Vodafone 2007 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.142 Vodafone Group Plc Annual Report 2007

Notes to the Consolidated Financial Statements

continued

38. US GAAP information continued

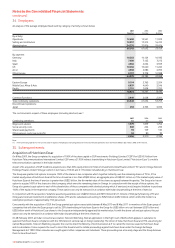

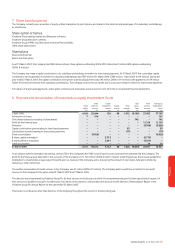

The Group has adopted SFAS No. 123 (Revised 2004) using the modified

retrospective method. Under this method, the Group has adjusted the

financial statements for the periods between 1 April 1995 and 30 September

2005 to give effect to the fair value method of accounting for awards granted,

modified or settled during those periods on a basis consistent with the pro

forma amounts disclosed under the requirements of the original SFAS

No. 123, “Accounting for Stock-Based Compensation”. The provisions of SFAS

No. 123 (Revised 2004) will be applied to all awards granted, modified or

settled after 1 October 2005. The effect of applying the original provisions of

SFAS No. 123 under the modified retrospective method of adoption on the

year ended 31 March 2005 was to decrease loss before income taxes, loss

from continuing operations and net loss by £66 million, £30 million and

£30 million respectively (six months ended 30 September 2005: increases of

£4 million, £8 million and £8 million respectively). The adjustment also had

the effect of decreasing both basic and diluted loss per share from continuing

operations and net loss by 0.05 pence (six months ended 30 September

2005: increase 0.01 pence). The adoption of SFAS No. 123 (Revised 2004)

increased shareholders’ equity at 1 April 2004 by £112 million.

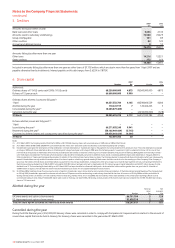

k. Loss per share

The share options and shares described in note 20 were excluded from the

calculation of diluted loss per share as the effect of their inclusion in the

calculation would be not dilutive due to the Group recognising a loss in all

periods presented.

39. New accounting standards

IFRS

The Group has not adopted the following pronouncements, which have been

issued by the IASB, but have not yet been endorsed for use in the EU.

•IFRS 8, “Operating Segments” (effective for annual periods beginning on or

after 1 January 2009, with early application permitted). If endorsed for use

in the EU, the Group currently intends to adopt this standard in the 2008

financial year. The standard is not expected to significantly impact the

Group but may change the Group’s disclosure in relation to segment

information.

•IAS 23 Revised, “Borrowing Costs” (effective for annual periods beginning

on or after 1 January 2009, with early application permitted). This revised

standard has not yet been endorsed for use in the EU. The Group is

currently assessing the impact and expected timing of adoption of this

standard on the Group’s results and financial position.

The Group has not adopted the following pronouncements, which have been

issued by the IASB or the International Financial Reporting Interpretations

Committee (“IFRIC”). The Group does not currently believe the adoption of

these pronouncements will have a material impact on the consolidated

results or financial position of the Group.

•IAS Amendment, “Amendment to IAS 1, “Presentation of Financial

Statements” – Capital Disclosures” (effective for annual periods beginning

after 1 January 2007, with earlier application encouraged). This amendment

has been endorsed for use in the EU.

•IFRIC 10, “Interim Financial Reporting and Impairment” (effective for annual

periods beginning on or after 1 November 2006, with early application

encouraged). This interpretation has not yet been endorsed for use in the EU.

•IFRIC 11, “IFRS 2 – Group Treasury Share Transactions” (effective for annual

periods beginning on or after 1 March 2007, with early application

permitted). This interpretation has not yet been endorsed for use in the EU.

•IFRIC 12, “Service Concession Arrangements” (effective for annual periods

beginning on or after 1 January 2008, with early application permitted). This

interpretation has not yet been endorsed for use in the EU.

US GAAP

FASB Interpretation No. 48

FASB Interpretation No. 48, “Accounting for Uncertainty in Income Taxes”

(“FIN 48”), an interpretation of SFAS No. 109, “Accounting for Income Taxes”,

prescribes a recognition threshold and measurement attribute for the

financial statement recognition and measurement of a tax position taken or

expected to be taken in a tax return. FIN 48 also provides guidance on

derecognition, classification, interest and penalties, accounting in interim

periods, disclosure and transition. The Group will adopt FIN 48 with effect

from 1 April 2007 and is currently assessing the impact of the adoption of

this standard on the Group’s results and financial position.

EITF Issue 06-1

EITF Issue 06-1, “Accounting for Consideration Given by a Service Provider to

Manufacturers or Resellers of Equipment Necessary for an End-Customer to

Receive Service From the Service Provider” (Issue 06-1), requires the income

statement classification of consideration provided to a manufacturer or

reseller to be determined based on the form of the consideration rendered to

the end customer as directed by the service provider, if the consideration is

contractually linked to the benefit received by the end customer. Under this

standard, “cash consideration” would be classified as a reduction in revenue

while “other than cash consideration” would be accounted for as an expense.

The Group will adopt Issue 06-1 no later than 1 April 2008 and is currently

assessing the impact of the adoption of this standard on the Group’s results

and financial position.

SFAS No. 157

SFAS No. 157, “Fair Value Measurements” (“SFAS 157”) defines fair value,

establishes a framework for measuring fair value and expands disclosure of

fair value measurements. SFAS 157 applies to fair value measurements under

other existing accounting pronouncements that require or permit fair value

measurements and does not require any new fair value measurements. The

Group will adopt SFAS 157 no later than 1 April 2008 and is currently

assessing the impact of the adoption of this standard on the Group’s results

and financial position.