for CHF4.25 billion (£1.8 billion).

•8 May 2007 – India: Acquired companies with interests in Hutchison Essar

for $10.9 billion (£5.5 billion), following which the Group controls

Hutchison Essar (see note 35 to the Consolidated Financial Statements).

•9 May 2007 – India: A Bharti group company irrevocably agreed to

purchase the Group’s 5.60% direct shareholding in Bharti Airtel (see note

35 to the Consolidated Financial Statements).

Business