Vodafone 2007 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2007 3

At/year ended 31 March

2007 2007 2006 2005 2004 2003

$m £m £m £m £m £m

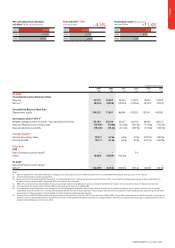

US GAAP

Consolidated Income Statement Data

Revenue 49,919 25,359 23,756 21,370 19,637 15,487

Net loss(4) (8,514) (4,325) (13,270) (13,752) (8,105) (9,072)

Consolidated Balance Sheet Data

Shareholders’ equity 139,923 71,081 86,984 107,295 129,141 140,580

Earnings per share (“EPS”)(3)

Weighted average number of shares – basic and diluted (millions) 55,144 55,144 62,607 66,196 68,096 68,155

Basic and diluted loss per ordinary share (15.43)¢ (7.84)p (21.20)p (20.77)p (11.90)p (13.31)p

Basic and diluted loss per ADS (154.3)¢ (78.4)p (212.0)p (207.7)p (119.0)p (133.1)p

Cash Dividends(3)(5)

Amount per ordinary share 13.31¢ 6.76p 6.07p 4.07p 2.0315p 1.6929p

Amount per ADS 133.1¢ 67.6p 60.7p 40.7p 20.315p 16.929p

Other Data

IFRS

Ratio of earnings to fixed charges(6) –––7.0

Deficit (8,640) (4,389) (16,520) –

US GAAP

Ratio of earnings to fixed charges(6) ––––––

Deficit(7) (13,319) (6,766) (13,875) (9,756) (9,059) (8,436)

Notes:

(1) Refer to “Performance – Non-GAAP Information” on page 62 for a reconciliation of this non-GAAP measure to the most comparable GAAP measure and a discussion of this measure.

(2) Amounts reported refer to continuing operations.

(3) See note 8 to the Consolidated Financial Statements, “(Loss)/earnings per share”. Earnings per American Depository Share (“ADS”) is calculated by multiplying earnings per ordinary share by ten, the

number of ordinary shares per ADS. Dividend per ADS is calculated on the same basis.

(4) 2005 net loss includes the cumulative effect of accounting changes related to intangible assets and post employment benefits that increase net loss by £6,372 million or 9.63p per ordinary share.

(5) The final dividend for the year ended 31 March 2007 was proposed by the directors on 29 May 2007.

(6) For the purposes of calculating these ratios, earnings consist of profit before tax adjusted for fixed charges, dividend income from associated undertakings, share of profits and losses from associated

undertakings and profits and losses on ordinary activities before taxation from discontinued operations. Fixed charges comprise one-third of payments under operating leases, representing the estimated

interest element of these payments, interest payable and similar charges and preferred share dividends.

(7) The deficits for the 2003 and 2004 financial years are presented on the same basis as the Form 20-F for the year ended 31 March 2004. These deficits have not been restated for the effect of discontinued

operations, because the UK GAAP information, which forms the basis of the US GAAP information presented, has not been restated. Even if any such adjustments were made, it is expected that the ratio of

earnings to fixed charges would still show a deficit.

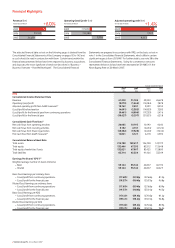

HighlightsHighlights

2007

2006

2005

Net cash inflow from operating

activities(2) (£m) Year ended 31 March

10,193

10,190

9,240

2007

2006

2005

Free cash flow(3) (£m)

Year ended 31 March –4.5%

6,127

6,418

6,592

2007

2006

2005

Dividends per share (pence per share)

Year ended 31 March +11.4%

6.76

6.07

4.07