Vodafone 2007 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2007 119

Financials

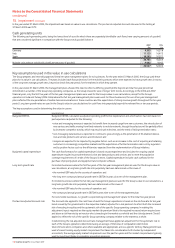

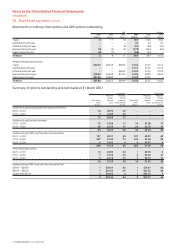

Share awards

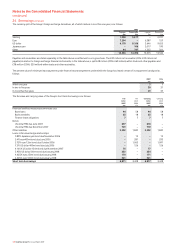

Movements in non-vested shares during the year ended 31 March 2007 are as follows:

All Shares Other Total

Weighted Weighted Weighted

average fair average fair average fair

value at grant value at grant value at grant

Millions date Millions date Millions date

1 April 2006 35 £1.19 141 £1.16 176 £1.17

Granted 20 £1.02 107 £0.91 127 £0.93

Vested (19) £1.15 (18) £1.12 (37) £1.14

Forfeited (3) £1.14 (33) £1.08 (36) £1.09

31 March 2007 33 £1.13 197 £1.04 230 £1.05

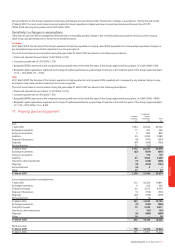

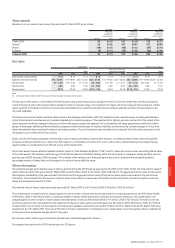

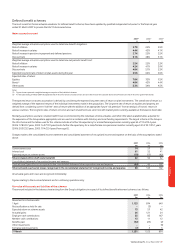

Fair value

ADS Options Ordinary Share Options

Board of directors and

Other Executive Committee Other

2007 2006 2005 2007 2006 2005 2007 2006 2005

Expected life of option (years) 5 – 6 8 – 9 6 – 7 5 – 6 6 – 7 5 – 6 5 – 7 8 – 9 6 – 7

Expected share price volatility 27.3 – 28.3% 17.9 -18.9% 25.6 – 26.6% 24.0 – 27.7% 17.6 –18.6% 24.3 – 25.3% 25.5 – 28.3% 17.9 –18.9% 25.6% – 26.6%

Dividend yield 5.1 – 5.5% 2.8 – 3.2% 1.7 – 2.1% 4.8 – 5.5% 2.6 – 3% 1.7 – 2.1% 5.1 – 6.1% 2.8 – 3.2% 1.7 – 2.1%

Risk free rates 4.8% 4.2% 5.1% 4.7 – 4.9% 4.2% 5.2% 4.6 – 4.9% 4.2% 5.1%

Exercise price(1) £1.15 £1.36 £1.40 £1.15 – 1.36 £1.45 £1.40 £1.14 – 1.16 £1.36 £1.40

Note:

(1) In the year ended 31 March 2007 there was more than one grant of ordinary share options

The fair value of the options is estimated at the date of grant using a lattice-based option valuation model (i.e. binomial model) that uses the assumptions

noted in the above table. Lattice-based option valuation models incorporate ranges of assumptions for inputs and those ranges are disclosed above. Certain

options granted to the Board of directors and Executive Committee have a market based performance condition attached and hence the assumptions are

disclosed separately.

The Group uses historical data to estimate option exercise and employee termination within the valuation model; separate groups of employees that have

similar historical exercise behaviour are considered separately for valuation purposes. The expected life of options granted is derived from the output of the

option valuation model and represents the period of time that options granted are expected to be outstanding; the range given above results from certain

groups of employees exhibiting different behaviour. Expected volatilities are based on implied volatilities as determined by a simple average of no less than

three international banks excluding the highest and lowest numbers. The risk-free rates for periods within the contractual life of the option are based on the

UK gilt yield curve in effect at the time of grant.

Shares used for the Group’s employee incentive plans can be newly issued shares, shares held in treasury or market purchased shares either through the

Company’s employee benefit trust or direct from the market or a combination of sources. The source of the shares is determined by the Company having

regard to what is considered the most efficient source at the relevant time.

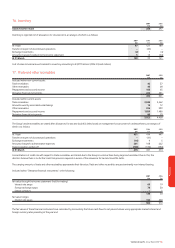

Some share awards have an attached market condition, based on Total Shareholder Return (“TSR”), which is taken into account when calculating the fair value

of the share awards. The valuation methodology for the TSR was based on Vodafone’s ranking within the same group of companies (where possible) over the

past five years (2006: ten years, 2005: ten years). The volatility of the ranking over a three year period was used to determine the probability weighted

percentage number of shares that could be expected to vest and hence affect fair value.

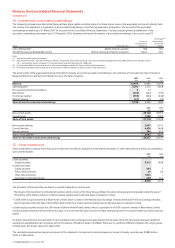

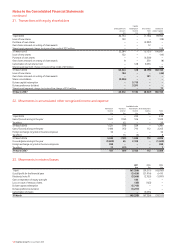

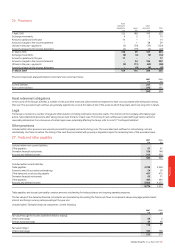

Other information

The weighted average grant-date fair value of options granted during the 2007 financial year was £0.22 (2006: £0.30, 2005: £0.34). The total intrinsic value of

options exercised during the year ended 31 March 2007 was £65 million (2006: £164 million, 2005: £28 million). The aggregate intrinsic value of fully vested

share options outstanding at the year end was £102 million and the aggregate intrinsic value of fully vested share options exercisable at the year end was

£73 million. Cash received from the exercise of options under share options schemes was £193 million and the tax benefit realised from options exercised

during the annual period was £21 million.

The total fair value of shares vested during the year ended 31 March 2007 was £41 million (2006: £18 million, 2005: £5 million).

The compensation cost that has been charged against income in respect of share options and share plans for continuing operations was £93 million (2006:

£109 million, 2005: £130 million), which is comprised entirely of equity-settled transactions. Including discontinued operations, the compensation cost

charged against income in respect of share options and share plans in total was £93 million (2006: £114 million, 2005: £137 million). The total income tax

benefit recognised in the consolidated income statement in respect of share options and share plans was £34 million (2006: £50 million, 2005: £17 million).

Compensation costs in respect of share options and share plans capitalised during the years ended 31 March 2007, 31 March 2006 and 31 March 2005 were

insignificant. As of 31 March 2007, there was £130 million of total compensation cost relating to non-vested awards not yet recognised, which is expected to

be recognised over a weighted average period of two years.

No cash was used to settle equity instruments granted under share-based payment schemes.

The average share price for the 2007 financial year was 129 pence.