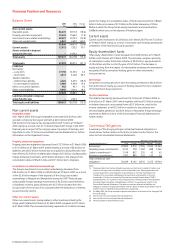

Vodafone 2007 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2007 47

PerformancePerformance

The Europe region experienced increased competition during the 2006

financial year, with many markets impacted by new market entrants whilst

penetration rates were close to, or exceeding, 100% in many of the

European markets. Regulator-imposed rate reductions on incoming calls

were also announced in all European markets except Albania.

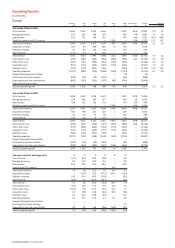

In the Europe region, total revenue increased by 4.7%, or by 5.6% on an

organic basis. This was mainly due to a 7.1% increase in the customer base

since 31 March 2005, a 13.4% increase in total voice usage and strong data

growth, driven by successful usage stimulation programmes and innovative

services, partially offset by pressures on pricing and termination rate cuts.

Service revenue increased in the Europe region by 5.2%, or by 5.9% on an

organic basis, mainly due to growth in the customer base which was

partially offset by a decline in ARPU, with Spain and Arcor achieving

particularly strong growth. In Spain, the launch of attractive tariffs,

successful promotional campaigns and the offer of an appealing handset

portfolio increased the average customer base and encouraged growth of

44.0% in total voice usage, which contributed to a rise in service revenue of

22.0%, in local currency. In Arcor, service revenue increased by 20.7% in

local currency due to customer and usage growth, partially offset by tariff

decreases in a competitive market.

In Germany, service revenue increased by 1.4% in local currency as the

benefits of a larger customer base and increases in messaging and data

revenue were partly offset by the effect of termination rate cuts and

reduced voice pricing as a result of aggressive competition. In Italy, local

currency service revenue rose by 1.8%, reflecting the continuing growth in

non-voice services as voice revenue declined marginally following a

termination rate cut. Excluding the impact of the termination rate cut,

service revenue increased by 5.2% in local currency. In the UK, service

revenue increased by 1.6%, benefiting from an increase in the average

customer base of 7.8%, partially offset by falling ARPU and the effect of a

termination rate cut, notwithstanding a rise in voice usage. Excluding the

impact of the termination rate cut, service revenue increased by 3.2%. In

Other Europe, service revenue increased by 2.1%, or by 5.4% on an organic

basis, mainly driven by Greece where service revenue increased by 9.4% due

to a 13.6% increase in the average customer base, offset by falling ARPU

mainly due to a termination rate cut of 16.8% in September 2004, and in

Ireland, where service revenue increased by 5.9% due to a 5.9% increase in

the average customer base and a 9.2% increase in total voice usage.

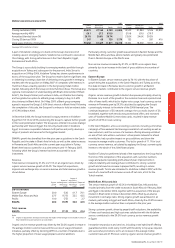

Voice revenue

Voice revenue rose by 2.3%, or by 3.2% on an organic basis, with Spain as

the main contributor. Spain experienced a 20.9% increase in voice revenue

in local currency which was driven by the increase in the customer base and

the increase in total voice usage, which was encouraged by the launch of

attractive tariffs and successful promotional campaigns, partially offset by

the impact of the 10.6% cut in the termination rate in November 2005.

In Germany, voice revenue decreased by 1.3%, driven by a termination rate

cut in December 2005 from 13.2 to 11.0 eurocents per minute, and by

reduced voice pricing resulting from increasing competition, partly offset by

increased voice usage by 13.7% which was driven by new prepaid tariffs,

including a low priced internet only offer, and ongoing promotional activity

such as an offer which allowed prepaid customers to pay a fixed charge for

calls to fixed lines and other Vodafone customers which was taken up by

more than one and a quarter million customers. These offers and

promotions also assisted in increasing the average customer base by 8.4%.

In Italy, voice revenue in local currency decreased by 0.7% driven by an

average 20.5% reduction in termination rates from September 2005, partly

offset by a 5.1% increase in voice usage, which was the result of strong

promotional activities such as free calls after the first minute and the

increase in the customer base.

In the UK, the effect of the termination rate cut in September 2004 was a

decline in voice revenue of 0.8%, although this was partially offset by a rise

in total voice usage of 10.1% driven by new customer promotions such as

Stop the Clock and a rise in the average customer base of 7.8%.

In Other Europe, voice revenue remained stable as the effect of the sale of

the Group’s operations in Sweden was offset by organic growth of 3.4%.

Non-voice revenue

Messaging revenue rose by 7.2%, or 7.6% on an organic basis. The increase

was mainly driven by Italy and Spain, where strong promotional activities,

which encouraged usage growth, and the increased customer bases,

increased messaging revenue by 12.7% and 22.0% respectively.

Data revenue increased by 46.4%, or 48.8% on an organic basis, with the

primary driver being the additional 6.0 million 3G devices registered on the

Group’s networks in the Europe region since 31 March 2005, bringing the

total to 7.4 million devices at 31 March 2006.

In Germany, data revenue increased by 47.0% in local currency, with

Vodafone maintaining its leadership in the 3G market, demonstrated by

Vodafone live! with 3G customers generating over 3.1 million full track

music downloads in the 2006 financial year for Vodafone, more than any

other mobile network operator in Germany. The number of active Vodafone

live! devices continued to increase, with 28.3% growth in the 2006 financial

year. In the business segment, there were 241,000 Vodafone Mobile

Connect 3G/GPRS data cards and 226,000 wireless push e-mail enabled

devices registered on the network at 31 March 2006.

In Italy, increased penetration of 3G devices, a focus on retaining high value

customers, increased usage of Vodafone live! and Vodafone Mobile Connect

data cards and attractive data promotions were the main contributors to

29.9% growth in data revenue in local currency.

In Spain, the growth of 43.7% in data revenue in local currency was due to

an increase of 814,000 in the number of registered 3G devices and the

success of data solutions, which have contributed to Vodafone leading the

3G market in Spain, along with an 84.3% increase in the number of

Vodafone live! devices.

In the UK, growth of 843,000 over the financial year in registered 3G devices

and the continued success of Vodafone Mobile Connect data cards and

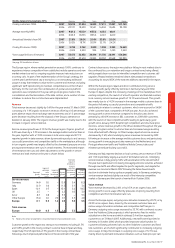

Mobile telecommunications KPIs

Germany Italy Spain UK Other Europe

Closing customers (’000) 2006 29,191 18,490 13,521 16,304 15,692 93,198

2005 27,223 17,280 11,472 15,324 15,691 86,990

Average monthly ARPU 2006 23.3 28.5 35.6 £24.0 £22.0

2005 24.9 29.9 34.5 £25.5 £23.3

Annualised blended churn (%) 2006 20.2% 18.7% 20.9% 32.1% 24.2%

2005 18.3% 17.2% 21.9% 29.7% 24.8%

Closing 3G devices (’000) 2006 2,025 2,250 902 1,033 1,230 7,440

2005 358 511 88 190 253 1,400

Voice usage (millions of minutes) 2006 26,787 29,604 23,835 28,059 27,648 135,933

2005 23,560 28,170 17,793 25,486 24,894 119,903

See page 159 for definition of terms