Vodafone 2007 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82 Vodafone Group Plc Annual Report 2007

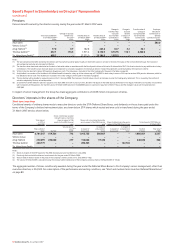

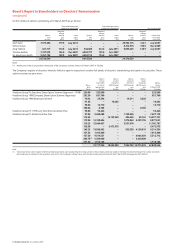

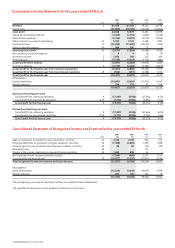

Board’s Report to Shareholders on Directors’ Remuneration

continued

In addition, an allowance of £6,000 is payable each time a non-Europe

based non-executive director is required to travel to attend Board and

Committee meetings, to reflect the additional time commitment involved.

A full review of non-executive directors’ fees was carried out in February

2007 taking into account market data and current market trends provided

by Towers Perrin. The previous review was in 2005. As a result of this review

the revised fees payable from 1 April 2007 are as follows:

Fees payable

from 1 April 2007

£’000

Chairman 525

Deputy Chairman and Senior Independent Director 145

Basic Non-Executive Director fee 105

Chairmanship of Audit Committee 25

Chairmanship of Remuneration Committee 20

Chairmanship of Nominations and Governance Committee 15

Details of each non-executive director’s remuneration for the 2007 financial

year are included in the table on page 83.

Non-executive directors do not participate in any incentive or benefit plans.

The Company does not provide any contribution to their pension

arrangements. The Chairman is entitled to use of a car and a driver whenever

and wherever he is providing his services to or representing the Company.

Service contracts and appointments of directors

Executive directors

The Remuneration Committee has determined that, after an initial term that

may be of up to two years’ duration, executive directors’ contracts should

thereafter have rolling terms and be terminable on no more than one year’s

notice. All current executive directors’ contracts have an indefinite term (to

normal retirement date) and one year notice periods. No payments should

normally be payable on termination other than the salary due for the notice

period and such entitlements under incentive plans and benefits that are

consistent with the terms of such plans.

All the UK based executive directors have, whilst in service, entitlement

under a long term disability plan from which two-thirds of base salary, up to

a maximum benefit determined by the insurer, would be provided until

normal retirement date.

Vittorio Colao

Vittorio Colao was appointed as the Company’s Deputy Chief Executive with

effect from 9 October 2006.

Thomas Geitner

Thomas Geitner left the Company on 31 December 2006 and received

salary and compensation for loss of office in accordance with his legal

entitlement. The total payment was £1.7 million. His pro-rated annual

bonus for the 2007 financial year was waived in return for a series of six

equal monthly payments of £95,723. These payments are contingent on

Mr Geitner not joining a competitor. The Remuneration Committee has

exercised discretion to allow him access to long term incentive awards,

pro-rated for time and performance. He is eligible to draw his pension from

1 January 2008 as set out in the pensions section of this report on page 84.

Sir Julian Horn-Smith

Sir Julian Horn-Smith retired after the AGM on 25 July 2006. He received his

bonus for the year to date of retirement, payment in lieu of holiday accrued

and awards vested under his long term incentive plans under the normal

rules for retirement.

Peter Bamford

Peter Bamford left the Company’s on 1 April 2006. He received compensation

for loss of office in accordance with his legal entitlement of £1.06 million.

Fees retained for non-executive directorships in other companies

Some executive directors hold positions in other companies as

non-executive directors. The fees received in respect of the 2007 financial

year and retained by directors were as follows:

Fees retained by the

Company in which individual in the 2007

non-executive directorship is held financial year £’000(1)

Arun Sarin The Bank of England 6.0

Thomas Geitner(2) Singulus Technologies AG 7.7

Sir Julian Horn-Smith(3) Smiths Group plc 17.0

Lloyds TSB Group plc 28.6

Sage Group plc 14.0

Notes:

(1) Fees were retained in accordance with Company policy.

(2) Fees were retained in the period to 31 December 2006.

(3) An option over 400,000 shares granted to Sir Julian in November 2005 by China Mobile Limited

for his duties as non-executive director, and held for the benefit of the Company, lapsed on his

retirement on 25 July 2006. Fees shown are for the period 1 April to 25 July 2006.

Chairman and non-executive directors

Lord MacLaurin retired as the Company’s Chairman following the AGM on

25 July 2006. Lord MacLaurin continued to receive fees in accordance with

his service contract until 31 December 2006. The Company has entered

into an agreement with Lord MacLaurin that he will provide advisory

services to the Company for a period of three years following his retirement.

During this period he will receive an annual fee of £125,000, which he has

confirmed to the Company he intends to donate to charity.

Sir John Bond was appointed as Chairman of the Company with effect from

the AGM on 25 July 2006. As Chairman for 2006 he received a pro-rated fee

equivalent to £475,000 per annum having received standard non-executive

director fees up to the date of appointment. His appointment is indefinite

and may be terminated by either party on one year’s notice.

Paul Hazen stepped down from the role of Deputy Chairman following the AGM

on 25 July 2006. John Buchanan was appointed into this role on the same date.

Penny Hughes stepped down from the Board on 25 July 2006.

Anthony Watson, Alan Jebson and Nick Land were appointed to the Board as

non-executive directors with effect from 1 May 2006, 1 December 2006 and

1 December 2006 respectively, and hold office on the same terms as other

non-executive directors.

Non-executive directors, including the Deputy Chairman, are engaged on

letters of appointment that set out their duties and responsibilities. The

appointment of non-executive directors may be terminated without

compensation.

The terms and conditions of appointment of non-executive directors are

available for inspection by any person at the Company’s registered office

during normal business hours and at the AGM (for 15 minutes prior to the

meeting and during the meeting).

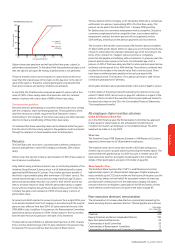

TSR performance

The following chart shows the performance of the Company relative to the

FTSE100 index and the FTSE Global Telecommunications index, which are

the most relevant indices for the Company.

Graph provided by Towers Perrin and calculated according to a methodology that is compliant with

the requirements of Schedule 7A of the Companies Act of 1985. Data Sources: FTSE and Datastream

Note: Performance of the Company shown by the graph is not indicative of vesting levels under the

Company’s various incentive plans.

20

40

60

80

100

120

140

160

180

Mar07Mar 06Mar 05Mar 04Mar 03Mar 02

Value of hypothetical £100 holding

Historical TSR Performance

Growth in the value of a hypothetical £100 holding up to March 2007

FTSE Global Telecoms and FTSE 100 comparison based on spot values.

FTSE Global Telecoms

FTSE 100 Vodafone Group Plc