Vodafone 2007 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6Vodafone Group Plc Annual Report 2007

Chief Executive’s Review

The past 12 months have been an important period for Vodafone. We

updated our strategy in 2006 to address changing customer needs, the

availability of new technologies, a growing demand for broadband services

and the greater growth potential of emerging markets. This new strategy is

positioning us well as competition and regulatory pressures increase and our

customers have greater choice in communications.

Operationally, we have grown new revenue streams across the Group and

implemented numerous programmes to significantly reduce our cost base.

Our emerging markets assets have continued to show strong growth and our

recent acquisition in India significantly increases our presence in high growth

markets. Our customer franchise was further strengthened both through

organic growth and acquisition and now exceeds 206 million proportionate

customers.

We have met or exceeded our stated financial expectations for the year in

all areas. Robust cash generation continues to support returns to our

shareholders, with dividends per share increasing by 11.4% to 6.76 pence

per share, representing a payout of 60% of our adjusted earnings per share.

We have made good progress executing our updated strategy throughout the

year and we are now beginning to realise some positive early results. We will

remain focused on executing our strategic objectives in the year ahead and

believe your business is well positioned to be the leader in the

communications industry.

Financial review

Statutory revenue increased by 6% to £31.1 billion, with organic revenue

growth of 4.3%. The Europe region, where competitive and regulatory

pressure is most intense, delivered organic revenue growth of 1.4%.

Continued strong progress in Spain, which delivered another year of double

digit revenue growth, offset year on year declines in Germany and Italy. The

market environment is challenging for all operators in Europe. However, we

have outperformed our principal competitors in Germany and Spain on

revenue and EBITDA growth, and have delivered a similar performance to our

principal competitor in Italy. In the UK, we revised our tariffs mid-way through

the year to improve our competitiveness and share of market growth. Our

EMAPA region produced strong growth, with organic revenue up 21.1% and

strong performances in many emerging markets.

While overall voice revenue remains under pressure, messaging and, in

particular data revenue, continue to show strong organic growth of 7% and

31% respectively. Data revenue reached £1.4 billion, primarily from business

services and the continued growth in the take up of 3G devices in our

customer base, which doubled to 15.9 million.

Our focus on profitable growth delivered a 4.2% organic increase in adjusted

operating profit, with 1.4% growth in total. Strong performances in the US,

Spain and a number of emerging markets offset declines in our other major

European markets.

We invested £4.2 billion in capital expenditure during the year and have now

achieved the core level of 3G and HSDPA coverage across our European

networks necessary for the wider uptake of high speed data services. Free

cash flow generation remained strong at £6.1 billion, although lower than last

year, primarily due to higher tax payments as expected.

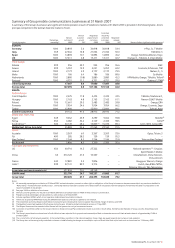

We now have an unrivalled global customer reach, with over 206 million

proportionate customers across 25 countries, adding over 35 million customers

during the year. We completed the sale of our operation in Japan in April 2006

and of our minority interests in Belgium and Switzerland later in the year. In May

2006, we completed the acquisition of the assets of Telsim in Turkey and more

recently gained a controlling position in a leading Indian operator.

Delivering on our strategy

In May 2006, we introduced five new strategic objectives to ensure our

continued success. Our focus on executing this strategy throughout the year

has generated positive results across a number of areas.

Revenue stimulation and cost reduction in Europe

In Europe, our focus is to drive additional usage and revenue from core

mobile voice and messaging services and to reduce our cost base.

Central to stimulating revenue is driving mobile usage through larger minute

bundles, innovative tariffs, prepaid to contract migrations and targeted

promotions. We are also focused on leveraging our market leading position in

the business segment, which

represents 25% of our service

revenue in Europe. New tariff

options, such as free weekends,

have been launched in the UK and

Germany that stimulated usage

and in Italy we ran successful voice

and messaging promotions during

the year that increased revenue per customer. We also continued to perform

well in Spain, driving an increase in total voice minutes of around 30%.

However, pricing pressure is expected to remain strong in the year ahead and

improving price elasticity is core to our revenue stimulation objective in

Europe.

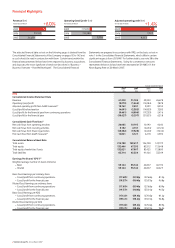

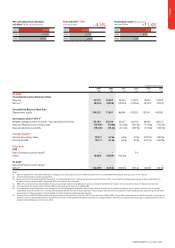

05 101520253035

Revenue (£bn)

2007

2006 29.4

31.1

+6.0%

0246810

Adjusted operating profit (£bn)

2007

2006 9.4

9.5

+1.4%

02468

Free cash flow (£bn)

2007

2006 6.4

6.1

–4.5%

We updated our strategy in 2006 and have made good

progress executing each strategic objective through-

out the year. We have met or exceeded our stated

financial expectations for the year in all areas and

your business is well positioned for the future.

Our strategic objectives

• Revenue stimulation and cost reduction in Europe

• Innovate and deliver on our customers’ total communications needs

• Deliver strong growth in emerging markets

• Actively manage our portfolio to maximise returns

• Align capital structure and shareholder returns policy to strategy

“We have launched

innovative offerings and are

lowering our cost structure

to position us well for the

future”