Vodafone 2007 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

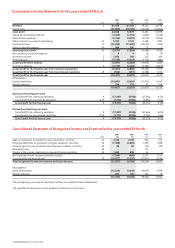

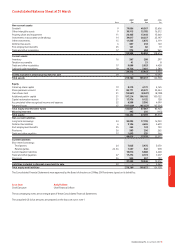

100 Vodafone Group Plc Annual Report 2007

Notes to the Consolidated Financial Statements

continued

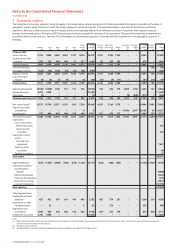

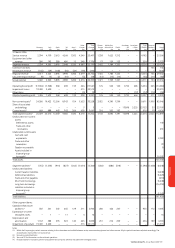

Other Total Eastern Middle East, Associates Associates Total Common

Germany Italy Spain UK Arcor(1) Europe – Europe Europe Africa & Asia Pacific – US – Other – EMAPA Functions Group

£m £m £m £m £m £m £m £m £m £m £m £m £m £m £m

31 March 2007

Service revenue 5,156 4,083 4,062 4,681 1,419 4,018 23,419 2,392 2,332 1,245 – – 5,969 – 29,388

Equipment and other

revenue 287 162 438 443 22 257 1,609 85 233 154 – – 472 – 2,081

Segment revenue 5,443 4,245 4,500 5,124 1,441 4,275 25,028 2,477 2,565 1,399 – – 6,441 – 31,469

Common functions 168 168

Intra-region revenue (123) (44) (106) (54) (27) (82) (436) – – – – – – – (436)

Regional revenue 5,320 4,201 4,394 5,070 1,414 4,193 24,592 2,477 2,565 1,399 – – 6,441 168 31,201

Less: Inter-region

revenue (9) (5) (3) (9) – (4) (30) (31) (9) (11) – – (51) (16) (97)

Group revenue 5,311 4,196 4,391 5,061 1,414 4,189 24,562 2,446 2,556 1,388 – – 6,390 152 31,104

Operating (loss)/profit (5,345) (3,325) 1,100 511 171 936 (5,952) 184 694 159 2,080 1,150 4,267 121 (1,564)

Impairment losses 6,700 4,900 – – – – 11,600 – – – – – – – 11,600

Other items (1) – – – – – (1) – – – (3) (508) (511) 7 (505)

Adjusted operating profit 1,354 1,575 1,100 511 171 936 5,647 184 694 159 2,077 642 3,756 128 9,531

Non-current assets(2) 16,279 13,754 12,327 8,551 829 7,328 59,068 6,347 3,160 1,379 – – 10,886 5,989 75,943

Share of associated

undertakings – – – – – 8 8 – – – 17,486 2,697 20,183 36 20,227

Current assets(2) 779 849 483 884 238 698 3,931 367 455 223 – – 1,045 255 5,231

Total segment assets(2) 17,058 14,603 12,810 9,435 1,067 8,034 63,007 6,714 3,615 1,602 17,486 2,697 32,114 6,280 101,401

Unallocated

non-current assets:

Deferred tax assets 410

Trade and other

receivables 224

Unallocated current

assets:

Cash and cash

equivalents 7,481

Trade and other

receivables 80

Taxation recoverable 21

Total assets 109,617

Segment liabilities(2) (827) (1,449) (1,000) (940) (376) (1,125) (5,717) (843) (886) (403) – – (2,132) (1,927) (9,776)

Unallocated liabilities:

Current taxation

liabilities (5,088)

Deferred tax liabilities (4,626)

Trade and other payables (219)

Short term borrowings (4,817)

Long term borrowings (17,798)

Total liabilities (42,324)

Other segment items:

Capitalised fixed asset

additions(3) 425 421 547 661 189 489 2,732 435 574 251 – – 1,260 216 4,208

Expenditure on other

intangible assets – 26 – – – 6 32 – 276 – – – 276 – 308

Depreciation and

amortisation 1,063 556 449 930 144 586 3,728 349 272 194 – – 815 568 5,111

Impairment of goodwill 6,700 4,900 – – – – 11,600 – – – – – – – 11,600

Notes:

(1) Within the Europe region, certain revenues relating to Arcor have been reclassified between service revenue and equipment and other revenue. All prior periods have been adjusted accordingly. The

reclassification had no effect on total revenue.

(2) Excluding unallocated items.

(3) Includes additions to property, plant and equipment and computer software, included within intangible assets.

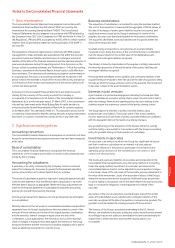

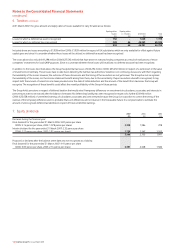

3. Segmental analysis

The Group has one business segment, being the supply of communications services and products. Primary segmental information is provided on the basis of

geographic regions, being the basis on which the Group manages its worldwide interests. The segmental analysis is provided for the Group’s continuing

operations. Revenue is determined by location of assets, which is not materially different from revenue by location of customer. Inter-segment sales are

charged at arms length prices. During the 2007 financial year, the Group changed the structure of its organisation. The results for all periods are presented in

accordance with the new structure. See note 29 for information on discontinued operations. Germany and Arcor together form the geographic segment of

Germany.