Vodafone 2007 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.38 Vodafone Group Plc Annual Report 2007

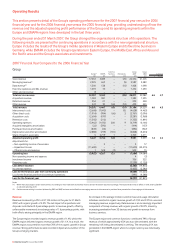

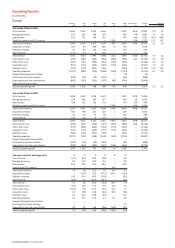

Operating Results

continued

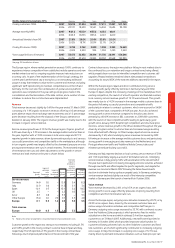

offers and focus on high value customers and business customers. In Spain,

the improved customer mix and success of both consumer and business

offerings assisted in increasing outgoing voice usage by 34.2%. New and

more competitive tariffs launched in the UK in July 2006 and September

2006 and various promotions specifically aimed at encouraging usage

contributed to the 16.7% increase in Vodafone UK’s outgoing voice usage.

Offsetting the organic growth in outgoing voice usage was the impact of

pricing pressures in all markets due to increased competition, which has led

to outgoing voice revenue per minute decreasing by 16.8% in the year

ended 31 March 2007.

Termination rate cuts were the main factor in the 7.4% decline in organic

incoming voice revenue, with all markets except the UK experiencing

termination rate cuts during the year. Announced termination rate cuts since

30 September 2006 include a cut of 7% to 11.35 eurocents per minute in

Spain effective from October 2006 and a 20% cut to 8.8 eurocents per

minute in Germany effective from November 2006. The impact of the

termination rate cuts in the Europe region was to reduce the average

effective incoming price per minute by around 13% to approximately 7

pence. Further termination rate cuts of 0.87 eurocents every six months will

occur in Spain with effect from April 2007, reducing the rate to 7.0 eurocents

by April 2009, whilst in Italy reductions in July 2007 and July 2008 of 13%

below the retail price index have also been announced.

The success of Vodafone Passport, a competitively priced roaming proposition

with over 11 million customers as at 31 March 2007, contributed to increasing

the volume of organic roaming minutes by 15.8%. Around 50% of the Group’s

roaming minutes within Europe are now on Vodafone Passport. Organic

roaming revenue increased by 1.2% as the higher usage was largely offset by

price reductions, due to increasing adoption of Vodafone Passport and also

the Group’s commitment to reduce the average cost of roaming in the EU by

40% by April 2007 when compared to summer 2005.

On 23 May 2007, the European Parliament voted to introduce regulation on

retail and wholesale roaming prices. We expect roaming revenues to be

lower year on year in 2008 due to the combined effect of Vodafone’s own

initiatives and this direct regulatory intervention.

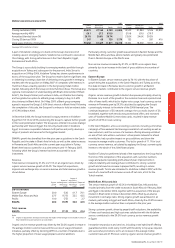

Non-voice revenue

Messaging revenue increased by 3.1%, or by 4.6% on an organic basis,

mainly due to growth in Italy, Other Europe and particularly Spain and the

UK, partly offset by declines in Germany. In Spain, the increase was driven

by the larger customer base, while in the UK, SMS volumes increased by

25.0% following higher usage per customer. The growth in Italy was driven

by an increase in SMS usage of 9.5%, with sharp acceleration in the second

half of the year following successful demand stimulation initiatives. In

Germany, messaging volumes declined, resulting from the attraction of

bigger voice bundles and the fact that promotional activity that had

occurred relating to messaging in the previous financial year was not

repeated in the 2007 financial year.

