Vodafone 2007 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.30 Vodafone Group Plc Annual Report 2007

Critical Accounting Estimates

The Group prepares its Consolidated Financial Statements in accordance

with IFRS, the application of which often requires judgements to be made

by management when formulating the Group’s financial position and

results. Under IFRS, the directors are required to adopt those accounting

policies most appropriate to the Group’s circumstances for the purpose of

presenting fairly the Group’s financial position, financial performance and

cash flows. The Group also prepares a reconciliation of the Group’s revenue,

net profit or loss and shareholders’ equity between IFRS and US GAAP.

In determining and applying accounting policies, judgement is often

required in respect of items where the choice of specific policy, accounting

estimate or assumption to be followed could materially affect the reported

results or net asset position of the Group should it later be determined that

a different choice would be more appropriate.

Management considers the accounting estimates and assumptions

discussed below to be its critical accounting estimates and, accordingly,

provides an explanation of each below. Where it is considered that the

Group’s US GAAP accounting policies differ materially from the IFRS

accounting policy, a separate explanation is provided.

The discussion below should also be read in conjunction with the Group’s

disclosure of significant IFRS accounting policies, which is provided in note

2 to the Consolidated Financial Statements, “Significant accounting

policies” and with the “US GAAP information” provided in note 38 to the

Consolidated Financial Statements.

Management has discussed its critical accounting estimates and associated

disclosures with the Company’s Audit Committee.

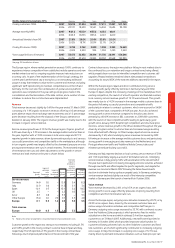

Impairment Reviews

Asset recoverability is an area involving management judgement, requiring

assessment as to whether the carrying value of assets can be supported by

the net present value of future cash flows derived from such assets using

cash flow projections which have been discounted at an appropriate rate.

In calculating the net present value of the future cash flows, certain

assumptions are required to be made in respect of highly uncertain matters,

as noted below.

IFRS requires management to undertake an annual test for impairment of

indefinite lived assets and, for finite lived assets, to test for impairment if

events or changes in circumstances indicate that the carrying amount of

an asset may not be recoverable. Group management currently undertakes

an annual impairment test covering goodwill and other indefinite lived

assets and also reviews finite lived assets and investments in associated

undertakings at least annually to consider whether a full impairment review

is required. In the year to 31 March 2007, the Group has recognised

impairment losses amounting to £11,600 million relating to the Group’s

operations in Germany and Italy.

US GAAP

Under US GAAP, the requirements for testing the recoverability of intangible

assets and property, plant and equipment differ from IFRS. US GAAP requires

the carrying value of such assets with finite lives to be compared to

undiscounted future cash flows over the remaining useful life of the primary

asset of the asset group being tested for impairment, to determine if the

asset or asset group is recoverable. If the carrying value exceeds the

undiscounted cash flows, the carrying value is not recoverable and the asset

or asset group is written down to the net present value of future cash flows

derived in a manner similar to IFRS.

For purposes of goodwill impairment testing under US GAAP, the fair value

of a reporting unit including goodwill is compared to its carrying value. If

the fair value of a reporting unit is lower than its carrying value, the fair

value of the goodwill within that reporting unit is compared with its

respective carrying value, with any excess carrying value written off as an

impairment. The fair value of the goodwill is the difference between the fair

value of the reporting unit and the fair value of the net assets of the

reporting unit.

The carrying value of the Group’s mobile operations in Germany at

31 January 2007, the date of the Group’s annual impairment test, was more

than £25 billion, significantly in excess of its fair value, estimated using

discounted cash flows. However, in accordance with SFAS No. 144,

“Accounting for the Impairment or Disposal of Long-Lived Assets”, no

impairment has been recognised as the estimated undiscounted cash flows

are in excess of the carrying value. At 31 January 2007, a 16.0% reduction in

the undiscounted cash flows would eliminate this excess and result in a

material impairment loss under US GAAP. Any impairment loss would be

measured by comparing the carrying value of the Group’s mobile operations

in Germany with its respective fair value, estimated using discounted cash

flows.

Assumptions

There are a number of assumptions and estimates involved in calculating

the net present value of future cash flows from the Group’s businesses,

including management’s expectations of:

•growth in EBITDA, calculated as adjusted operating profit before

depreciation and amortisation;

•timing and quantum of future capital expenditure;

•uncertainty of future technological developments;

•long term growth rates; and

•the selection of discount rates to reflect the risks involved.

The Group prepares and internally approves formal ten-year plans for its

businesses and uses these as the basis for its impairment reviews.

Management uses the initial five years of the plans, except in markets which

are forecast to grow ahead of the long term growth rate for the market. In

such cases, further years will be used until the forecast growth rate trends

towards the long term growth rate, up to a maximum of ten years.

For mobile businesses where the first five years of the ten year

management plan are used for the Group’s value in use calculations, a long

term growth rate into perpetuity has been determined as the lower of:

•the nominal GDP rates for the country of operation; and

•the long term compound annual growth rate in EBITDA in years six to ten

of the management plan.

For mobile businesses where the full ten year management plans are used

for the Group’s value in use calculations, a long term growth rate into

perpetuity has been determined as the lower of:

•the nominal GDP rates for the country of operation; and

•the compound annual growth rate in EBITDA in years nine to ten of the

management plan.

For non-mobile businesses, no growth is expected beyond management’s

plans for the initial five year period.

Changing the assumptions selected by management, in particular the

discount rate and growth rate assumptions used in the cash flow

projections, could significantly affect the Group’s impairment evaluation

and, hence, results.

The Group’s review includes the key assumptions related to sensitivity in the

cash flow projections.