Vodafone 2007 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2007 59

Expected benefits from investment in networks,

licences and new technology may not be realised.

The Group has made substantial investments in the acquisition of licences

and in its mobile networks, including the roll out of 3G networks. The Group

expects to continue to make significant investments in its mobile networks

due to increased usage and the need to offer new services and greater

functionality afforded by new or evolving telecommunications technologies.

Accordingly, the rate of the Group’s capital expenditures in future years could

remain high or exceed that which it has experienced to date.

There can be no assurance that the introduction of new services will

proceed according to anticipated schedules or that the level of demand for

new services will justify the cost of setting up and providing new services.

Failure or a delay in the completion of networks and the launch of new

services, or increases in the associated costs, could have a material adverse

effect on the Group’s operations.

The Group may experience a decline in revenue or

profitability notwithstanding its efforts to increase

revenue from the introduction of new services.

As part of its strategy, the Group will continue to offer new services to its

existing customers and seek to increase non-voice service revenue as a

percentage of total service revenue. However, the Group may not be able to

introduce commercially these new services, or may experience significant

delays due to problems such as the availability of new mobile handsets,

higher than anticipated prices of new handsets or availability of new

content services. In addition, even if these services are introduced in

accordance with expected time schedules, there is no assurance that

revenue from such services will increase ARPU or maintain profit margins.

The Group’s business and its ability to retain customers

and attract new customers may be impaired by actual

or perceived health risks associated with the

transmission of radiowaves from mobile telephones,

transmitters and associated equipment.

Concerns have been expressed in some countries where the Group operates

that the electromagnetic signals emitted by mobile telephone handsets and

base stations may pose health risks at exposure levels below existing

guideline levels and may interfere with the operation of electronic equipment.

In addition, as described under the heading “Legal proceedings” in note 31 to

the Consolidated Financial Statements, several mobile industry participants,

including the Company and Verizon Wireless, have had lawsuits filed against

them alleging various health consequences as a result of mobile phone

usage, including brain cancer. While the Company is not aware that such

health risks have been substantiated, there can be no assurance that the

actual, or perceived, risks associated with radiowave transmission will not

impair its ability to retain customers and attract new customers, reduce

mobile telecommunications usage or result in further litigation. In such event,

because of the Group’s strategic focus on mobile telecommunications, its

business and results of operations may be more adversely affected than those

of other companies in the telecommunications sector.

The Group’s business would be adversely affected by

the non-supply of equipment and support services by

a major supplier.

Companies within the Group source their network infrastructure and related

support services from third party suppliers. The removal from the market of

one or more of these third party suppliers would adversely affect the Group’s

operations and could result in additional capital expenditures by the Group.

Seasonality

The Group’s financial results have not, historically, been subject to

significant seasonal trends.

Outlook

The measures presented in the Group’s outlook have been derived from

amounts calculated in accordance with IFRS but are not themselves IFRS

measures. Further disclosures are provided in “Performance – Non-GAAP

Information” on pages to 62 to 63 and below for proportionate measures.

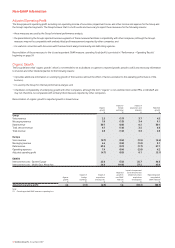

2007 financial year

The following sets out the outlook provided by the Group in respect of the

2007 financial year and the Group’s actual performance:

2007 2007

Actual Performance Outlook

Organic proportionate mobile 6.3% 5% to 6.5%

revenue growth(1)

Organic proportionate 0.9 percentage points Around 1 percentage

mobile EBITDA margin(1) lower than 2006 point lower than

financial year 2006 financial year

Free cash flow £6.1 billion(2) £4.7 to £5.2 billion

Capitalised fixed asset £4.2 billion £4.2 to £4.6 billion

additions

Notes:

(1) Assumes constant exchange rates and excludes the impact of business acquisitions and disposals

for the financial measures and adjusted to reflect like-for-like ownership levels in both years.

(2) Amount includes £0.5 billion benefit from timing differences and the deferral of payments

originally expected in the year and is stated after £0.4 billion of tax payments, including

associated interest, in respect of a number of long standing tax issues.

2008 financial year

The following sets out the Group’s outlook for the 2008 financial year:

2008 Outlook(1)(2)

Revenue growth £33.3 billion to £34.1 billion

Adjusted operating profit £9.3 billion to £9.8 billion

Capitalised fixed asset additions £4.7 billion to £5.1 billion

Free cash flow £4.0 billion to £4.5 billion

Notes:

(1) This Outlook section contains forward looking statements within the meaning of the US Private

Securities Litigation Reform Act of 1995. Please refer to “Cautionary Statement Regarding

Forward-Looking Statements” set out on page 61.

(2) Includes assumption of average foreign exchange rates for the 2008 financial year of

approximately Euro 1.47:£1 and US$1.98:£1. A substantial majority of the Group’s revenue,

adjusted operating profit, capitalised fixed asset additions and free cash flow is denominated in

currencies other than sterling, the Group’s reporting currency.

The Group’s outlook statement now reflects only statutory financial

measures. Following completion of the Hutchison Essar transaction in India

on 8 May 2007, its results will be fully consolidated into the Group’s results

from that date and are therefore reflected in the outlook measures set out

below. The Group’s outlook ranges reflect current expectations for average

foreign exchange rates for the 2008 financial year.

Operating conditions are expected to continue to be challenging in Europe,

with competition remaining intense and ongoing regulatory pressure,

notwithstanding continued positive trends in data revenue and voice usage

growth. Increasing market penetration continues to result in overall strong

growth prospects for the EMAPA region.

Group revenue is expected to be in the range of £33.3 billion to

£34.1 billion. Adjusted operating profit is expected to be in the range of

£9.3 billion to £9.8 billion, with the Group EBITDA margin lower year on year.

Total depreciation and amortisation charges are anticipated to be around

£5.8 billion to £5.9 billion, higher than the 2007 financial year, primarily as a

result of the Hutchison Essar acquisition.

PerformancePerformance