Data revenue grew by 27.1%, or by 29.5% on an organic basis, with the

growth being stimulated by the 97.1% increase in registered 3G enabled

devices on the Group’s networks as at 31 March 2007, encouraged by an

expanded portfolio and competitively priced offerings. Strong growth was

experienced in all Europe’s segments, though Germany demonstrated

particularly strong growth of 50% as a result of attractive tariff offerings,

including flat rate tariff options, and the benefit of improved coverage of the

HSDPA technology enabled network, facilitating superior download speeds

for data services. Growth in Italy, Spain and the UK has been assisted by the

roll-out of HSDPA network coverage and increased penetration of Vodafone

Mobile Connect data cards, of which 74%, 64% and 53% were sold during the

year as HSDPA enabled devices in each of these markets respectively. The

launch of a modem which provides wireless internet access for personal

computers has also made a positive contribution to data revenue. In Other

Europe, successful Vodafone Mobile Connect data cards initiatives in the

Netherlands and Portugal were the primary cause of growth in data revenue.

Fixed line operator and DSL revenue increased by 9.9%, due to Arcor’s

increased customer base.

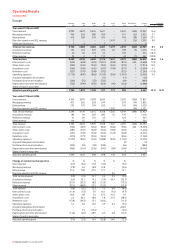

Adjusted operating profit

Adjusted operating profit fell by 5.1%, or by 4.7% on an organic basis, with

the disposal of the Group’s operations in Sweden being the main cause of

the decline. The growth in operating expenses and other direct costs,

including the charge in relation to a regulatory fine in Greece of £53 million

also had an adverse effect on adjusted operating profit.

Interconnect costs remained stable for the year, once the effect of the

disposal of Sweden was excluded, with the increased outgoing call volumes

to other networks offset by the cost benefit from the impact of the

termination rate cuts.

Reported acquisition and retention costs for the region decreased by 2.5%,

but remained stable on an organic basis, when compared to the prior year.

In Spain, the main drivers of the increased costs were the higher volumes of

gross additions and upgrades, especially with regard to the higher

proportion of contract gross additions which are being achieved with higher

costs per customer as competition has intensified. In Italy, costs have

increased slightly due to an increased focus on acquiring high value

contract customers and an increased volume of prepaid customers. In

Germany, retention costs declined as the cost per upgrade was reduced and

volumes slightly decreased. The UK saw a reduction in retention costs

resulting from a change in the underlying commercial model with indirect

distribution partners, where a portion of commissions are now recognised in

other direct costs. Acquisition costs in Other Europe decreased, primarily as

a result of lower gross contract additions in Greece and a reduction in cost

per gross addition in the Netherlands.

Other direct costs increased by 14.9%, or by 16.7% on an organic basis,

primarily caused by the regulatory fine in Greece and commissions in the

UK discussed above. Arcor saw an increase in direct access charges primarily

as a result of having a higher customer base.

Operating expenses increased by 4.2%, or by 7.4% on an organic basis,

primarily caused by increased intercompany recharges, a result of the

centralisation of data centre and service platform operations, which were

offset by a corresponding reduction in depreciation expense, and a 14.2%

increase in local currency in Spain’s operating expenses as a result of the

growth in this operating company, but which only slightly increased as a

percentage of service revenue. Increased publicity spend in the UK, Italy

and Greece, and restructuring costs in Germany, the UK and Ireland, also

adversely affected operating expenses during the year.

As many of the cost reduction initiatives are centralised in common functions,

as described earlier, the Group’s target in respect of operating expenses for

the total of the Europe region (excluding Arcor) includes common functions

but excludes the developing and delivering of new services and business

restructuring costs. On this basis, these costs grew by 3.5% in 2007 financial

year for the reasons outlined in the preceding paragraph.

Cost reduction initiatives

The Group has set targets in respect operating expenses and capitalised

fixed asset additions. The operating expense and capitalised fixed asset

additions targets relate to the Europe region (excluding Arcor) and common

functions in aggregate. The targets are detailed in “Performance – Risk

Factors, Seasonality and Outlook” on page 60. During the 2007 financial

year, the implementation of a range of Group wide initiatives and cost

saving programmes commenced, designed to deliver savings in the 2008

financial year and beyond. The key initiatives are as follows:

•The application development and maintenance initiative is focusing on

driving cost and productivity efficiencies through outsourcing the

application development and maintenance for key IT systems. In October

2006, the Group announced that EDS and IBM had been selected to provide

application development and maintenance services to separate groupings

of operating companies within the Group. The initiative is currently in the