Vodafone 2007 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2007 121

Financials

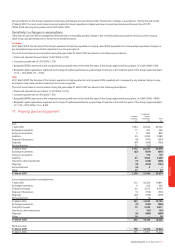

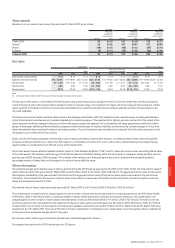

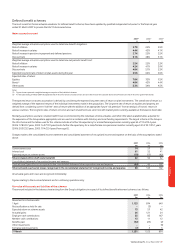

24. Borrowings

2007 2006

Short term Long term Short term Long term

borrowings borrowings Total borrowings borrowings Total

£m £m £m £m £m £m

Financial liabilities measured at amortised cost:

Bank loans 94 2,086 2,180 58 1,414 1,472

Bank overdrafts 23 – 23 18 – 18

Redeemable preference shares – 818 818 – 902 902

Finance lease obligations 75966 76875

Bonds 1,648 3,953 5,601 – 3,928 3,928

Other liabilities 2,202 156 2,358 1,840 295 2,135

Loans and bonds in fair value hedge relationships 843 10,726 11,569 1,525 10,143 11,668

4,817 17,798 22,615 3,448 16,750 20,198

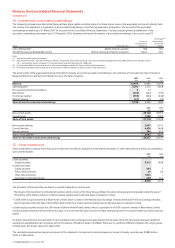

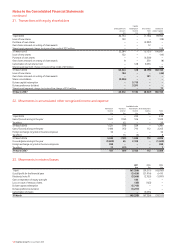

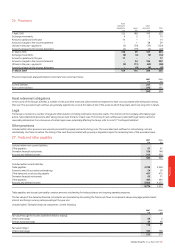

Maturity of borrowings

The maturity profile of the anticipated future cash flows including interest in relation to the Group’s non-derivative financial liabilities, on an undiscounted basis

and which, therefore, differs from both the carrying value and fair value, is as follows:

Redeemable Finance Loans in fair

preference lease value hedge

Bank loans shares obligations Bonds Other liabilities relationships Total

£m £m £m £m £m £m £m

Within one year 116 43 11 1,853 2,225 1,464 5,712

In one to two years 142 43 11 1,100 21 1,346 2,663

In two to three years 153 43 10 334 – 3,802 4,342

In three to four years 1,265 43 10 123 51 355 1,847

In four to five years 265 43 9 1,430 – 979 2,726

In more than five years 384 1,187 32 1,707 84 9,140 12,534

2,325 1,402 83 6,547 2,381 17,086 29,824

Effect of discount/financing rates (145) (584) (17) (946) – (5,517) (7,209)

31 March 2007 2,180 818 66 5,601 2,381 11,569 22,615

Within one year 68 49 12 167 1,858 2,093 4,247

In one to two years 53 49 11 2,044 295 1,450 3,902

In two to three years 58 49 11 936 – 1,116 2,170

In three to four years 61 49 11 55 – 3,982 4,158

In four to five years 1,314 49 10 55 – 267 1,695

In more than five years 45 1,387 42 1,375 – 7,428 10,277

1,599 1,632 97 4,632 2,153 16,336 26,449

Effect of discount/financing rates (127) (730) (22) (704) – (4,668) (6,251)

31 March 2006 1,472 902 75 3,928 2,153 11,668 20,198

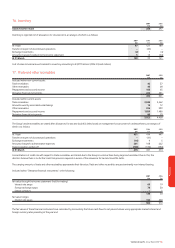

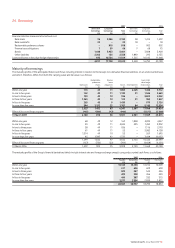

The maturity profile of the Group’s financial derivatives (which include interest rate and foreign exchange swaps), using undiscounted cash flows, is as follows:

2007 2006

Payable Receivable Payable Receivable

£m £m £m £m

Within one year 15,163 15,163 14,012 14,009

In one to two years 611 626 609 600

In two to three years 503 587 545 556

In three to four years 403 398 456 523

In four to five years 400 387 332 315

In more than five years 3,577 3,596 2,839 2,851

20,657 20,757 18,793 18,854